Life Insurance Quotes

Life insurance is an essential aspect of financial planning, offering individuals and their families peace of mind and a safety net during uncertain times. Understanding the intricacies of life insurance policies and quotes is crucial for making informed decisions that align with your specific needs and circumstances. This comprehensive guide aims to delve into the world of life insurance quotes, exploring the factors that influence them, the different types of policies available, and the steps to secure the most suitable coverage.

Unraveling Life Insurance Quotes: A Comprehensive Overview

Life insurance quotes serve as a window into the world of insurance coverage, providing individuals with a snapshot of the financial protection they can expect. These quotes are influenced by a multitude of factors, each playing a unique role in determining the cost and scope of the policy. By exploring these elements, individuals can gain a deeper understanding of the insurance landscape and make more informed choices.

The Impact of Age and Health

One of the primary factors influencing life insurance quotes is the age and health status of the policyholder. Insurance companies carefully assess these variables, as they directly impact the risk associated with providing coverage. Generally, younger individuals with no pre-existing health conditions are viewed as lower-risk candidates, resulting in more favorable quotes. On the other hand, older individuals or those with health complications may face higher premiums, reflecting the increased likelihood of claims.

Consider the case of John, a 35-year-old with a clean bill of health. When he applied for life insurance, he received quotes that were significantly lower compared to his friend Mike, who is 50 years old and has a history of heart disease. This disparity in quotes highlights the impact of age and health on insurance premiums.

Lifestyle and Occupation

Insurance companies also consider an individual’s lifestyle and occupation when generating quotes. Engaging in high-risk activities, such as extreme sports or hazardous occupations, can lead to increased premiums. For instance, a professional skydiver may face higher insurance costs due to the inherent risks associated with their sport.

Similarly, certain occupations may carry higher insurance premiums. For example, a firefighter, who regularly faces life-threatening situations, may pay more for life insurance compared to an office worker. These factors are carefully evaluated to assess the potential risks and determine appropriate coverage.

Family History and Genetics

Family history and genetics play a crucial role in life insurance quotes. Insurance companies analyze an individual’s family medical history to assess the potential for inherited health conditions. Conditions such as heart disease, diabetes, or certain types of cancer can increase the risk of early mortality, leading to higher insurance premiums.

Imagine Sarah, a 40-year-old woman with a family history of breast cancer. Despite her own good health, her life insurance quotes may reflect the increased risk associated with her genetic predisposition. This example underscores the importance of disclosing family medical history when applying for life insurance.

Smoking and Substance Use

Lifestyle choices, particularly smoking and substance use, can significantly impact life insurance quotes. Smokers, for instance, are often considered higher-risk candidates due to the increased health complications associated with tobacco use. Insurance companies may charge higher premiums or even deny coverage to smokers, as the risk of health issues and early mortality is elevated.

Similarly, substance abuse, including alcohol and drug use, can lead to higher insurance costs. These behaviors can increase the likelihood of accidents, injuries, and health complications, resulting in elevated insurance premiums. Insurance companies carefully evaluate these factors to assess the overall risk profile of the policyholder.

