Insurance For Travelers

In today's fast-paced world, travel has become an integral part of our lives, whether for leisure, business, or adventure. With the rise in international travel and the increasing complexity of global journeys, the need for comprehensive insurance coverage has never been more apparent. This article aims to delve into the world of travel insurance, exploring its importance, the various aspects it covers, and the key considerations travelers should make to ensure a smooth and secure journey.

The Significance of Travel Insurance

Travel insurance is a crucial aspect of responsible travel planning. It provides travelers with financial protection and peace of mind, ensuring that unforeseen circumstances do not derail their journey or cause significant financial setbacks. From medical emergencies to trip cancellations, travel insurance offers a safety net that can make all the difference in a traveler’s experience.

In the event of an emergency, travelers may incur substantial costs for medical treatment, evacuation, or even lost baggage. Travel insurance can cover these expenses, ensuring that travelers are not left financially burdened. Additionally, it provides a layer of protection against trip interruptions, ensuring that travelers can recover some or all of their prepaid expenses in case their plans change unexpectedly.

Comprehensive Coverage: What Does Travel Insurance Offer?

Travel insurance policies can vary greatly in scope and coverage. Understanding the key components of a travel insurance plan is essential to ensure you have the right protection for your journey. Here’s a breakdown of the key coverage areas:

Medical Expenses and Emergency Care

One of the primary concerns for travelers is access to medical care. Travel insurance typically covers a wide range of medical expenses, including doctor visits, hospital stays, emergency dental care, and even prescription medications. This coverage is especially crucial when traveling to regions with limited or expensive healthcare facilities.

For instance, imagine you're on a hiking trip in a remote area and suffer a severe injury. Travel insurance can cover the cost of medical evacuation, which could involve helicopter transportation to the nearest hospital, ensuring you receive timely and appropriate care.

Trip Cancellation and Interruption

Unforeseen events can lead to trip cancellations or interruptions. Travel insurance policies often provide coverage for non-refundable trip costs if the trip is canceled due to a covered reason, such as illness, injury, or natural disasters. This can include flights, accommodations, and even prepaid tours or activities.

Let's say you've planned a family vacation, but unfortunately, a family member falls ill just before the trip. With travel insurance, you can claim a refund for the prepaid expenses, ensuring you don't lose out financially.

Baggage and Personal Belongings

Losing or damaging your luggage can be a significant inconvenience during travel. Travel insurance policies usually offer coverage for lost, stolen, or damaged baggage and personal items. This can include the cost of replacing essential items like clothing, electronics, and even travel documents.

Consider a scenario where your checked baggage is lost during a flight transfer. Travel insurance can provide reimbursement for the cost of purchasing essential items while you wait for your luggage to be located or replaced.

Travel Delay and Missed Connections

Travel delays and missed connections are common occurrences, often caused by unforeseen circumstances like bad weather or mechanical issues. Travel insurance policies may provide coverage for additional expenses incurred due to delays, such as accommodation and meals, ensuring you’re not left stranded or financially burdened.

For example, if your flight is significantly delayed, causing you to miss a crucial connection, travel insurance can cover the cost of alternative transportation and accommodation until you can continue your journey.

Emergency Assistance and Support

In addition to financial coverage, travel insurance policies often include access to emergency assistance services. This can range from 24⁄7 travel assistance hotlines to help with medical referrals, translation services, legal assistance, and even emergency cash transfer services in case of financial emergencies.

Having access to these support services can be invaluable when navigating foreign countries and unfamiliar situations.

Key Considerations for Choosing the Right Travel Insurance

With a myriad of travel insurance options available, selecting the right policy can be a daunting task. Here are some key factors to consider when evaluating travel insurance plans:

Destination and Travel Activities

Consider the nature of your trip and the activities you plan to engage in. If you’re embarking on an adventurous journey involving extreme sports or activities, ensure your insurance policy covers these specific activities. Similarly, if you’re traveling to a region with unique medical considerations, make sure the policy provides adequate medical coverage for that region.

