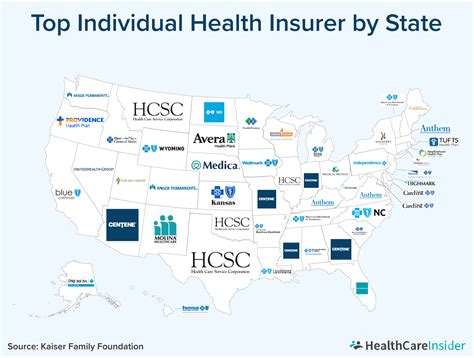

Massachusetts Insurance Companies

Massachusetts, often regarded as a pioneer in the insurance industry, boasts a robust market with a diverse range of insurance companies catering to various needs. From large multinational corporations to smaller, specialized providers, the Bay State offers a comprehensive insurance landscape. This article delves into the world of Massachusetts insurance, exploring the key players, their unique offerings, and the impact they have on the local and national markets.

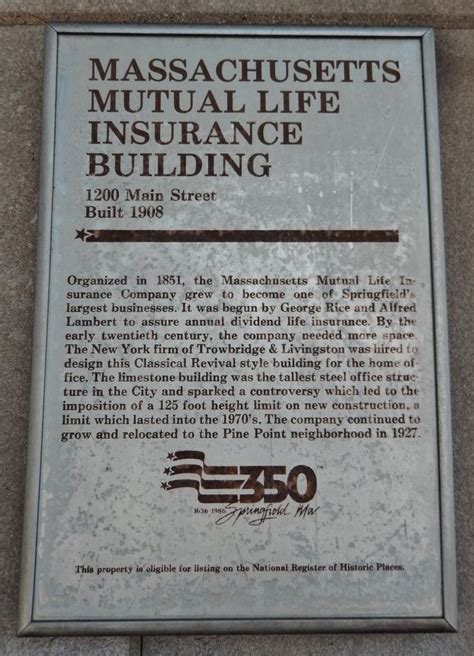

The Historical Evolution of Insurance in Massachusetts

The insurance industry in Massachusetts has a rich history, dating back to the early 18th century. The need for protection against maritime risks and the growth of the shipping industry laid the foundation for the state’s insurance sector. One of the earliest insurance companies, the Massachusetts Fire and Marine Insurance Company, was established in 1794, marking a significant milestone in the state’s insurance evolution.

Over the years, Massachusetts has witnessed the emergence of numerous insurance providers, each contributing to the development of the industry. The state's strong academic institutions, particularly Harvard University and the Massachusetts Institute of Technology (MIT), have played a pivotal role in shaping the insurance landscape through research and innovation. The collaboration between these institutions and insurance companies has led to groundbreaking advancements in risk management and insurance technology.

Today, Massachusetts is home to a thriving insurance ecosystem, with a mix of traditional and innovative companies. Let's explore some of the prominent insurance providers in the state and their unique contributions.

Leading Insurance Companies in Massachusetts

Massachusetts is home to a diverse range of insurance companies, each with its own niche and areas of expertise. Here’s an in-depth look at some of the key players:

Liberty Mutual Insurance

Headquarters: Boston, Massachusetts

Established: 1912

Liberty Mutual is a leading global insurer and one of the largest property and casualty insurers in the United States. With a strong presence in Massachusetts, the company offers a wide range of insurance products, including auto, home, business, and life insurance. Liberty Mutual’s commitment to innovation is evident in its adoption of advanced technologies for improved customer experience and risk assessment.

The company’s global reach and extensive product portfolio make it a trusted choice for both individuals and businesses. Liberty Mutual’s local ties and community involvement have earned it a strong reputation in the state.

Hanover Insurance Group

Headquarters: Worcester, Massachusetts

Established: 1852

The Hanover Insurance Group is a leading provider of property and casualty insurance, with a rich history dating back to the mid-19th century. The company offers a comprehensive range of insurance solutions for businesses, individuals, and families. Its expertise lies in commercial insurance, particularly for small and mid-sized businesses.

The Hanover Insurance Group’s commitment to innovation is showcased through its digital initiatives and partnerships with tech startups. The company’s focus on emerging risks and specialized insurance solutions has solidified its position as a leader in the industry.

Mapfre Insurance

Headquarters: Webster, Massachusetts

Established: 1992 (U.S. operations)

Mapfre Insurance, a subsidiary of the Spanish insurance giant Mapfre S.A., offers a comprehensive range of insurance products in Massachusetts. The company specializes in auto, home, and business insurance, catering to the diverse needs of the local market. Mapfre’s global expertise and local presence make it a trusted choice for Massachusetts residents.

