Insurance Texas

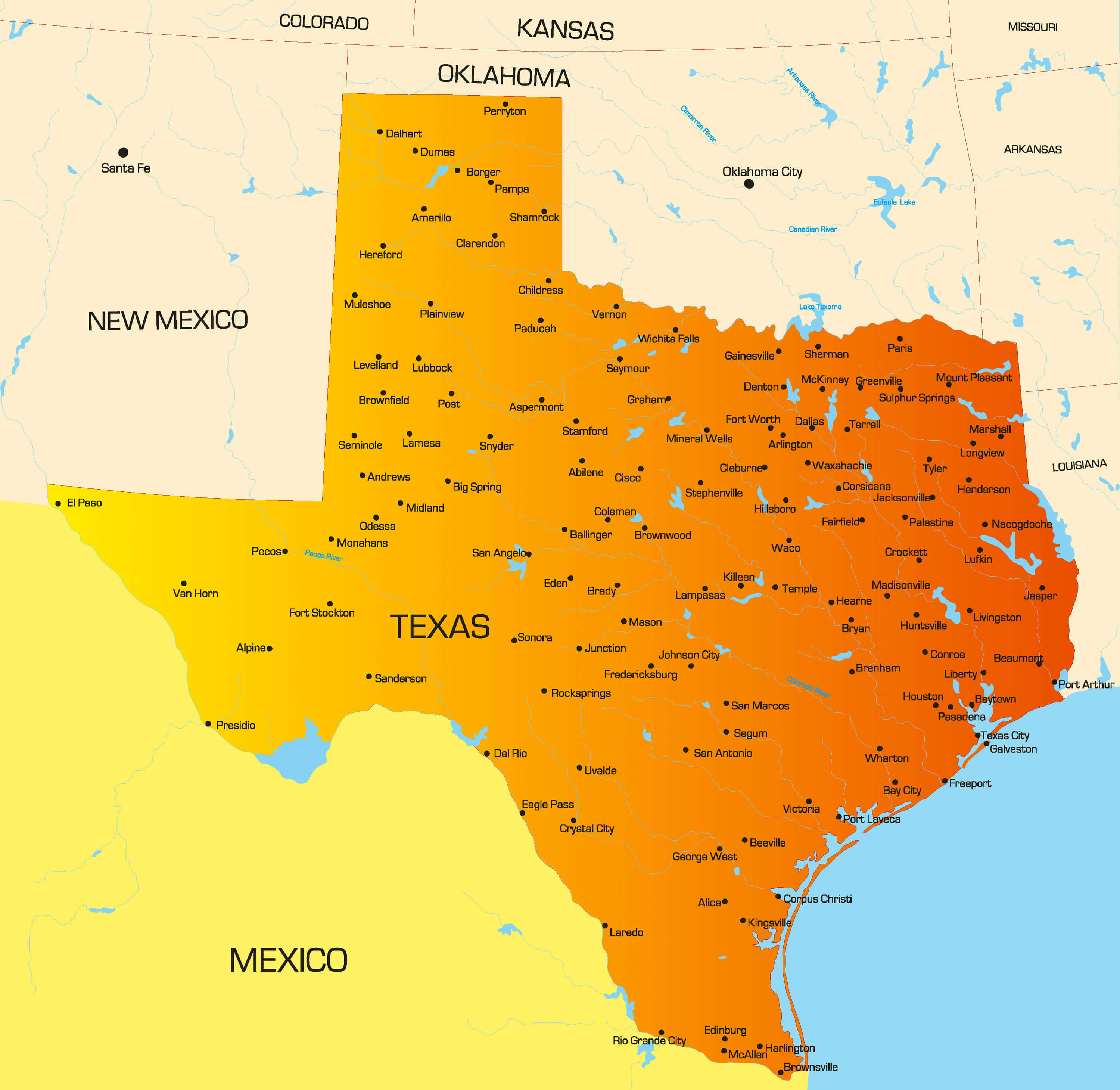

Insurance, a fundamental pillar of financial security, takes on a unique role in the vast state of Texas. With its diverse landscape, thriving economy, and vibrant population, Texas presents a complex and dynamic insurance landscape. From the bustling cities of Houston and Dallas to the sprawling ranches of the rural regions, Texans rely on insurance to protect their assets, health, and future. This comprehensive guide delves into the world of insurance in Texas, exploring the specific policies, regulations, and trends that shape this critical industry.