Policy Limits and Deductibles

Review the policy limits and deductibles carefully. Policy limits refer to the maximum amount the insurance company will pay for a covered expense, while deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Ensure the limits and deductibles align with your needs and financial capacity.

Pre-Existing Medical Conditions

If you have any pre-existing medical conditions, it’s crucial to disclose them to the insurance provider. Some policies may exclude coverage for pre-existing conditions, while others may offer coverage with additional premiums. Understanding how your specific condition is covered is essential to avoid any surprises.

Compare Providers and Reviews

Research and compare different travel insurance providers. Look for reputable companies with a good track record of claim handling and customer satisfaction. Read reviews and testimonials to gain insights into the provider’s performance and reliability.

Read the Fine Print

Always carefully read the policy wording and understand the exclusions and limitations. Some common exclusions may include acts of war, participation in professional sports, or travel to regions under a travel advisory. Ensure you’re aware of these exclusions to avoid any misunderstandings.

Real-Life Examples of Travel Insurance Claims

To illustrate the importance of travel insurance, let’s explore a few real-life scenarios where travelers have benefited from their insurance coverage:

Medical Emergency: A traveler on a European tour suffered a severe allergic reaction, requiring immediate medical attention. Their travel insurance covered the cost of emergency treatment, including specialized medication and a few days of hospitalization.

Trip Cancellation: A family had to cancel their dream vacation to the Caribbean due to a sudden illness. Their travel insurance policy reimbursed them for the non-refundable trip costs, including flights and hotel bookings.

Lost Luggage: A business traveler's checked luggage was lost during a flight connection. The travel insurance policy covered the cost of purchasing essential clothing and toiletries until the luggage was located.

Future Implications and Trends in Travel Insurance

The travel insurance industry is continuously evolving to meet the changing needs of travelers. Here are some future implications and trends to watch out for:

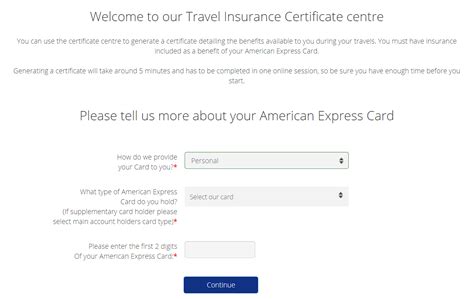

Increased Focus on Digitalization

Travel insurance providers are embracing digital technologies to enhance the customer experience. From online claim submissions to real-time policy management, the industry is moving towards a more streamlined and efficient process.

Personalized Coverage Options

With the rise of customizable travel experiences, travel insurance providers are offering more tailored coverage options. Travelers can now choose add-ons or select specific coverage levels based on their unique needs, ensuring a more personalized insurance experience.

Integration with Travel Platforms

Travel insurance is increasingly being integrated into online travel booking platforms. This allows travelers to easily compare and purchase insurance policies alongside their travel bookings, providing a more seamless and convenient experience.

Conclusion

Travel insurance is an essential aspect of responsible travel planning, offering financial protection and peace of mind. By understanding the key coverage areas, evaluating policy options, and being aware of real-life examples, travelers can make informed decisions to ensure a secure and enjoyable journey. As the travel insurance industry continues to evolve, travelers can look forward to even more comprehensive and personalized coverage options.

FAQ

Can I purchase travel insurance after my trip has started?

+

In most cases, travel insurance policies must be purchased before your trip begins. Some policies may offer limited coverage for emergencies that occur after the start of the trip, but it’s best to purchase insurance beforehand to ensure comprehensive protection.

What happens if I need to file a claim while traveling?

+

If you need to file a claim, contact your insurance provider’s emergency assistance hotline as soon as possible. They will guide you through the claim process, which may involve providing documentation and supporting evidence for your expenses. It’s important to keep all relevant receipts and documents.

Are there any situations where travel insurance may not be sufficient?

+

While travel insurance provides comprehensive coverage, there may be situations where it falls short. For example, if you engage in high-risk activities not covered by your policy or travel to regions with extreme political instability, your insurance may not provide coverage. Always review the policy wording carefully to understand any limitations.