How Much Do Insurance Premiums Go Up After An Accident

An auto insurance premium is the monthly or annual cost of maintaining an insurance policy. The premium is determined by various factors, including the type of coverage, the insured's driving history, and their claims record. When an accident occurs, insurance companies adjust their premiums to account for the increased risk associated with the policyholder.

This comprehensive article will delve into the intricate process of insurance premium adjustments after an accident, shedding light on the key factors that influence these changes and offering valuable insights into how individuals can navigate this complex landscape. Through an examination of real-world data and industry expertise, we aim to provide a detailed understanding of the financial implications that follow an accident, empowering readers with the knowledge to make informed decisions about their insurance coverage.

Understanding the Impact of Accidents on Insurance Premiums

When a policyholder is involved in an accident, it can have a significant impact on their insurance premiums. Insurance companies use a variety of methods to assess the risk associated with a policy, and accidents are considered a major factor in determining the level of risk.

The increase in premiums after an accident can vary greatly depending on several factors. These factors include the severity of the accident, the insurance company's assessment of fault, and the policyholder's overall claims history. Let's explore these aspects in more detail to understand the dynamics behind premium adjustments.

Severity of the Accident

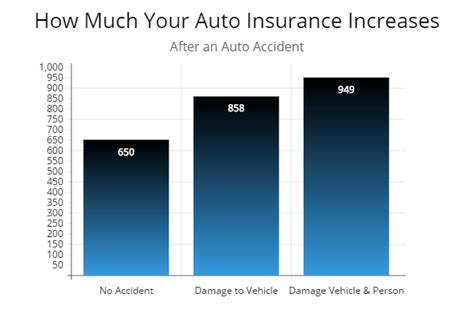

The severity of an accident plays a crucial role in determining the extent of premium increases. Insurance companies categorize accidents based on factors such as property damage, bodily injuries, and the number of vehicles involved. More severe accidents, resulting in substantial property damage or personal injuries, are likely to lead to higher premium adjustments.

For instance, consider a scenario where a driver is involved in a minor fender bender with minimal property damage and no injuries. In such cases, the insurance company may impose a smaller premium increase, recognizing the low-risk nature of the accident. On the other hand, a severe accident resulting in significant property damage and multiple injuries would likely result in a more substantial premium hike.

Assessment of Fault

Insurance companies carefully evaluate the circumstances surrounding an accident to determine fault. If the policyholder is deemed at fault, it can have a significant impact on their premiums. Being at fault suggests a higher level of risk, which insurance companies reflect in their premium calculations.

In cases where the policyholder is not at fault, the impact on premiums may be less severe. However, even in no-fault accidents, insurance companies may still consider the incident as a potential risk factor. This is especially true if the accident involves factors like adverse weather conditions or road hazards, which can impact future driving conditions.

Claims History and Prior Accidents

A policyholder’s claims history is a critical factor in determining premium adjustments after an accident. Insurance companies analyze the frequency and severity of past claims to assess the overall risk associated with the policyholder. A history of multiple accidents or frequent claims can lead to higher premium increases, as it indicates a higher likelihood of future accidents.

Additionally, the recency of accidents plays a role in premium adjustments. Recent accidents are often weighted more heavily in the risk assessment process, as they indicate a higher risk of future incidents. Insurance companies may view a policyholder with a recent accident as a higher-risk client, resulting in a more substantial premium increase.

Factors Influencing Insurance Premium Adjustments

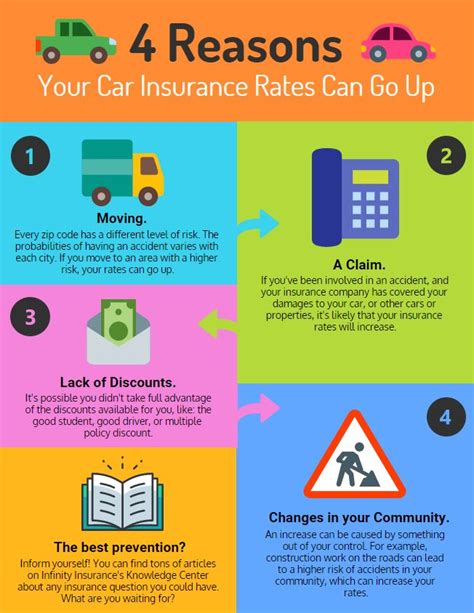

Insurance companies employ a range of methodologies to assess risk and determine premium adjustments after an accident. These factors include the policyholder’s driving record, credit score, and geographic location, each of which can influence the extent of premium increases.