Understanding the Texas Insurance Landscape

Texas, with its rich history and diverse population, has a unique insurance market that reflects the state’s character. The insurance industry in Texas is characterized by a blend of traditional and innovative approaches, catering to the needs of its residents and businesses. Let’s delve into the specific aspects that define insurance in the Lone Star State.

Texas Insurance Regulations: A Complex Web

The regulatory framework for insurance in Texas is extensive and intricate. The Texas Department of Insurance (TDI) oversees and enforces a wide range of insurance laws and regulations. These regulations cover everything from consumer protection and rate-setting to market conduct and producer licensing. The TDI’s role is crucial in maintaining a fair and competitive insurance market, ensuring that Texans receive the coverage they need without being exploited.

One of the key responsibilities of the TDI is to approve insurance rates. This process involves a detailed review of insurance company filings, ensuring that rates are not excessive, inadequate, or unfairly discriminatory. The TDI also investigates consumer complaints, conducts market conduct exams, and enforces compliance with Texas insurance laws. Additionally, the TDI provides valuable resources and education to consumers, helping Texans understand their insurance options and rights.

| Key Insurance Regulation Areas in Texas | Description |

|---|---|

| Consumer Protection | Strict guidelines to safeguard policyholders' rights and interests. |

| Rate Setting | Comprehensive process to ensure fair and reasonable insurance rates. |

| Market Conduct | Regular examinations to ensure insurance companies operate ethically and efficiently. |

| Producer Licensing | Strict licensing requirements for insurance agents and brokers. |

Key Insurance Policies in Texas

The insurance policies available in Texas are as diverse as the state itself. Texans have access to a wide range of coverage options to protect their homes, vehicles, businesses, and health. Here’s a glimpse into some of the most common and crucial insurance policies in the state.

Home Insurance

Texas is known for its diverse weather patterns, from hurricanes along the coast to tornadoes in the Panhandle. As a result, home insurance is a critical consideration for Texans. Homeowners’ policies in Texas typically cover damage caused by windstorms, hail, and fire. However, it’s important to note that flood damage is typically excluded and requires a separate flood insurance policy.

Texas also has unique challenges when it comes to home insurance. For instance, the state's extensive coastline makes it vulnerable to hurricane damage. As a result, many insurance companies have specific underwriting guidelines for coastal properties, which can impact coverage and rates.

Auto Insurance

Texas has a large and diverse population of drivers, making auto insurance a vital coverage for many residents. The state requires drivers to carry liability insurance to cover injuries and property damage they may cause in an accident. However, Texas is an at-fault state, meaning the driver responsible for an accident is typically liable for the damages, and their insurance coverage comes into play.

In addition to liability coverage, Texans often opt for comprehensive and collision coverage to protect their vehicles from damage caused by accidents, theft, or natural disasters. Uninsured/underinsured motorist coverage is also popular, as it provides protection in the event of an accident with a driver who lacks sufficient insurance.

Health Insurance

Access to affordable health insurance is a significant concern for many Texans. The state has a large population, including many who are uninsured or underinsured. The Affordable Care Act (ACA) has played a crucial role in expanding health insurance coverage in Texas, with the state offering a health insurance marketplace where residents can shop for and purchase qualified health plans.

Texans have a range of health insurance options, including individual and family plans, employer-sponsored coverage, and Medicaid and Medicare for eligible residents. The state also offers various programs and initiatives to improve access to healthcare and insurance, particularly for low-income individuals and families.

Business Insurance

Texas is home to a thriving business community, from small startups to large corporations. Business insurance is essential for these enterprises to protect against a range of risks, from property damage and liability to workers’ compensation and cyber threats.

The specific business insurance needs of a company in Texas will depend on its industry, size, and unique risks. Common policies include general liability insurance, commercial property insurance, professional liability insurance (also known as errors and omissions insurance), and business owner's policies (BOPs) that bundle several coverages into one convenient package.

Trends and Innovations in Texas Insurance

The insurance industry in Texas is not static; it is evolving to meet the changing needs and expectations of its residents and businesses. Let’s explore some of the key trends and innovations shaping the future of insurance in the Lone Star State.

Digital Transformation and Insurtech

The digital revolution has had a profound impact on the insurance industry, and Texas is no exception. Insurtech, the intersection of insurance and technology, is driving significant changes in how insurance is sold, serviced, and delivered in the state.

