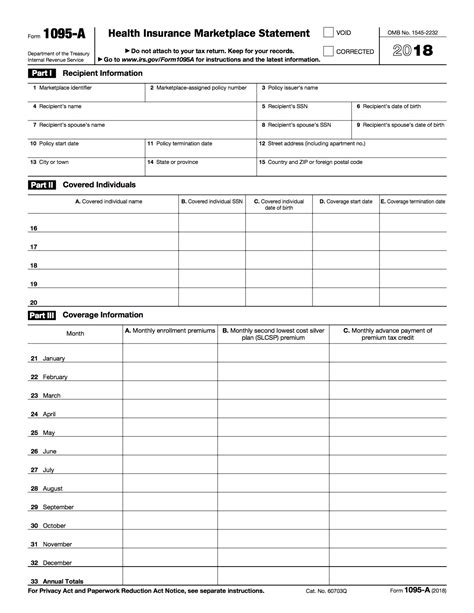

Marketplace Health Insurance Form 1095A

Understanding the 1095-A: A Guide to Marketplace Health Insurance

The 1095-A form is a crucial document in the world of health insurance, specifically for those who obtain their coverage through the Health Insurance Marketplace. This comprehensive guide aims to demystify the 1095-A, shedding light on its purpose, content, and implications for individuals and families seeking affordable healthcare.

The Purpose of Form 1095-A

Form 1095-A, officially known as the "Health Insurance Marketplace Statement," serves as a record of your health insurance coverage for a given tax year. It is issued by the Health Insurance Marketplace, also known as the Health Insurance Exchange, to individuals who have enrolled in a qualified health plan through this marketplace.

The primary purpose of this form is to facilitate the reconciliation of the Premium Tax Credit (PTC), a tax benefit that helps eligible individuals and families offset the cost of their health insurance premiums. The 1095-A provides essential information to taxpayers and the Internal Revenue Service (IRS) to ensure accurate tax reporting and compliance.

Key Information on the 1095-A

The 1095-A form contains critical details about your health insurance coverage, including:

- Recipient Information: This includes your name, address, and taxpayer identification number (TIN), ensuring the form is correctly associated with your tax records.

- Coverage Period: The specific dates of your health insurance coverage, indicating the start and end dates of the plan year.

- Plan Details: Information about the health insurance plan you enrolled in, including the plan name, type of coverage (e.g., individual, family), and whether it is a Qualified Health Plan (QHP) under the Affordable Care Act (ACA) guidelines.

- Premium Amounts: The monthly premiums you paid for your health insurance plan, which are essential for calculating your Premium Tax Credit eligibility.

- Advance Premium Tax Credit (APTC): If you received advance payments of the Premium Tax Credit to lower your monthly premiums, the 1095-A will show the total amount of APTC received during the coverage period.

| Coverage Category | Description |

|---|---|

| Self | Coverage for the primary individual |

| Spouse | Coverage for the primary individual's spouse |

| Dependent(s) | Coverage for the primary individual's qualifying dependents |

Using the 1095-A for Tax Purposes

The 1095-A form plays a vital role in the tax filing process for individuals who received health insurance coverage through the Marketplace and claimed the Premium Tax Credit.

Reconciliation of Premium Tax Credit

When you file your federal income tax return, you will need to reconcile the Premium Tax Credit you received during the year. This process ensures that the credit you claimed matches the actual amount you were eligible for based on your household income and family size.

To reconcile the PTC, you will use the information provided on your 1095-A form. The form will indicate the total amount of APTC (Advance Premium Tax Credit) you received, which you can compare with the PTC calculation based on your income and family size.

If the APTC you received is less than the calculated PTC, you may be eligible for an additional credit on your tax return. Conversely, if the APTC is more than the calculated PTC, you may need to repay a portion of the credit you received.

Filing Status and Dependents

The 1095-A form also helps determine your filing status and eligibility for certain tax benefits, such as the Child Tax Credit or the Earned Income Tax Credit. It provides details about your dependents, allowing you to claim tax credits or deductions for eligible family members.

Understanding Your Coverage and Premiums

The 1095-A form is a valuable tool for understanding your health insurance coverage and the associated costs. By reviewing this form, you can:

- Confirm the dates of your coverage and ensure you have continuous coverage throughout the year.

- Verify the type of plan you enrolled in, such as a Bronze, Silver, Gold, or Platinum plan, and understand the level of coverage and associated costs.

- Review the monthly premiums you paid and ensure they match your expectations based on your income and family size.

- Understand the impact of the Premium Tax Credit on your out-of-pocket costs and the overall affordability of your health insurance.

Future Implications and Considerations

The 1095-A form is an essential document for individuals and families navigating the Health Insurance Marketplace. It provides a clear record of coverage and helps ensure accurate tax reporting and compliance. Here are some key considerations for the future:

Premium Tax Credit Adjustments

If your household income or family size changes during the year, it's crucial to update your information with the Marketplace. These changes can impact your eligibility for the Premium Tax Credit and may require adjustments to your advance payments or tax refund/liability.

Continuous Coverage

To avoid gaps in coverage and potential tax penalties, it's essential to maintain continuous health insurance coverage throughout the year. The 1095-A form can help you track your coverage period and ensure you meet the requirements for continuous coverage.

Plan Selection and Cost Considerations

When selecting a health insurance plan, carefully review the information provided on the 1095-A form and other plan documents. Consider factors such as the level of coverage, out-of-pocket costs, and any tax benefits you may be eligible for to make an informed decision about your healthcare needs and budget.

Marketplace Navigation and Support

The Health Insurance Marketplace can be complex, but assistance is available. If you have questions or need help understanding your options, reach out to the Marketplace's customer service or consult with a qualified healthcare navigator or tax professional. They can provide guidance tailored to your specific circumstances.

FAQs

What if I didn’t receive Form 1095-A, but I enrolled in a Marketplace plan?

+If you believe you should have received a 1095-A form but did not, contact the Marketplace’s customer service. They can help verify your enrollment and ensure you receive the necessary documents for tax filing.

Can I claim the Premium Tax Credit if I didn’t receive advance payments?

+Yes, even if you did not receive advance payments of the Premium Tax Credit, you may still be eligible to claim the credit on your tax return. The 1095-A form will provide the necessary information for calculating your PTC eligibility.

How do I know if I need to repay any portion of the Premium Tax Credit?

+The amount of Premium Tax Credit you need to repay, if any, is determined during the tax reconciliation process. Compare the APTC (Advance Premium Tax Credit) you received, as shown on your 1095-A form, with the calculated PTC based on your income and family size. If the APTC exceeds the calculated PTC, you may need to repay a portion of the credit.

Can I use the 1095-A form for state tax purposes as well?

+The 1095-A form is primarily used for federal tax purposes. However, some states may have their own health insurance-related tax provisions. Check with your state’s tax agency or consult a tax professional to understand the specific requirements for your state.