Mobile Insurance Company

The mobile industry has witnessed a remarkable evolution, with smartphones becoming an integral part of our daily lives. As these devices become more advanced and costly, the need for protection against accidental damage, theft, or loss has grown exponentially. This is where Mobile Insurance Company steps in, offering comprehensive coverage plans tailored to the unique needs of mobile device users.

A Comprehensive Guide to Mobile Insurance

Mobile Insurance Company understands the value of your mobile device and the impact its loss or damage can have on your daily routine. With a range of innovative insurance plans, we aim to provide peace of mind and ensure that you stay connected, no matter what life throws your way.

Understanding the Need for Mobile Insurance

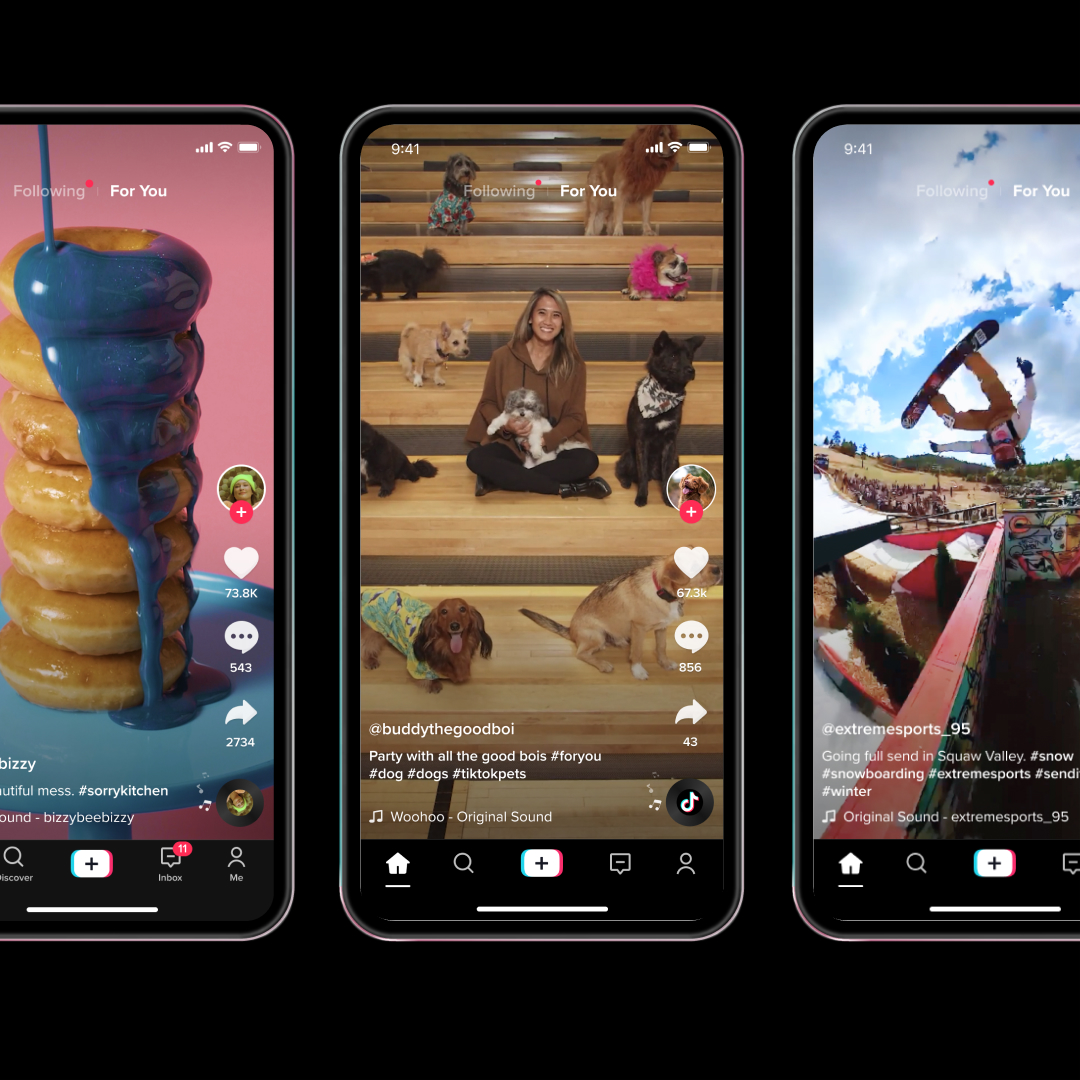

In today's fast-paced world, our smartphones are more than just communication devices. They store our personal data, photos, and memories, and often serve as our primary tool for work and entertainment. Unfortunately, accidents happen, and the cost of repairing or replacing a damaged or lost phone can be significant.

