Is Aetna Private Insurance

In the world of health insurance, the name Aetna often comes up as a prominent player, but the question remains: is Aetna a private insurance company? This comprehensive guide aims to delve into the details of Aetna's insurance offerings, shedding light on its nature and the services it provides. By exploring its history, coverage options, and unique features, we can gain a clearer understanding of Aetna's role in the healthcare industry.

Aetna’s Journey: From Roots to Renaissance

Aetna, with its rich history dating back to the 19th century, has evolved significantly over the years. Founded in 1853 as the Aetna Insurance Company, it initially focused on offering life insurance policies. However, its foray into health insurance began in the 1930s, marking a pivotal shift in its business strategy. Since then, Aetna has become a prominent name in the healthcare sector, offering a range of insurance products to cater to diverse needs.

One of the key milestones in Aetna's journey was its acquisition by CVS Health in 2018. This strategic move not only expanded Aetna's reach but also integrated healthcare and pharmacy services, creating a comprehensive healthcare ecosystem. As a result, Aetna's insurance offerings now encompass a wide range of services, from traditional health insurance plans to innovative wellness programs.

The Nature of Aetna’s Insurance: Private or Public?

To determine whether Aetna is a private insurance company, we must first understand the distinction between private and public insurance. Private insurance, often referred to as commercial insurance, is typically provided by for-profit companies. These companies operate independently and offer insurance plans to individuals and businesses, allowing for a higher degree of customization and flexibility in coverage options.

On the other hand, public insurance is provided by government entities and is funded through taxes. Examples of public insurance programs include Medicare and Medicaid in the United States. These programs are designed to provide healthcare coverage to specific segments of the population, such as seniors, individuals with disabilities, and low-income families.

Given this context, Aetna indeed operates as a private insurance company. Its insurance plans are offered by CVS Health, a privately held company, and are available to individuals, families, and businesses. Aetna's plans are designed to meet the diverse needs of its customers, offering a range of coverage options and benefits.

Aetna’s Insurance Plans: A Comprehensive Overview

Aetna’s insurance portfolio is diverse and caters to a wide range of healthcare needs. Here’s an overview of the key insurance plans Aetna offers:

Health Insurance Plans

Aetna’s health insurance plans are designed to provide comprehensive coverage for medical expenses. These plans typically include coverage for doctor visits, hospital stays, prescription medications, and preventive care services. Aetna offers various plan types, including:

- Health Maintenance Organization (HMO) Plans: These plans provide coverage within a specific network of healthcare providers. Members usually need to select a primary care physician and obtain referrals for specialist care.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility, allowing members to choose from a network of preferred providers without the need for referrals. Out-of-network care is also covered but may incur higher costs.

- Exclusive Provider Organization (EPO) Plans: EPO plans combine elements of HMO and PPO plans. Members have access to a network of providers but typically do not require referrals. Out-of-network care is usually not covered.

Dental and Vision Insurance

Aetna also offers dental and vision insurance plans, providing coverage for routine dental care, orthodontic treatments, and vision-related services. These plans can be purchased separately or bundled with health insurance plans, offering a comprehensive approach to oral and eye health.

Medicare and Medicaid Plans

Aetna participates in the Medicare and Medicaid programs, offering insurance plans tailored to the needs of seniors and low-income individuals. These plans include Medicare Advantage plans, which provide additional benefits beyond original Medicare coverage, and Medicaid plans, which are designed to meet the unique healthcare requirements of Medicaid beneficiaries.

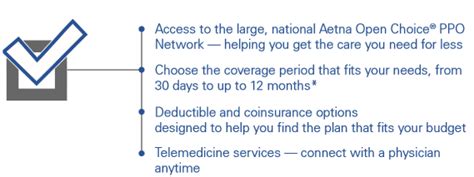

Short-Term Health Insurance

For individuals in need of temporary coverage, Aetna offers short-term health insurance plans. These plans provide coverage for a specified period, typically ranging from a few months to a year. They are ideal for individuals between jobs, awaiting coverage from a new employer, or those seeking a temporary solution until they qualify for long-term insurance.

