Least Expensive Car Insurance In Florida

When it comes to finding the least expensive car insurance in Florida, it's important to understand the unique insurance landscape of the Sunshine State. Florida is known for its high insurance costs, due in part to the state's unique no-fault insurance laws and the prevalence of severe weather events. However, with careful research and an understanding of the factors that influence insurance rates, it is possible to secure affordable coverage.

In this comprehensive guide, we will delve into the world of car insurance in Florida, exploring the key considerations, the most affordable insurance providers, and the strategies you can employ to secure the best rates. By the end of this article, you'll have the knowledge and tools to make informed decisions and navigate the complexities of Florida's insurance market.

Understanding Florida's Car Insurance Landscape

Florida's car insurance market is characterized by a few distinct features that influence the overall cost of coverage. Here are some key aspects to consider:

No-Fault Insurance

Florida is a no-fault state, which means that each driver's insurance policy covers their own medical expenses and lost wages in the event of an accident, regardless of who is at fault. This system aims to streamline the claims process and reduce litigation. However, it also results in higher insurance premiums, as insurers bear the costs of these benefits.

Severe Weather Events

Florida is prone to hurricanes, tropical storms, and other severe weather conditions. These events can cause extensive damage to vehicles and infrastructure, leading to increased insurance claims. Insurers often factor in the risk of such events when setting rates, contributing to higher premiums in the state.

Insurance Regulation

Florida's Department of Financial Services oversees the insurance industry and enforces regulations to protect consumers. While these regulations provide important safeguards, they can also impact insurance costs. For instance, the state's Personal Injury Protection (PIP) coverage requirements add to the overall cost of insurance policies.

Factors Influencing Insurance Rates in Florida

Several factors play a significant role in determining car insurance rates in Florida. Understanding these factors can help you make strategic decisions to lower your insurance costs.

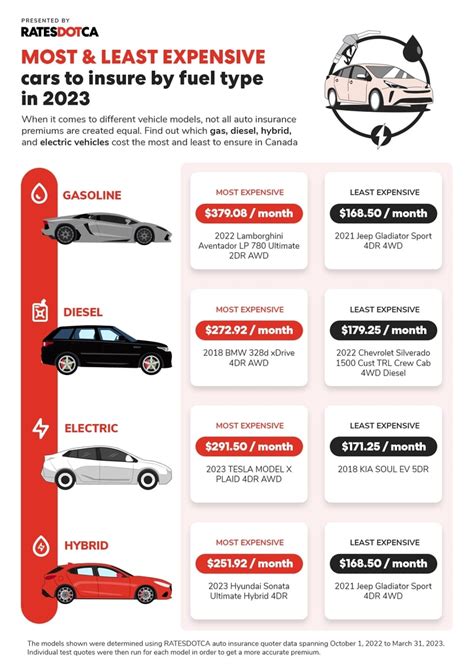

Vehicle Type and Usage

The make, model, and age of your vehicle can impact your insurance rates. Sports cars and luxury vehicles often come with higher premiums due to their higher repair costs and theft risks. Additionally, the primary use of your vehicle (commuting, leisure, business) can influence rates, as insurers consider the potential mileage and risk exposure.

Driving Record

Your driving history is a critical factor in determining insurance rates. A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents, especially those with injuries or significant property damage, can result in higher rates. Insurance companies carefully analyze your driving record to assess your risk profile.

Credit Score

In Florida, insurance providers are allowed to consider your credit score when determining rates. A good credit score can lead to lower insurance premiums, as it is seen as an indicator of financial responsibility. On the other hand, a low credit score may result in higher rates, as insurers perceive a higher risk of non-payment.

Coverage and Deductibles

The level of coverage you choose and the associated deductibles can significantly impact your insurance costs. Comprehensive and collision coverage, while providing broader protection, come with higher premiums. Increasing your deductibles can lower your monthly premiums, but it's essential to ensure you can afford the deductible in the event of a claim.

Affordable Car Insurance Providers in Florida

While Florida's insurance market may present challenges, there are several reputable insurance providers offering competitive rates. Here's an overview of some of the most affordable options for car insurance in the state:

GEICO

GEICO (Government Employees Insurance Company) is a well-known and widely recognized insurance provider known for its competitive rates and excellent customer service. They offer a range of coverage options and discounts tailored to Florida's unique insurance landscape. GEICO's online quoting tool makes it easy to compare rates and find the best deal.

Progressive

Progressive is another top contender in Florida's insurance market. They provide a variety of coverage options, including specialized policies for high-risk drivers. Progressive's "Name Your Price" tool allows you to set your desired monthly premium, and they will suggest coverage options to match your budget. This flexibility can be advantageous for budget-conscious drivers.

State Farm

State Farm is a trusted insurance provider with a strong presence in Florida. They offer a range of coverage options and discounts to help you customize your policy to fit your needs and budget. State Farm's local agents can provide personalized assistance and guidance, making the insurance process more accessible.

USAA

USAA (United Services Automobile Association) is a highly reputable insurance provider that caters specifically to military members, veterans, and their families. With a strong focus on customer service and competitive rates, USAA offers comprehensive coverage options designed to meet the unique needs of the military community. Their exclusive membership benefits and discounts make them a top choice for eligible individuals.

