My Insurance Information

In today's world, insurance is an essential aspect of financial planning and risk management. It provides a safety net, offering protection and peace of mind against various unforeseen events and potential losses. Understanding your insurance information is crucial to ensure you have adequate coverage and to navigate the complexities of insurance policies effectively.

The Importance of Insurance Information

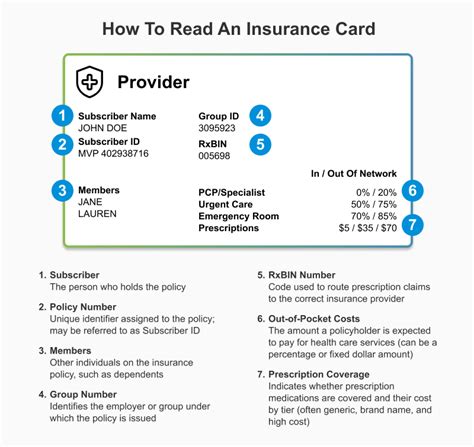

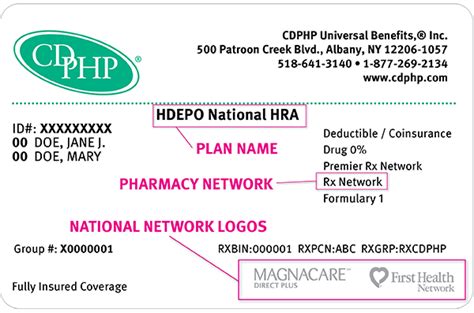

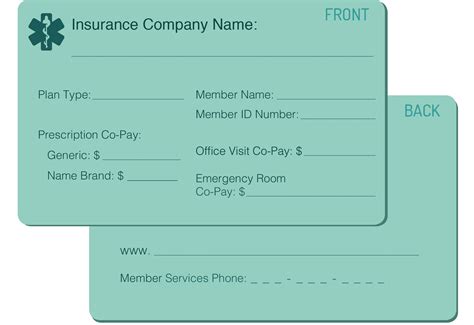

Insurance information encompasses a range of vital details that form the foundation of your insurance coverage. It includes your policy number, coverage limits, deductibles, exclusions, and the specific terms and conditions outlined in your policy documents. Having a thorough understanding of this information is key to making informed decisions about your insurance needs and managing potential risks.

Policy Number and Coverage Details

Your policy number is a unique identifier assigned to your insurance policy. It serves as a reference point for all interactions with your insurance provider, whether it's for claims, policy updates, or general inquiries. The policy number, along with your personal details, allows insurance companies to access your specific coverage information quickly and efficiently.

Coverage details outline the scope and extent of your insurance protection. These details include the types of risks covered, the maximum amount payable in the event of a claim (known as coverage limits), and any specific conditions or exclusions that may apply. For instance, a home insurance policy might cover damage caused by natural disasters like hurricanes or earthquakes, but it may exclude coverage for flood damage, requiring a separate flood insurance policy.

| Insurance Type | Coverage Details |

|---|---|

| Home Insurance | Structure, personal belongings, liability, specific perils, coverage limits, deductibles |

| Auto Insurance | Liability, collision, comprehensive, personal injury protection, uninsured/underinsured motorist coverage |

| Health Insurance | Medical, surgical, prescription drug, preventive care, mental health services, coverage limits, co-pays, deductibles |

Deductibles and Out-of-Pocket Costs

Deductibles are an important component of insurance policies, representing the amount you must pay out of pocket before your insurance coverage kicks in. This amount can vary depending on the type of insurance and the level of coverage you've chosen. For example, a high-deductible health insurance plan may offer lower premiums but require you to pay more out of pocket for medical expenses before insurance coverage begins.

Out-of-pocket costs can also include co-pays, which are fixed amounts you pay for certain services or prescriptions, and co-insurance, which is a percentage of the cost you share with your insurance provider for covered services. Understanding these costs is crucial for financial planning and managing your healthcare or other insured expenses effectively.

