Kids Insurance

Ensuring the well-being and future security of our children is a top priority for parents and guardians worldwide. One crucial aspect of this responsibility is providing adequate insurance coverage to protect their health, safety, and financial stability. In this comprehensive guide, we will delve into the world of kids' insurance, exploring the various types, their benefits, and how they can provide peace of mind for families.

Understanding Kids’ Insurance: A Comprehensive Overview

Kids’ insurance, also known as child insurance or pediatric insurance, is a specialized form of coverage designed to address the unique needs and risks associated with childhood. It goes beyond the standard health insurance plans, offering tailored benefits and support to meet the evolving requirements of growing children.

The Importance of Kids’ Insurance

Children are vulnerable to a range of health issues, accidents, and unforeseen circumstances. From common illnesses and injuries to more complex medical conditions, kids’ insurance steps in to provide financial protection and access to quality healthcare. Here’s a closer look at why this type of insurance is essential:

- Medical Expenses: Kids' insurance helps cover the costs of medical treatments, hospitalization, medications, and specialized care, ensuring that children receive the necessary care without putting a strain on family finances.

- Accident Coverage: Children are naturally curious and active, which can lead to accidents. Kids' insurance provides coverage for accidental injuries, offering financial support for treatment and rehabilitation.

- Preventive Care: Many kids' insurance plans include preventive care benefits, encouraging regular check-ups, vaccinations, and early detection of potential health issues. This proactive approach can prevent more significant health problems down the line.

- Specialized Treatment: Some children may require specialized medical care, such as pediatric oncology or developmental therapies. Kids' insurance can provide access to these specialized services, ensuring children receive the best possible care.

- Peace of Mind: Knowing that your child's health and future are protected gives parents and guardians a sense of reassurance. Kids' insurance removes the financial worry associated with unexpected medical events, allowing families to focus on their child's well-being.

Types of Kids’ Insurance

Kids’ insurance comes in various forms, each tailored to meet different needs. Understanding the options available is crucial when choosing the right coverage for your child.

Health Insurance for Kids

Health insurance for kids, also known as pediatric health insurance, is a comprehensive plan that covers a wide range of medical services. These plans typically include:

- Hospitalization: Coverage for inpatient stays, surgeries, and intensive care.

- Outpatient Services: Visits to doctors, specialists, and diagnostic tests.

- Prescription Drugs: Coverage for necessary medications.

- Preventive Care: Regular check-ups, vaccinations, and screenings.

- Dental and Vision Care: Coverage for routine dental check-ups and vision examinations.

- Mental Health Services: Access to counseling and therapy for emotional well-being.

| Health Insurance Provider | Coverage Highlights |

|---|---|

| ABC Family Health Plan | Comprehensive coverage, including pediatric specialty care. |

| KidCare Plus | Focuses on preventive care and offers generous wellness benefits. |

| Healthy Kids Network | Specializes in providing coverage for children with pre-existing conditions. |

Accident Insurance

Accident insurance is a type of coverage specifically designed to protect children in case of accidental injuries. These plans typically provide benefits for accidents occurring both inside and outside the home, covering:

- Medical Expenses: Treatment costs, including emergency room visits and surgeries.

- Rehabilitation: Coverage for physical therapy, occupational therapy, and speech therapy.

- Accidental Death and Dismemberment: Provides a benefit in case of severe injuries leading to dismemberment or death.

- Hospital Indemnity: A daily or weekly benefit paid directly to the policyholder for each day the child is hospitalized due to an accident.

| Accident Insurance Provider | Key Benefits |

|---|---|

| SafeKids Insurance | Covers a wide range of accidental injuries with no pre-existing condition exclusions. |

| AccidentGuard | Offers 24/7 accident assistance and access to a global network of medical providers. |

| Family Accident Plan | Provides coverage for the entire family, with higher benefits for children. |

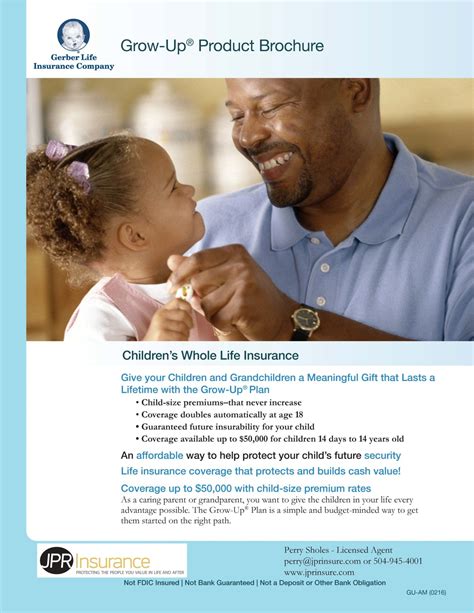

Life Insurance for Children

Life insurance for children is a unique type of coverage that offers financial protection and long-term benefits. It typically includes:

- Death Benefit: A lump-sum payment to the policyholder in case of the child's unfortunate death.