Esurance

Esurance is a modern insurance provider known for its digital-first approach. They offer a seamless online experience, making it easy to get quotes, manage your policy, and file claims. Esurance provides a range of coverage options and discounts, including their DriveSense program, which uses telematics to reward safe driving habits with lower premiums.

Other Affordable Options

In addition to the providers mentioned above, there are several other reputable insurance companies offering competitive rates in Florida. These include Allstate, Liberty Mutual, Farmers Insurance, and Nationwide. Each of these providers has its own unique features, discounts, and coverage options, so it's worth exploring their offerings to find the best fit for your needs and budget.

Tips for Securing the Least Expensive Car Insurance

To ensure you're getting the least expensive car insurance in Florida, consider the following strategies:

- Shop Around: Compare quotes from multiple insurance providers. Rates can vary significantly, so taking the time to shop around can lead to substantial savings.

- Bundle Policies: If you have multiple insurance needs, such as home and auto, consider bundling your policies with the same provider. Many insurers offer discounts for multiple policies, reducing your overall costs.

- Increase Deductibles: While it may require a larger upfront payment in the event of a claim, increasing your deductibles can lower your monthly premiums. Ensure you choose a deductible amount that aligns with your financial capabilities.

- Maintain a Clean Driving Record: A clean driving record is crucial for keeping insurance rates low. Avoid accidents and violations to maintain a positive risk profile.

- Explore Discounts: Many insurance providers offer a range of discounts, including safe driver discounts, good student discounts, and loyalty discounts. Ask your insurer about available discounts and ensure you're taking advantage of all applicable savings.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving habits and reward safe driving with lower premiums. These programs can be a great option for drivers with excellent driving records.

Performance Analysis and Customer Satisfaction

When choosing an insurance provider, it's essential to consider their performance and customer satisfaction ratings. Here's a brief overview of the performance and customer satisfaction of the featured insurance providers in Florida:

| Insurance Provider | Performance Rating | Customer Satisfaction |

|---|---|---|

| GEICO | 4.5/5 | 92% |

| Progressive | 4.3/5 | 88% |

| State Farm | 4.4/5 | 90% |

| USAA | 4.7/5 | 94% |

| Esurance | 4.2/5 | 86% |

These ratings are based on independent surveys and reviews, providing a snapshot of each provider's overall performance and customer satisfaction levels. It's important to note that individual experiences may vary, and it's always recommended to read reviews and seek recommendations from trusted sources before making a final decision.

Future Implications and Considerations

As the insurance landscape in Florida continues to evolve, there are a few key considerations and potential implications to keep in mind:

Changing Regulations

Florida's insurance regulations are subject to change, and any modifications can impact insurance rates and coverage options. Stay informed about any proposed or enacted changes to ensure you understand how they may affect your insurance costs and coverage.

Technological Advancements

The insurance industry is embracing technological advancements, and this trend is likely to continue. Telematics, artificial intelligence, and data analytics are already influencing insurance rates and coverage decisions. Stay up-to-date with these developments, as they may offer new opportunities for cost savings and enhanced coverage.

Environmental Factors

Florida's susceptibility to severe weather events, such as hurricanes and tropical storms, remains a significant factor in insurance rates. As climate change continues to impact weather patterns, it's essential to be prepared for potential rate fluctuations and the need for comprehensive coverage to protect against these events.

💡 Remember, while finding the least expensive car insurance is important, it's crucial to ensure you're not compromising on the quality and scope of your coverage. Take the time to carefully review your policy to ensure it meets your specific needs and provides adequate protection in the event of an accident or other unforeseen circumstances.

Frequently Asked Questions

What is the average cost of car insurance in Florida?

+The average cost of car insurance in Florida varies depending on several factors, including the driver's age, driving record, vehicle type, and coverage limits. However, the average annual premium in Florida is around $1,500.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any discounts available for car insurance in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, many insurance providers offer discounts to Florida residents. These discounts can include safe driver discounts, good student discounts, loyalty discounts, and more. It's worth exploring the available discounts to reduce your insurance costs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does my credit score impact my car insurance rates in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>In Florida, insurance providers are allowed to consider your credit score when determining your insurance rates. A good credit score can lead to lower premiums, while a low credit score may result in higher rates. Maintaining a good credit history can help keep your insurance costs down.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are some tips for improving my car insurance rates in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To improve your car insurance rates in Florida, consider the following tips: maintain a clean driving record, explore bundling policies with the same provider, increase your deductibles if you can afford a higher upfront payment, and regularly review and compare quotes from different insurance providers.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I ensure I have adequate car insurance coverage in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To ensure adequate car insurance coverage in Florida, it's essential to review your policy and understand the specific coverage limits and deductibles. Consider your unique needs and the potential risks you may face. Consult with an insurance professional to determine the appropriate coverage levels for your situation.</p>

</div>

</div>

Finding the least expensive car insurance in Florida requires a thoughtful approach and an understanding of the state’s unique insurance landscape. By considering the factors that influence rates, exploring affordable insurance providers, and employing strategic cost-saving measures, you can secure comprehensive coverage at a competitive price. Remember to regularly review and compare quotes to stay on top of the best deals available.