Navigating the World of Life Insurance Policies

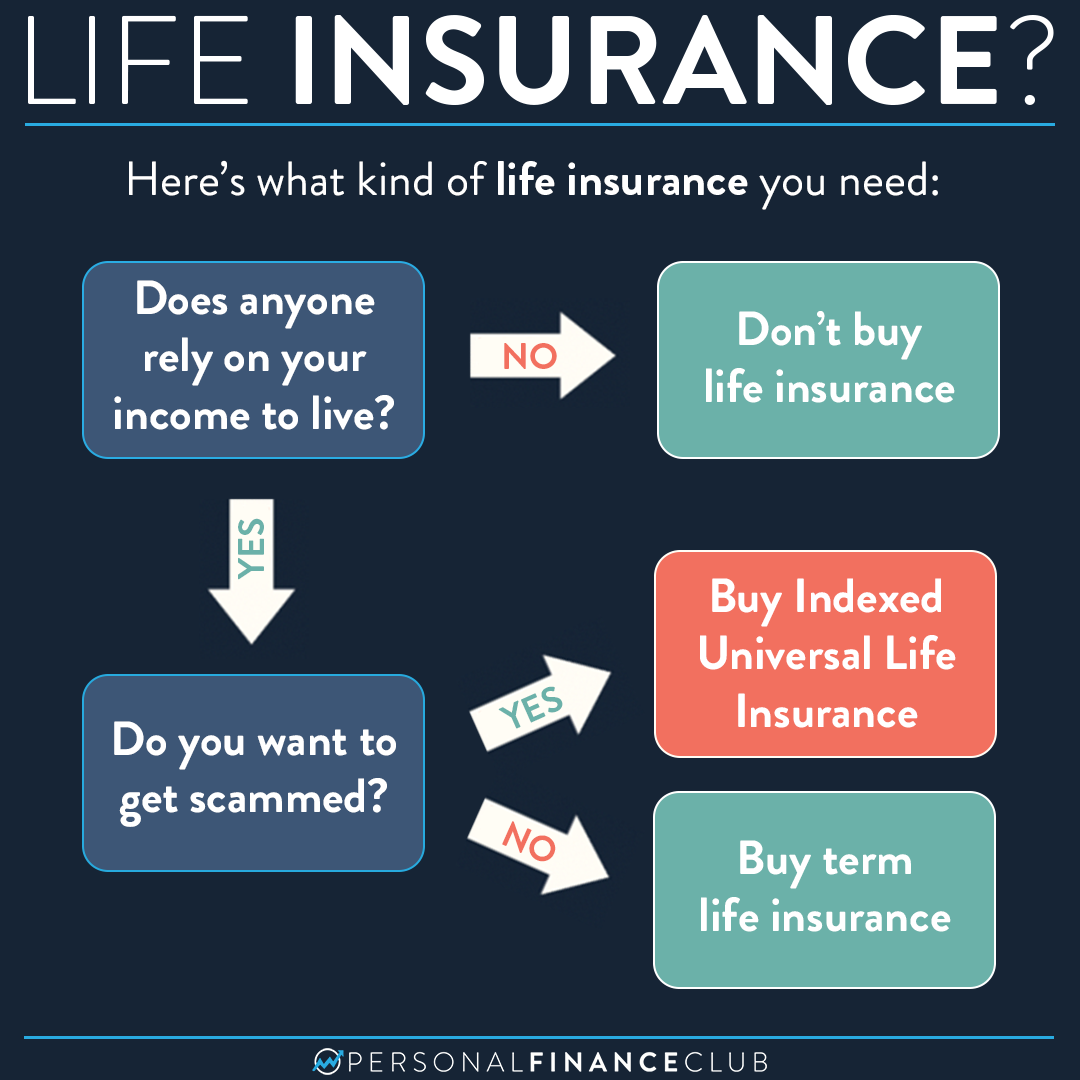

Understanding the different types of life insurance policies is essential for making informed decisions. Each policy type caters to specific needs and circumstances, offering varying levels of coverage and benefits. By exploring the options available, individuals can choose the policy that aligns best with their financial goals and the protection they desire for their loved ones.

Term Life Insurance

Term life insurance is a popular choice for many individuals, offering coverage for a specific period, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive a payout. Term life insurance is often more affordable compared to other types of policies, making it an attractive option for those seeking temporary coverage or those with budget constraints.

For example, consider a young couple with growing children. They may opt for term life insurance to ensure that their family is financially protected during the years when their children are dependent on them. As their children grow older and become more independent, the need for life insurance may diminish, making term life insurance an ideal choice for this stage of life.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the policyholder’s entire life. This type of policy offers a fixed premium and a guaranteed death benefit, ensuring that the beneficiaries receive the payout regardless of when the policyholder passes away. Whole life insurance also accumulates cash value over time, which can be borrowed against or used for various financial purposes.

Imagine a business owner who wants to ensure the financial stability of their company in the event of their untimely death. Whole life insurance provides a reliable and consistent death benefit, allowing the business to continue operations and providing financial support to the owner's family. The cash value component of whole life insurance can also be utilized for business needs, such as funding expansion or covering unexpected expenses.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that allows policyholders to adjust their premiums and death benefits over time. This policy offers a level of customization, enabling individuals to increase or decrease their coverage based on changing needs and circumstances. Universal life insurance also accumulates cash value, similar to whole life insurance, providing additional financial flexibility.

A retired couple may choose universal life insurance to ensure their financial security in retirement. As their income and expenses change over time, they can adjust their premiums and death benefits accordingly. The cash value component of universal life insurance can also be used to supplement their retirement income or cover unexpected medical expenses.

Securing the Right Life Insurance Coverage

Obtaining the most suitable life insurance coverage involves a thoughtful process of evaluation and comparison. By following these steps, individuals can navigate the insurance landscape with confidence and make informed decisions that protect their loved ones.

Assess Your Needs

The first step in securing life insurance coverage is to assess your specific needs. Consider factors such as your financial obligations, the number of dependents you have, and your future financial goals. Understanding your unique circumstances will help you determine the appropriate amount of coverage and the type of policy that best suits your requirements.

For instance, a single individual with no dependents may require a smaller life insurance policy to cover their final expenses and any outstanding debts. On the other hand, a married couple with young children may need a more substantial policy to ensure their family's financial stability and provide for their children's future education and living expenses.

Compare Quotes and Policies

Once you have assessed your needs, it’s time to compare quotes and policies from different insurance providers. Utilize online tools and resources to gather quotes and evaluate the terms and conditions of each policy. Look for providers that offer competitive rates and policies that align with your needs and preferences.

When comparing quotes, pay attention to the fine print. Factors such as the policy's renewal options, the grace period for premium payments, and any additional riders or benefits can significantly impact the overall value of the policy. Take the time to thoroughly review and understand the terms before making a decision.

Work with a Reputable Insurance Agent

Engaging the services of a reputable insurance agent can provide valuable guidance and support throughout the life insurance selection process. Insurance agents have extensive knowledge of the industry and can offer personalized advice based on your specific needs. They can help you navigate the complexities of different policies, explain the fine print, and ensure that you make an informed decision.

