How To Get A Quote For Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other mishaps. Obtaining a quote for car insurance is the first step towards ensuring you have adequate coverage for your vehicle and understanding the associated costs. This comprehensive guide will walk you through the process of getting a car insurance quote, covering everything from the necessary information to provide to the factors that influence your premium.

Understanding the Basics of Car Insurance Quotes

A car insurance quote is an estimate of the cost of your insurance policy, based on the information you provide to the insurance company. It is a crucial step in the process of selecting the right insurance provider and coverage for your needs. The quote helps you assess the affordability and suitability of different insurance options.

When you request a car insurance quote, the insurance company will evaluate various factors to determine the level of risk associated with insuring your vehicle. These factors include your personal information, driving history, vehicle details, and the coverage options you select. Based on this assessment, the insurance company will calculate a premium, which is the amount you'll pay for your insurance coverage.

Factors Influencing Your Car Insurance Quote

- Driver Information: Your age, gender, driving experience, and any previous claims or violations can impact your quote. Younger drivers, for instance, may face higher premiums due to their lack of experience on the road.

- Vehicle Details: The make, model, year, and value of your car play a significant role. High-performance vehicles or those with expensive repair costs may result in higher insurance rates.

- Coverage Options: The level of coverage you choose will directly affect your quote. Comprehensive coverage, which includes collision, liability, and additional perks, will typically be more expensive than basic liability-only coverage.

- Location and Usage: Where you live and how often you drive can impact your quote. Urban areas with higher traffic density and crime rates often result in higher insurance costs.

- Discounts and Bundles: Many insurance companies offer discounts for various reasons, such as safe driving records, vehicle safety features, or bundling multiple policies (e.g., car and home insurance) with the same provider.

Step-by-Step Guide to Getting a Car Insurance Quote

Now that we’ve covered the fundamentals, let’s delve into the practical steps of obtaining a car insurance quote.

Step 1: Gather Your Information

Before requesting a quote, ensure you have the following information readily available:

- Personal details: Name, date of birth, address, and contact information.

- Driver’s license number and state of issue.

- Vehicle information: Make, model, year, vehicle identification number (VIN), and estimated annual mileage.

- Driving history: Details of any accidents, claims, or traffic violations in the past 3-5 years.

- Current insurance coverage (if applicable): Policy number and expiration date.

- Desirable coverage options: Consider the type and level of coverage you require, such as liability, collision, comprehensive, or additional perks like rental car coverage.

Step 2: Choose Your Insurance Provider

There are numerous car insurance providers to choose from, each offering unique coverage options and pricing structures. Research and compare different providers to find the one that best aligns with your needs and budget. Consider factors such as:

- Financial stability and reputation of the insurance company.

- Coverage options and customization.

- Customer service and claims handling processes.

- Discounts and special programs offered.

- Online reviews and customer feedback.

Step 3: Request a Quote

Once you’ve selected a provider, request a quote through their website or by contacting their customer service team. You can typically request a quote online, over the phone, or by visiting a local branch. Provide the necessary information and select the coverage options you’re interested in.

Step 4: Review and Compare Quotes

After submitting your request, the insurance company will assess your information and provide you with a quote. Compare quotes from different providers to identify the best fit for your needs. Consider not only the premium amount but also the coverage limits, deductibles, and any additional benefits or exclusions.

Step 5: Select Your Coverage and Purchase

Once you’ve found the insurance provider and policy that meet your requirements, you can proceed with purchasing your car insurance. Review the policy documents carefully to ensure all the details are accurate and that you understand the coverage you’re purchasing. Sign the necessary documents and make the initial payment to activate your insurance coverage.

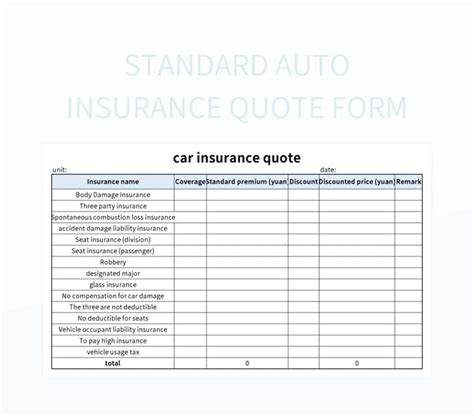

| Insurance Provider | Premium | Coverage Limits | Deductible |

|---|---|---|---|

| Provider A | $1,200 annually | Liability: $50,000/$100,000 Collision: $1,000 deductible |

$500 |

| Provider B | $1,350 annually | Liability: $100,000/$300,000 Collision: $500 deductible |

$250 |

| Provider C | $1,150 annually | Liability: $75,000/$150,000 Collision: $750 deductible |

$350 |

In the table above, we've provided a sample comparison of quotes from three different insurance providers. You can use such tables to analyze and compare the key aspects of different policies side by side.

Tips for Getting the Best Car Insurance Quote

Here are some additional tips to help you secure the most favorable car insurance quote:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. Online quote comparison tools can be a convenient way to do this.

- Bundling Policies: Consider bundling your car insurance with other policies, such as home or life insurance, to potentially save on premiums.

- Increase Your Deductible: Opting for a higher deductible can reduce your premium, but ensure you can afford the out-of-pocket expense if needed.

- Review Your Coverage Annually: Insurance needs and rates can change over time. Review your policy annually to ensure you’re still getting the best value and coverage.

- Utilize Discounts: Take advantage of any applicable discounts, such as safe driver discounts, multi-car discounts, or student discounts.

Frequently Asked Questions

What documents do I need to provide when getting a car insurance quote?

+When requesting a car insurance quote, you’ll typically need to provide personal information such as your name, address, and date of birth. You’ll also need to provide details about your vehicle, including the make, model, and year. Additionally, your driving history, including any accidents or violations, will be taken into account. If you currently have insurance, you may need to provide your policy number and expiration date.

How long does it take to get a car insurance quote?

+The time it takes to receive a car insurance quote can vary depending on the insurance provider and the method you use to request the quote. Online quotes can often be obtained within minutes, while quotes requested over the phone or in-person may take a bit longer. On average, you can expect to receive a quote within 24 hours.

Can I negotiate my car insurance quote?

+While car insurance quotes are typically based on standard rates and factors, there may be room for negotiation in certain situations. If you have a clean driving record, multiple vehicles to insure, or other factors that could lower your risk profile, it’s worth discussing these with your insurance provider to see if they can offer a better rate. Additionally, if you’re a loyal customer with a long-standing relationship with the insurer, you may have more leverage to negotiate.