Wellness and Lifestyle Programs

Aetna recognizes the importance of holistic healthcare, which is why it offers a range of wellness and lifestyle programs. These programs aim to promote healthy habits and prevent illnesses by providing access to fitness programs, nutrition counseling, stress management resources, and other lifestyle-enhancing services.

| Insurance Category | Coverage Options |

|---|---|

| Health Insurance | HMO, PPO, EPO Plans |

| Dental and Vision Insurance | Routine Dental Care, Orthodontics, Vision Services |

| Medicare and Medicaid Plans | Medicare Advantage, Medicaid Plans |

| Short-Term Health Insurance | Temporary Coverage for Transitions |

| Wellness Programs | Fitness, Nutrition, Stress Management |

Unique Features of Aetna’s Insurance

Aetna’s insurance offerings go beyond traditional coverage, incorporating innovative features that enhance the customer experience and improve overall healthcare outcomes. Here are some notable aspects of Aetna’s insurance plans:

Digital Health Tools

Aetna recognizes the potential of technology in healthcare, which is why it has integrated digital health tools into its insurance plans. Members can access their health records, schedule appointments, and manage their benefits through user-friendly mobile apps and online platforms. These tools provide convenience and empower individuals to take an active role in their healthcare journey.

Preventive Care Emphasis

Aetna places a strong emphasis on preventive care, understanding its crucial role in maintaining good health and managing healthcare costs. Many of Aetna’s insurance plans offer coverage for a wide range of preventive services, including annual check-ups, screenings, immunizations, and health education programs. By promoting preventive care, Aetna aims to catch health issues early on and prevent them from becoming more complex and costly.

Telehealth Services

Aetna’s insurance plans often include telehealth services, providing members with access to virtual healthcare consultations. This innovative approach allows individuals to connect with healthcare providers remotely, offering convenience and accessibility, especially for those in rural areas or with limited mobility. Telehealth services can be utilized for non-emergency medical advice, mental health counseling, and even prescription refills.

Discount Programs

Aetna offers a range of discount programs to help members save on healthcare expenses. These programs provide access to discounted rates on prescription medications, dental procedures, vision care, and even fitness memberships. By leveraging these discounts, members can make their healthcare budgets stretch further and prioritize their well-being.

Performance and Customer Satisfaction

Aetna’s performance in the insurance market has been impressive, with a track record of providing reliable coverage and satisfying its customers. The company’s financial stability and strong market position have earned it recognition as a trusted provider of healthcare insurance.

According to industry surveys and customer feedback, Aetna consistently ranks highly in terms of customer satisfaction. Its comprehensive coverage options, efficient claims processing, and excellent customer service have contributed to its positive reputation. Aetna's commitment to transparency and member education further enhances its standing in the insurance landscape.

Future Implications and Industry Impact

As the healthcare industry continues to evolve, Aetna’s role as a private insurance company is poised to have a significant impact. With its focus on innovation and member-centric approaches, Aetna is well-positioned to meet the changing needs of its customers. The integration of technology, emphasis on preventive care, and holistic wellness programs showcase Aetna’s forward-thinking approach.

Looking ahead, Aetna's insurance offerings are likely to continue evolving to adapt to the dynamic healthcare landscape. The company's ability to stay ahead of industry trends and incorporate new technologies will be crucial in maintaining its competitive edge. Additionally, Aetna's commitment to accessibility and affordability will play a pivotal role in shaping the future of healthcare coverage, especially as the industry navigates complex challenges and seeks sustainable solutions.

Is Aetna considered a reliable insurance provider?

+Absolutely. Aetna has a strong reputation for reliability and customer satisfaction. Its financial stability and comprehensive coverage options make it a trusted choice for many individuals and businesses seeking healthcare insurance.

How does Aetna’s insurance compare to other private insurance companies?

+Aetna offers a competitive range of insurance plans with diverse coverage options. Its focus on preventive care, digital health tools, and holistic wellness sets it apart from many competitors. Additionally, its acquisition by CVS Health provides unique integration opportunities, enhancing its overall offering.

What are the benefits of choosing Aetna’s insurance plans over public insurance programs like Medicare or Medicaid?

+Aetna’s private insurance plans offer more flexibility and customization compared to public insurance programs. They provide a broader range of coverage options, including dental, vision, and wellness programs. Additionally, private insurance plans often have lower out-of-pocket costs and more comprehensive benefits.