Jerry's Insurance

In the world of insurance, a name that has stood out and garnered attention is Jerry's Insurance. This innovative company has been making waves in the industry, offering unique and customer-centric approaches to insurance services. With a focus on transparency, convenience, and affordability, Jerry's Insurance has become a game-changer for many individuals seeking reliable coverage.

The Rise of Jerry’s Insurance: A Revolutionary Approach

Founded by visionary entrepreneurs, Jerry’s Insurance emerged with a mission to simplify the often-complicated insurance landscape. The company’s innovative business model revolves around leveraging technology to streamline the insurance process, making it accessible and understandable for all.

At its core, Jerry's Insurance believes in empowering customers to make informed decisions about their insurance needs. By utilizing advanced algorithms and a user-friendly interface, the company provides personalized recommendations, ensuring individuals receive the right coverage at the best possible price.

Key Features of Jerry’s Insurance

- Real-Time Comparison: Jerry’s platform allows users to compare insurance quotes from multiple providers in real-time. This feature ensures that customers can quickly identify the most suitable and cost-effective options for their specific requirements.

- AI-Assisted Support: The company’s artificial intelligence-powered assistant, “Jerry,” assists users throughout the process. From answering queries to guiding users through the policy selection, Jerry ensures a seamless and efficient experience.

- Paperless Process: Embracing a digital-first approach, Jerry’s Insurance eliminates the need for tedious paperwork. All interactions and transactions are conducted online, reducing administrative burdens and streamlining the overall process.

- Transparent Pricing: Unlike traditional insurance providers, Jerry’s Insurance provides transparent pricing structures. Customers can easily understand the breakdown of their premiums, ensuring there are no hidden costs or surprises.

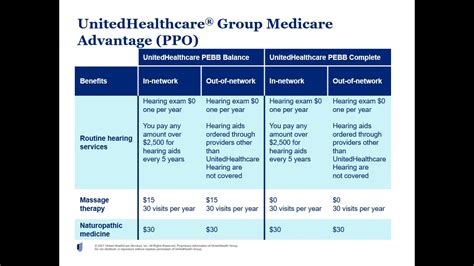

| Insurance Type | Coverage Options |

|---|---|

| Auto Insurance | Comprehensive, Liability, Collision, and more |

| Home Insurance | Dwelling, Personal Property, Liability, and Additional Living Expenses |

| Health Insurance | Individual, Family, and Group Plans |

The Impact of Jerry’s Insurance on the Industry

The emergence of Jerry’s Insurance has had a significant impact on the insurance industry, challenging the status quo and forcing traditional providers to reconsider their strategies.

Challenging Industry Norms

By introducing a tech-centric model, Jerry’s Insurance has exposed the inefficiencies and complexities often associated with traditional insurance processes. This has led to a wider industry discussion on how to improve customer experiences and streamline services.

Moreover, the company's emphasis on transparency and affordability has set a new benchmark for insurance providers. Customers now expect clearer pricing structures and more personalized options, pushing the industry to adapt and innovate.

Enhanced Competition and Consumer Benefits

The success of Jerry’s Insurance has intensified competition within the insurance market. This increased competition has resulted in a range of consumer benefits, including more competitive pricing, improved coverage options, and enhanced customer service standards across the board.

Additionally, Jerry's focus on digital transformation has inspired other insurance providers to invest in technology, further improving the overall customer experience. This includes the development of user-friendly platforms, mobile apps, and AI-powered assistants, all aimed at providing more accessible and efficient services.

The Future of Jerry’s Insurance and Industry Trends

Looking ahead, Jerry’s Insurance is poised for continued growth and innovation. The company’s commitment to staying at the forefront of technological advancements ensures it will remain a key player in the insurance industry.

Expansion and Diversification

Jerry’s Insurance is likely to expand its services beyond auto, home, and health insurance. The company may explore offering coverage for niche markets, such as pet insurance, travel insurance, or even specialty insurance for unique assets like fine art or collectibles.

Furthermore, with the increasing demand for sustainable and ethical practices, Jerry's Insurance could position itself as a leader in eco-friendly insurance options, catering to consumers who prioritize environmentally conscious choices.

Integration of Emerging Technologies

The insurance industry is rapidly adopting emerging technologies, and Jerry’s Insurance is expected to be at the forefront of this trend. The company may explore the use of blockchain technology for secure and transparent transactions, or leverage augmented reality for enhanced risk assessment and claim processing.

Additionally, with the rise of autonomous vehicles and smart home technologies, Jerry's Insurance could develop innovative insurance products that cater to these emerging markets, providing coverage for potential risks associated with these advancements.

How does Jerry’s Insurance ensure data security and privacy?

+Jerry’s Insurance employs industry-leading security measures to protect customer data. This includes advanced encryption protocols, secure data storage, and regular security audits. The company also adheres to strict privacy policies, ensuring that customer information is used solely for providing insurance services and never shared without consent.

Can Jerry’s Insurance provide coverage for unique or specialized assets?

+Absolutely! Jerry’s Insurance understands that not all assets fit into traditional insurance categories. The company offers customizable insurance solutions for unique assets such as classic cars, fine art collections, or even specialized equipment used in various industries. Their team of experts works closely with clients to assess risks and develop tailored coverage plans.

What sets Jerry’s Insurance apart from traditional insurance providers?

+Jerry’s Insurance stands out due to its innovative use of technology, focus on transparency, and customer-centric approach. The company’s online platform simplifies the insurance process, making it accessible and understandable for all. Additionally, their AI-powered assistant, Jerry, provides personalized support and recommendations, ensuring customers receive the best coverage for their needs.