Need Medical Insurance

In today's world, healthcare is an essential aspect of our lives, and having access to quality medical services is crucial. Medical insurance, often referred to as health insurance, plays a vital role in ensuring that individuals and families can afford the necessary medical care without facing financial hardship. It provides a safety net, covering a wide range of healthcare expenses, from routine check-ups to specialized treatments. In this comprehensive guide, we will delve into the world of medical insurance, exploring its importance, understanding different types of coverage, and offering insights to help you make informed decisions about your healthcare needs.

Understanding the Importance of Medical Insurance

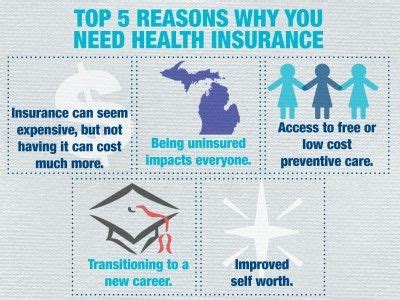

Medical insurance is a fundamental component of any comprehensive healthcare system. It serves as a financial safeguard, protecting individuals and their families from the potentially devastating costs associated with medical treatments. The primary objective of health insurance is to ensure that individuals have access to the healthcare services they require without facing financial barriers.

Without medical insurance, even a minor illness or injury can lead to substantial medical bills, which can be a significant burden, especially for those with limited financial resources. Health insurance helps spread the risk and cost of healthcare across a larger population, making it more manageable for individuals and providing a sense of security.

Moreover, medical insurance encourages preventative care and early detection of health issues. With insurance coverage, individuals are more likely to seek regular check-ups, screenings, and vaccinations, which can lead to better overall health outcomes. Early detection of diseases often results in more effective and less costly treatments, further emphasizing the importance of health insurance.

Types of Medical Insurance Coverage

Medical insurance comes in various forms, each designed to meet different needs and preferences. Understanding the different types of coverage is crucial when selecting the right plan for yourself or your family.

Private Health Insurance

Private health insurance is typically offered by private insurance companies and is often purchased by individuals or provided as an employment benefit. These plans offer a wide range of coverage options, allowing individuals to choose the level of coverage that suits their needs.

Private health insurance plans can be further categorized into various types, including:

- Indemnity Plans: These plans provide the most flexibility, allowing individuals to choose their healthcare providers and covering a percentage of the costs. The insured individual pays the remaining amount, known as the co-payment.

- Managed Care Plans: This category includes Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs require members to select a primary care physician (PCP) who coordinates their care, while PPOs offer more flexibility in choosing healthcare providers but may come with higher costs.

- Exclusive Provider Organizations (EPOs): EPOs are similar to PPOs but typically have a more limited network of providers. Members must choose healthcare providers within the network to receive coverage.

- Point-of-Service (POS) Plans: POS plans combine features of both HMOs and PPOs, allowing members to choose between in-network and out-of-network providers.

Public Health Insurance

Public health insurance is typically provided by government agencies and is designed to ensure access to healthcare for specific populations, such as low-income individuals, seniors, and those with disabilities.

The most well-known public health insurance programs include:

- Medicare: Medicare is a federal program that provides health insurance coverage for individuals aged 65 and older, as well as those with certain disabilities. It is divided into different parts, including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage), among others.

- Medicaid: Medicaid is a joint federal and state program that provides healthcare coverage for low-income individuals and families. Eligibility criteria vary by state, and it often covers a wide range of healthcare services.

- The Children's Health Insurance Program (CHIP): CHIP is a federal program that offers healthcare coverage for children in families with incomes that are too high to qualify for Medicaid but cannot afford private insurance.

Group Health Insurance

Group health insurance is commonly offered by employers as a benefit to their employees. It is often more affordable than individual plans, as the cost is shared among a larger group of individuals. Group plans typically offer comprehensive coverage and may include additional benefits such as dental and vision care.

Key Considerations When Choosing Medical Insurance

When selecting a medical insurance plan, several factors come into play. Here are some key considerations to help you make an informed decision:

Coverage and Benefits

Assess your healthcare needs and priorities. Consider the type of coverage you require, such as hospitalization, outpatient care, prescription drugs, mental health services, and preventive care. Ensure that the plan you choose covers the services you anticipate needing.

Network of Providers

Review the network of healthcare providers associated with the insurance plan. If you have a preferred doctor or hospital, ensure they are included in the network. Out-of-network care may result in higher costs, so it’s important to understand the network restrictions.