Navigating Insurance Policies

Insurance policies can be complex documents, filled with legal jargon and specific terms. Familiarizing yourself with the key components and seeking guidance when needed can help you navigate these policies with confidence.

Policy Terms and Conditions

The terms and conditions of your insurance policy outline the rights and responsibilities of both you and your insurance provider. These include the duration of the policy, the renewal process, and the steps to take in the event of a claim. It's essential to review these terms regularly, as they may change over time, especially when your policy is up for renewal.

Key terms to understand include the policy period, which specifies the dates your coverage is in effect; renewal options, which detail how and when you can renew your policy; and claim procedures, which outline the steps you must take to file a claim and the documentation required.

Reading and Interpreting Policy Documents

Policy documents can be lengthy and detailed, but understanding their key sections is vital. These documents typically include an overview of the coverage, the schedule of benefits or coverage limits, exclusions and limitations, and the general terms and conditions. Some policies may also have endorsements or riders, which are amendments that modify the original policy, adding or deleting coverage.

It's beneficial to review these documents with a clear understanding of the insurance terminology used. If certain terms or conditions are unclear, don't hesitate to reach out to your insurance provider or an insurance professional for clarification. They can help ensure you fully grasp the implications of your policy.

Making Informed Decisions

Having a clear understanding of your insurance information empowers you to make informed decisions about your coverage. It allows you to assess whether your current policies align with your needs, and whether any adjustments or additional coverage might be necessary.

Assessing Your Coverage Needs

Your insurance needs can evolve over time, influenced by life changes such as marriage, the birth of a child, a new home, or a career shift. Regularly reviewing your insurance information helps you stay updated on your coverage and make necessary adjustments.

For instance, if you've recently started a family, you may need to increase your life insurance coverage to protect your loved ones. Or, if you've purchased a new home, you'll want to ensure your home insurance policy provides adequate coverage for the value of your home and its contents.

Comparing Insurance Options

When it comes to insurance, there are often multiple options available, each with its own set of benefits and drawbacks. By understanding your insurance information, you can effectively compare different policies and providers to find the best fit for your needs.

Consider factors such as the coverage limits, deductibles, and exclusions when comparing policies. Also, take into account the reputation and financial stability of the insurance provider, as well as any additional services or benefits they offer, such as discounts, reward programs, or customer support.

Adjusting Coverage and Updating Information

As your life circumstances change, it's essential to update your insurance information accordingly. This includes notifying your insurance provider of any changes in your personal details, such as a new address, a change in marital status, or the addition of a dependent. Failure to do so could impact your coverage and leave you vulnerable to unforeseen risks.

Additionally, regularly reviewing and adjusting your coverage limits can help ensure you're adequately protected. For instance, if the value of your home or its contents has increased significantly, you may need to increase your home insurance coverage to reflect these changes.

Conclusion

Understanding your insurance information is an essential aspect of financial literacy and risk management. It empowers you to make informed decisions, navigate the complexities of insurance policies, and ensure you have the coverage you need to protect what matters most. By staying informed and proactive, you can rest assured that you're prepared for whatever life may bring.

Frequently Asked Questions

How often should I review my insurance information?

+

It’s recommended to review your insurance information annually, especially during policy renewal periods. This ensures you stay updated on any changes to your coverage and can make necessary adjustments. Additionally, life events such as marriage, the birth of a child, or a significant change in your financial situation should prompt an immediate review of your insurance needs.

What should I do if I’m unsure about my insurance coverage?

+

If you have questions or concerns about your insurance coverage, don’t hesitate to reach out to your insurance provider or an insurance professional. They can provide clarification on your policy terms, coverage limits, and any exclusions. It’s important to understand your policy fully to ensure you have the protection you need.

How can I lower my insurance premiums?

+

There are several strategies to potentially lower your insurance premiums. These include increasing your deductibles (which can lower premiums but increase out-of-pocket costs), taking advantage of discounts offered by insurance providers (such as safe driver discounts for auto insurance or bundle discounts for multiple policies), and maintaining a good credit score, as credit-based insurance scores can impact your premiums.