Mapfre’s commitment to sustainability and community involvement sets it apart. The company actively supports environmental initiatives and promotes road safety through various awareness campaigns.

Commerce Insurance Company

Headquarters: Webster, Massachusetts

Established: 1972

Commerce Insurance Company is a prominent auto and home insurance provider in Massachusetts. With a focus on delivering personalized service and competitive rates, the company has built a strong reputation in the state. Commerce Insurance’s commitment to customer satisfaction is evident in its responsive claims process and comprehensive coverage options.

The company’s local roots and dedication to community engagement have made it a trusted partner for Massachusetts residents seeking reliable insurance solutions.

Safety Insurance

Headquarters: Boston, Massachusetts

Established: 1979

Safety Insurance is a leading provider of auto, home, and business insurance in Massachusetts. The company’s focus on personalized service and risk management has earned it a strong reputation in the state. Safety Insurance’s innovative approach to insurance includes the use of telematics for auto insurance, offering discounts to safe drivers.

The company’s commitment to community involvement and education is reflected in its various initiatives, including scholarship programs and safety awareness campaigns.

The Impact of Massachusetts Insurance Companies

Massachusetts insurance companies have a significant impact on both the local and national markets. Their contributions extend beyond providing insurance coverage, shaping the industry through innovation, community engagement, and economic development.

Economic Impact

The insurance industry is a major contributor to the Massachusetts economy, providing employment opportunities and generating significant revenue. The presence of leading insurance companies attracts talent and fosters a skilled workforce. Additionally, the industry’s investments in technology and innovation drive economic growth and create a ripple effect across various sectors.

| Company | Estimated Revenue (2022) |

|---|---|

| Liberty Mutual Insurance | $45.5 billion |

| Hanover Insurance Group | $7.8 billion |

| Mapfre Insurance | $2.1 billion |

| Safety Insurance | $600 million |

Innovation and Technology

Massachusetts insurance companies are at the forefront of industry innovation. They invest heavily in technology to enhance customer experience, streamline processes, and improve risk assessment. From artificial intelligence to blockchain, these companies embrace emerging technologies to stay ahead of the curve. Their research and development efforts contribute to the advancement of the insurance industry as a whole.

Community Engagement

Massachusetts insurance companies actively engage with their local communities, supporting various initiatives and causes. From educational programs to environmental sustainability efforts, these companies demonstrate a strong sense of corporate social responsibility. Their involvement strengthens community bonds and contributes to the overall well-being of the state.

The Future of Insurance in Massachusetts

The insurance landscape in Massachusetts is poised for continued growth and evolution. With a strong foundation of established companies and a culture of innovation, the state is well-positioned to adapt to emerging trends and technologies. Here are some insights into the future of insurance in Massachusetts:

- Increased Digitalization: Massachusetts insurance companies will continue to embrace digital transformation, offering more convenient and personalized insurance experiences.

- Focus on Sustainability: With a growing emphasis on environmental sustainability, insurance providers are likely to develop green insurance products and support eco-friendly initiatives.

- Data-Driven Insights: Advanced analytics and data science will play a crucial role in improving risk assessment and offering tailored insurance solutions.

- Partnerships and Collaboration: Insurance companies may collaborate more closely with tech startups and academic institutions to drive innovation and stay ahead of industry disruptions.

Frequently Asked Questions

What is the average cost of auto insurance in Massachusetts?

+

The average cost of auto insurance in Massachusetts varies depending on factors such as location, driving history, and coverage type. According to recent data, the average annual premium for a minimum liability policy is around 1,050, while a full-coverage policy can cost upwards of 2,000.

Are there any unique insurance requirements in Massachusetts?

+

Yes, Massachusetts has some specific insurance requirements. For instance, all drivers are required to carry Personal Injury Protection (PIP) coverage as part of their auto insurance policy. Additionally, homeowners in high-risk areas may need to purchase flood insurance separately.

How can I find the best insurance rates in Massachusetts?

+

To find the best insurance rates, it’s advisable to shop around and compare quotes from multiple insurance providers. You can also explore discounts offered by companies based on factors like safe driving, multiple policies, or loyalty.

What are some emerging trends in the Massachusetts insurance industry?

+

Emerging trends in Massachusetts insurance include the use of telematics for auto insurance, the development of parametric insurance products, and the integration of artificial intelligence for improved risk assessment and claims processing.