- Cash Value Accumulation: Some policies offer a savings component, allowing the policy to build cash value over time.

- Future Convertibility: The option to convert the policy into a permanent life insurance plan as the child grows older.

- Rider Options: Additional benefits such as critical illness coverage or disability income protection.

| Life Insurance Provider | Notable Features |

|---|---|

| ChildSecure Life | Offers affordable premiums and the option to add critical illness coverage. |

| FutureStart | Provides flexible premium payment options and the ability to increase coverage as the child ages. |

| Family Legacy Plan | Focuses on building long-term savings and offers tax-advantaged growth. |

Key Considerations When Choosing Kids’ Insurance

When selecting kids’ insurance, several factors come into play. Here are some critical considerations to keep in mind:

Coverage Needs

Assess your child’s unique health needs and risks. Consider any pre-existing conditions, allergies, or family medical history that may impact their insurance requirements.

Network of Providers

Ensure that the insurance plan includes a network of healthcare providers and facilities that you trust and have easy access to. This is especially important for specialized care.

Premiums and Deductibles

Evaluate the cost of premiums and deductibles. While affordable plans are essential, ensure that the coverage provided aligns with your child’s needs. Higher premiums may offer more comprehensive benefits.

Policy Limitations and Exclusions

Read the fine print to understand any limitations or exclusions in the policy. Some plans may have restrictions on pre-existing conditions, certain treatments, or specific types of accidents.

Renewability and Longevity

Look for policies that offer renewability options and the potential for long-term coverage. This ensures that your child’s insurance needs are met as they grow and their health requirements change.

Reputation and Customer Service

Research the reputation of the insurance provider and their customer service record. Reliable customer support is crucial when dealing with claims and policy inquiries.

The Impact of Kids’ Insurance on Financial Security

Kids’ insurance plays a vital role in safeguarding the financial stability of families. Here’s how it makes a difference:

Reducing Financial Burden

Medical emergencies and unexpected accidents can lead to substantial financial strain. Kids’ insurance provides a safety net, ensuring that families can afford the necessary medical care without compromising their financial well-being.

Long-Term Savings

Life insurance policies for children often come with a savings component. This allows parents to start building a financial cushion for their child’s future, whether for education, homeownership, or other significant milestones.

Protection for the Future

As children grow into adults, the financial benefits of kids’ insurance continue. Life insurance policies can be converted into permanent plans, offering long-term protection and the potential for wealth accumulation.

Conclusion

Kids’ insurance is a vital tool for parents and guardians to protect their children’s health, safety, and future. By understanding the different types of coverage available and making informed choices, families can ensure that their children have access to the best possible care and financial security. Remember, the right kids’ insurance plan provides peace of mind, allowing parents to focus on what matters most—their child’s happiness and well-being.

How much does kids’ insurance cost, and are there any discounts available?

+The cost of kids’ insurance can vary based on factors such as the type of coverage, the child’s age, and the insurance provider. However, many insurance companies offer family discounts or multi-policy discounts, which can significantly reduce the overall cost. It’s always beneficial to inquire about available discounts when shopping for insurance.

Can kids’ insurance cover pre-existing conditions?

+Some kids’ insurance plans may have limitations or exclusions for pre-existing conditions. However, there are specialized plans designed specifically for children with pre-existing conditions. These plans aim to provide coverage and support for ongoing medical needs. It’s essential to carefully review the policy details to understand the coverage provided.

What happens if I need to make a claim under my kids’ insurance policy?

+Making a claim under your kids’ insurance policy typically involves gathering the necessary medical documentation and submitting it to the insurance provider. The process can vary depending on the insurer and the type of claim. It’s recommended to review the claim process outlined in your policy and reach out to the insurer’s customer service for guidance if needed.

Are there any tax benefits associated with kids’ insurance policies?

+In some cases, certain types of kids’ insurance policies, particularly life insurance plans with a savings component, may offer tax advantages. These policies can provide tax-deferred growth and potential tax benefits upon withdrawal. However, tax laws can vary, so it’s advisable to consult with a tax professional to understand the specific advantages in your region.

How do I choose the right insurance provider for my child’s needs?

+Choosing the right insurance provider involves careful research. Consider factors such as the provider’s reputation, financial stability, customer service reviews, and the specific coverage options they offer. It’s beneficial to compare multiple providers and seek recommendations from trusted sources, ensuring that the chosen provider aligns with your child’s unique health and financial needs.