Here are some compelling reasons why mobile insurance is a wise investment:

- Accidental Damage Protection: Mobile phones are prone to accidents, whether it's a dropped screen or liquid damage. Insurance provides coverage for such incidents, ensuring your device is repaired or replaced without a hefty out-of-pocket expense.

- Theft and Loss Coverage: Losing your phone can be a stressful experience, especially if it contains sensitive information. Mobile insurance policies often include coverage for theft and loss, helping you recover quickly and securely.

- Peace of Mind: With an insurance plan in place, you can enjoy your device without worrying about potential accidents or mishaps. It's like having a safety net for your valuable technology investment.

Mobile Insurance Company: Our Services

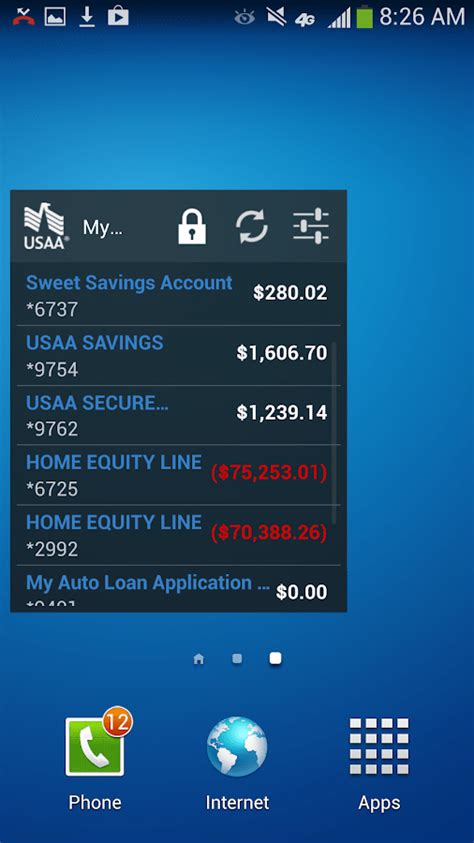

At Mobile Insurance Company, we pride ourselves on offering a comprehensive range of insurance plans to cater to different device types and user needs. Our services include:

- Comprehensive Coverage: Our flagship plan offers extensive protection against accidental damage, liquid damage, mechanical and electrical failures, and even natural disasters. It's the ultimate peace of mind for your device.

- Accidental Damage Plan: For those primarily concerned about drops and spills, this plan focuses on accidental damage coverage, ensuring your device is repaired or replaced efficiently.

- Theft and Loss Protection: If you're worried about your device being stolen or misplacing it, this plan provides coverage for such events, often including GPS tracking and data protection services.

- Customizable Plans: We understand that every user's needs are unique. That's why we offer customizable plans where you can choose the level of coverage and add-ons that best suit your requirements.

The Benefits of Choosing Mobile Insurance Company

When you choose Mobile Insurance Company, you're opting for a partner who understands the value of your mobile device and is committed to providing exceptional service.

- Expert Claims Handling: Our team of experienced professionals ensures a smooth and efficient claims process. We work closely with you to understand your needs and provide prompt resolutions.

- Nationwide Coverage: With our extensive network of authorized repair centers, you can access our services no matter where you are in the country.

- Flexible Payment Options: We offer various payment plans to suit different budgets, ensuring that mobile insurance is accessible to all.

- 24/7 Customer Support: Our dedicated customer support team is available around the clock to assist with any queries or concerns you may have.

| Plan Type | Coverage | Benefits |

|---|---|---|

| Comprehensive | Accidental Damage, Liquid Damage, Mechanical/Electrical Failures, Natural Disasters | Extensive protection, ideal for high-end devices |

| Accidental Damage | Accidental Damage, Liquid Damage | Cost-effective option for basic protection |

| Theft and Loss | Theft, Loss, GPS Tracking, Data Protection | Specialized plan for theft prevention and recovery |

Frequently Asked Questions

What is covered under Mobile Insurance Company's plans?

+Our plans cover a range of incidents, including accidental damage, liquid damage, mechanical and electrical failures, and even natural disasters. We also offer specialized plans for theft and loss protection.

How quickly can I file a claim with Mobile Insurance Company?

+You can file a claim with us as soon as an incident occurs. Our dedicated claims team will guide you through the process, ensuring a swift and efficient resolution.

Do I need to pay a deductible for my insurance claim?

+Yes, like most insurance policies, our plans have a deductible. The amount varies depending on the type of plan and the nature of the claim. Our team will provide a clear breakdown of costs during the claims process.

Can I customize my insurance plan to suit my needs?

+Absolutely! We understand that every user has unique requirements. Our customizable plans allow you to choose the level of coverage and add-ons that best fit your needs.

At Mobile Insurance Company, we’re committed to keeping you connected. For more information or to get a quote, visit our website or contact our friendly team today.