Cost and Premiums

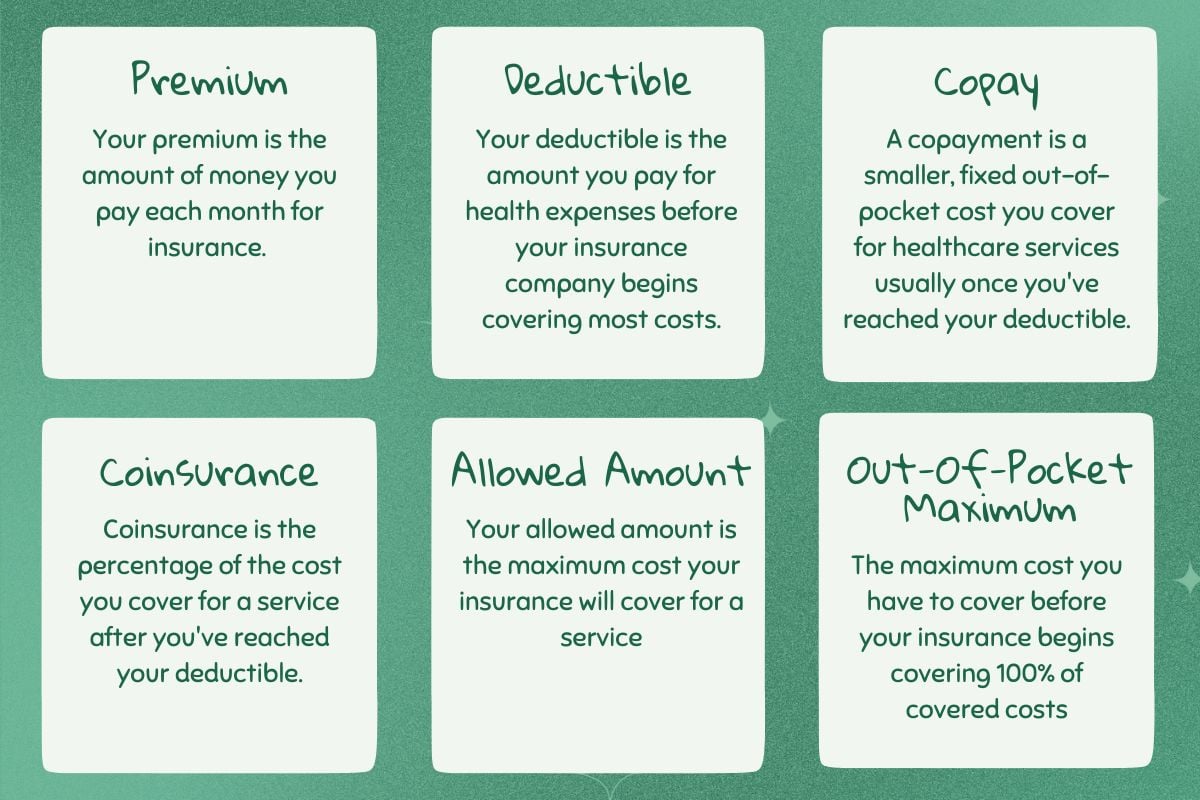

Evaluate the cost of the insurance plan, including monthly premiums, deductibles, co-payments, and co-insurance. Consider your budget and choose a plan that aligns with your financial capabilities. Remember that lower premiums may result in higher out-of-pocket expenses.

Prescription Drug Coverage

If you require prescription medications, ensure that the insurance plan provides adequate coverage. Check the plan’s formulary to understand which drugs are covered and at what cost. Some plans offer preferred drug lists, which can result in lower out-of-pocket expenses.

Wellness and Preventive Care

Look for plans that encourage and cover preventive care services, such as annual check-ups, screenings, and immunizations. Preventive care can help identify potential health issues early on, leading to better long-term health outcomes.

Flexibility and Customization

Consider your personal preferences and the level of flexibility you desire. Some plans offer customizable options, allowing you to tailor the coverage to your specific needs. This can be especially beneficial for individuals with unique healthcare requirements.

Navigating the Enrollment Process

The enrollment process for medical insurance can vary depending on the type of plan and the provider. Here are some general steps to guide you through the process:

- Research and compare different insurance plans, considering the factors mentioned earlier.

- Obtain quotes or price estimates from insurance providers to understand the costs involved.

- Review the plan's summary of benefits and coverage to ensure it meets your needs.