When choosing an insurance agent, consider their experience, qualifications, and reputation. Seek recommendations from trusted sources or conduct thorough research to find an agent who aligns with your values and priorities. A good insurance agent will take the time to understand your needs and provide tailored recommendations, ensuring that you receive the best possible coverage.

Understand the Application Process

The life insurance application process typically involves a medical examination and the completion of a detailed application form. During the medical examination, a paramedic will assess your health and collect samples for testing. This process helps insurance companies evaluate your overall health and determine your risk profile.

The application form requires you to provide comprehensive information about your health, lifestyle, and occupation. It's crucial to be honest and accurate in your responses, as any misrepresentations or omissions can lead to claim denials or increased premiums. Take the time to carefully review and complete the application, ensuring that all information is up-to-date and truthful.

The Future of Life Insurance: Evolving Trends and Innovations

The life insurance industry is continuously evolving, driven by advancements in technology and changing consumer preferences. As we look to the future, several trends and innovations are shaping the landscape of life insurance, offering enhanced convenience, accessibility, and personalized coverage.

Digital Transformation

The digital revolution has transformed the way we interact with insurance providers. Online platforms and mobile applications are increasingly becoming the go-to channels for obtaining life insurance quotes and managing policies. These digital tools offer convenience, allowing individuals to compare quotes, apply for coverage, and make payments with just a few clicks.

Insurance companies are investing in robust digital infrastructures to enhance the customer experience. From streamlined application processes to real-time policy management, digital transformation is making life insurance more accessible and user-friendly. Additionally, digital platforms enable insurance providers to gather valuable data, analyze customer behavior, and personalize coverage based on individual needs.

Parametric Insurance

Parametric insurance is an innovative approach to life insurance that provides coverage based on specific parameters or triggers. Rather than relying on traditional claims processes, parametric insurance pays out based on the occurrence of predefined events or conditions. This approach offers a faster and more efficient claims process, as payments are made automatically upon the activation of the predefined parameters.

For example, a parametric life insurance policy may pay out a benefit if the policyholder is diagnosed with a critical illness, such as cancer or a heart attack. By removing the need for extensive claims investigations, parametric insurance provides swift financial support during times of need. This innovative approach is particularly beneficial for individuals who value simplicity and timely access to funds.

Personalized Coverage with Wearable Technology

Wearable technology, such as fitness trackers and health monitoring devices, is revolutionizing the life insurance industry. Insurance companies are leveraging the data collected by these devices to offer personalized coverage and incentives. By tracking an individual’s health and fitness levels, insurance providers can tailor policies to their specific needs and offer rewards for healthy lifestyle choices.

For instance, an insurance company may offer discounted premiums to policyholders who consistently meet their fitness goals as tracked by their wearable device. This incentivizes individuals to adopt healthier habits and provides a win-win scenario for both the policyholder and the insurance provider. As wearable technology advances, the potential for personalized coverage and rewards is expected to grow, further enhancing the customer experience.

Blockchain Technology and Smart Contracts

Blockchain technology is poised to revolutionize the life insurance industry by introducing smart contracts and decentralized record-keeping. Smart contracts are self-executing agreements that automatically trigger actions based on predefined conditions. In the context of life insurance, smart contracts can streamline the claims process, making it more efficient and transparent.

By leveraging blockchain technology, insurance companies can create secure and tamper-proof records of policy information, claims data, and beneficiary details. Smart contracts can automatically verify and process claims, reducing the potential for fraud and errors. This technology also enables policyholders to have greater control over their data, providing transparency and peace of mind.

FAQs

What factors determine life insurance quotes?

+Life insurance quotes are influenced by various factors, including age, health status, lifestyle, occupation, family history, and genetics. Insurance companies assess these variables to determine the risk associated with providing coverage, which ultimately impacts the cost and scope of the policy.

How do I choose the right life insurance policy?

+Choosing the right life insurance policy involves assessing your specific needs, comparing quotes and policies from different providers, and seeking guidance from a reputable insurance agent. Consider your financial obligations, the number of dependents you have, and your future financial goals to determine the appropriate amount of coverage and policy type.

What is the difference between term life and whole life insurance?

+Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, while whole life insurance offers coverage for the policyholder’s entire life. Term life insurance is often more affordable and suitable for temporary coverage, while whole life insurance provides permanent coverage with a fixed premium and a guaranteed death benefit.

Can I adjust my life insurance coverage over time?

+Yes, some types of life insurance policies, such as universal life insurance, allow policyholders to adjust their premiums and death benefits over time. This flexibility enables individuals to increase or decrease their coverage based on changing needs and circumstances.

What is parametric insurance, and how does it work?

+Parametric insurance is an innovative approach that provides coverage based on specific parameters or triggers. Rather than relying on traditional claims processes, parametric insurance pays out based on the occurrence of predefined events or conditions. This approach offers a faster and more efficient claims process, as payments are made automatically upon the activation of the predefined parameters.