Texas insurance companies and agencies are increasingly leveraging digital tools and platforms to enhance the customer experience. This includes online policy management, digital claims processing, and the use of mobile apps for policyholders to access their insurance information and file claims quickly and conveniently.

Insurtech startups are also making their mark in Texas, introducing innovative solutions to traditional insurance challenges. These startups are using technology to streamline processes, improve risk assessment, and offer more personalized and flexible insurance products. From digital-first insurance companies to those leveraging AI and machine learning for enhanced underwriting and claims handling, the Texas insurance landscape is becoming increasingly tech-savvy.

Focus on Customer Experience and Personalization

Texas insurance companies are recognizing the importance of delivering a superior customer experience. This involves not only offering competitive insurance products but also providing personalized service and support throughout the policy lifecycle.

Many Texas insurance providers are investing in customer-centric initiatives, such as 24/7 customer service hotlines, online chat support, and personalized policy recommendations based on individual needs and risk profiles. By focusing on customer experience, insurance companies in Texas are building stronger relationships with their policyholders and improving customer loyalty and retention.

Risk Assessment and Mitigation

Texas faces a unique set of risks, from natural disasters like hurricanes and tornadoes to man-made risks such as cyber attacks and product liability issues. Insurance companies in the state are continually refining their risk assessment and mitigation strategies to better protect their policyholders.

Advanced analytics and data science are playing a crucial role in this process. Insurance companies are using these tools to identify patterns, predict risks, and develop more accurate pricing models. By better understanding the risks faced by Texans, insurance providers can offer more tailored coverage options and help policyholders mitigate potential losses.

The Future of Insurance in Texas

As we look ahead, the future of insurance in Texas promises to be exciting and dynamic. The state’s insurance market will continue to evolve, driven by technological advancements, changing consumer preferences, and evolving risk landscapes.

One key trend to watch is the continued growth of digital insurance solutions. With the increasing adoption of technology by Texans, insurance companies will need to further embrace digital transformation to remain competitive. This includes not only offering online and mobile services but also leveraging data analytics and AI to provide more personalized and efficient insurance products.

Additionally, the focus on customer experience and personalization will remain a priority for Texas insurance providers. As consumers become more educated and discerning, insurance companies will need to deliver exceptional service and tailored coverage options to meet their diverse needs. This may involve further investing in customer-centric technologies and initiatives to build stronger, more loyal customer relationships.

Furthermore, as the risk landscape in Texas continues to evolve, insurance companies will need to stay agile and adaptive. This involves continually refining risk assessment models, investing in innovative risk mitigation strategies, and collaborating with other industry stakeholders to address emerging risks effectively. By staying ahead of the curve, Texas insurance providers can ensure they are offering relevant and effective coverage to protect their policyholders in an ever-changing world.

What are the basic insurance requirements for Texas drivers?

+

Texas drivers are required to carry at least liability insurance, which covers bodily injury and property damage caused in an accident. The minimum liability limits are 30,000 for injury/death of one person, 60,000 for injury/death of two or more people, and $25,000 for property damage.

How does Texas handle auto insurance rates for high-risk drivers?

+

Texas allows insurance companies to use rating factors such as driving record, claims history, and credit score to determine auto insurance rates. This means that high-risk drivers, such as those with multiple violations or accidents, may face higher insurance premiums.

Are there any unique insurance considerations for Texas homeowners?

+

Yes, Texas homeowners face unique risks, particularly from natural disasters like hurricanes and tornadoes. As a result, it’s important for homeowners to review their insurance policies carefully to ensure they have adequate coverage for windstorm damage, hail, and other perils. Flood insurance is typically not included in standard home insurance policies and requires a separate policy.

How does Texas support access to health insurance for its residents?

+

Texas offers a health insurance marketplace under the Affordable Care Act (ACA), where residents can shop for and purchase qualified health plans. The state also has various programs and initiatives to improve access to healthcare and insurance, particularly for low-income individuals and families.

What are some emerging risks that Texas businesses should consider when purchasing insurance?

+

Texas businesses should be aware of emerging risks such as cyber attacks, data breaches, and supply chain disruptions. These risks can have significant financial implications and may not be covered by traditional insurance policies. It’s important for businesses to review their insurance coverage regularly and consider adding specialized policies like cyber liability insurance to protect against these emerging risks.