- If you are eligible for public health insurance, such as Medicare or Medicaid, understand the enrollment periods and requirements.

- For private or group health insurance, contact the insurance provider or your employer's human resources department to initiate the enrollment process.

- Complete the necessary paperwork, providing accurate and up-to-date information.

- Review your coverage options and choose the plan that best suits your needs.

- Pay the initial premium or make the required payment to activate your insurance coverage.

Maximizing Your Medical Insurance Benefits

Once you have selected and enrolled in a medical insurance plan, it’s essential to understand how to maximize its benefits.

Understand Your Plan

Familiarize yourself with the details of your insurance plan, including coverage limits, exclusions, and any special requirements. Review the summary of benefits and coverage, and don’t hesitate to reach out to your insurance provider if you have questions.

Choose In-Network Providers

Whenever possible, choose healthcare providers within your insurance network. This can result in lower out-of-pocket costs and ensure a smoother claims process.

Utilize Preventive Care

Take advantage of the preventive care services covered by your insurance plan. Regular check-ups, screenings, and immunizations can help detect potential health issues early on and improve your overall well-being.

Manage Your Medications

If you require prescription medications, work with your healthcare provider to choose cost-effective options. Understand the coverage and costs associated with your medications, and explore generic alternatives if available.

Stay Informed

Keep yourself updated on any changes or updates to your insurance plan. Insurance providers may introduce new benefits, modify coverage, or make other adjustments. Staying informed ensures you can make the most of your coverage.

Future Trends and Innovations in Medical Insurance

The field of medical insurance is constantly evolving, with new trends and innovations shaping the industry. Here are some developments to watch out for:

Telehealth and Digital Health Services

The rise of telehealth services has transformed the way healthcare is delivered. Many insurance plans now cover virtual consultations, remote monitoring, and digital health solutions, making healthcare more accessible and convenient.

Value-Based Care

Value-based care models are gaining traction, focusing on the quality and outcomes of healthcare rather than the quantity of services provided. This approach aims to improve patient outcomes while reducing costs.

Consumer-Directed Health Plans

Consumer-directed health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), are becoming increasingly popular. These plans give individuals more control over their healthcare spending and encourage responsible decision-making.

Artificial Intelligence and Data Analytics

Artificial intelligence and data analytics are being utilized to improve the efficiency and accuracy of insurance processes. These technologies can help identify patterns, predict healthcare needs, and streamline claims management.

Focus on Mental Health and Well-being

There is a growing recognition of the importance of mental health and well-being. Insurance providers are expanding their coverage to include mental health services, recognizing the impact of mental health on overall physical health.

Conclusion

Medical insurance is an essential tool for safeguarding your health and financial well-being. By understanding the different types of coverage, considering key factors, and navigating the enrollment process, you can make informed decisions about your healthcare needs. Remember, health insurance is not just about covering expenses; it’s about ensuring access to quality care and promoting overall wellness.

Stay informed, explore your options, and take control of your healthcare journey with the right medical insurance plan.

How do I know if I’m eligible for public health insurance programs like Medicare or Medicaid?

+Eligibility for public health insurance programs depends on various factors, including age, income, and certain disabilities. For Medicare, individuals aged 65 and older, or those with certain disabilities, are generally eligible. Medicaid eligibility is based on income and varies by state. It’s recommended to visit the official websites of these programs or contact your local health department for detailed information.

What is the difference between a deductible and a co-payment in a medical insurance plan?

+A deductible is the amount you must pay out of pocket before your insurance coverage begins. It is typically a fixed amount and must be met annually. On the other hand, a co-payment (co-pay) is a fixed amount you pay for a covered service, such as a doctor’s visit or prescription medication. Co-pays are usually smaller amounts and are paid at the time of service.

Can I change my medical insurance plan during the year, or am I locked into one plan?

+The ability to change your medical insurance plan during the year depends on the type of plan and your circumstances. Some plans, such as group health insurance through an employer, may have specific enrollment periods, and changes can only be made during those periods. However, certain life events, such as marriage, divorce, or the birth of a child, may qualify you for a Special Enrollment Period, allowing you to change your plan outside of the regular enrollment period.

How can I reduce my out-of-pocket expenses when using medical insurance?

+To reduce out-of-pocket expenses, consider choosing an insurance plan with a lower deductible and co-payments. Additionally, staying within the plan’s network of providers can help minimize costs. Utilizing preventive care services and managing your medications wisely can also contribute to lower out-of-pocket expenses.