Driving Record

A policyholder’s driving record is a key indicator of their risk profile. Insurance companies analyze driving records to assess the frequency and severity of past traffic violations and accidents. A clean driving record with no major violations or accidents can lead to more favorable premium adjustments, as it suggests a lower risk of future accidents.

Conversely, a driving record with multiple traffic violations or accidents can result in higher premium increases. Insurance companies view such records as indicative of a higher risk of future accidents, which justifies the need for increased premiums to cover potential claims.

Credit Score

Surprisingly, a policyholder’s credit score can also influence insurance premium adjustments. Studies have shown a correlation between credit scores and the likelihood of filing insurance claims. Insurance companies use credit scores as a proxy for assessing an individual’s overall financial responsibility and risk tolerance.

Policyholders with higher credit scores are often viewed as more financially stable and responsible, which can lead to more favorable premium adjustments. Conversely, lower credit scores may be interpreted as a sign of higher risk, resulting in higher premium increases.

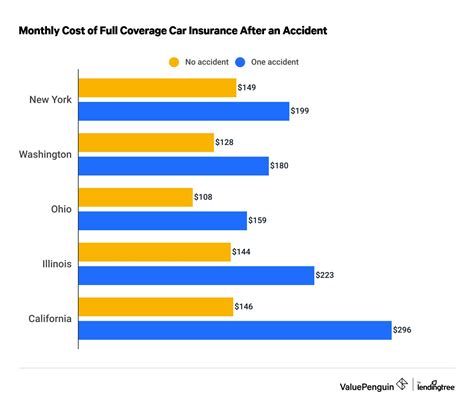

Geographic Location

The policyholder’s geographic location is another factor that insurance companies consider when adjusting premiums after an accident. Different regions have varying levels of accident frequency and severity, which can impact the overall risk assessment.

For example, urban areas with higher population densities and increased traffic congestion may have a higher incidence of accidents. As a result, policyholders residing in such areas may face higher premium increases after an accident compared to those in rural or less congested regions.

The Process of Premium Adjustments

The process of adjusting insurance premiums after an accident involves a series of steps, each of which plays a crucial role in determining the final premium amount. Understanding this process can help policyholders anticipate and manage the financial implications of an accident.

Accident Reporting and Investigation

When an accident occurs, the policyholder is required to report it to their insurance company promptly. The insurance company then initiates an investigation to assess the circumstances and determine fault. This investigation may involve gathering evidence, interviewing witnesses, and reviewing police reports.

The investigation process is crucial as it provides the insurance company with the necessary information to evaluate the accident's severity, assign fault, and determine the potential financial impact on the policyholder.

Risk Assessment and Premium Calculation

Once the investigation is complete, the insurance company conducts a comprehensive risk assessment. This assessment takes into account the factors discussed earlier, including the severity of the accident, fault determination, claims history, driving record, credit score, and geographic location.

Based on the risk assessment, the insurance company calculates the new premium amount. This calculation involves complex algorithms that consider the policyholder's specific risk profile and the insurance company's overall financial goals. The result is a premium that reflects the increased risk associated with the policyholder.

Notification and Appeal Process

After calculating the new premium, the insurance company notifies the policyholder of the change. This notification typically includes details about the accident, the risk assessment, and the reasoning behind the premium increase. Policyholders have the right to review this information and understand the factors contributing to the increase.

If a policyholder believes the premium increase is unfair or inaccurate, they have the option to appeal the decision. The appeal process involves providing additional evidence or information that may mitigate the risk assessment and potentially lead to a reduction in the premium increase.

Strategies to Minimize Premium Increases

While it is challenging to avoid premium increases entirely after an accident, there are strategies that policyholders can employ to minimize the financial impact. These strategies involve a combination of proactive risk management, policy adjustments, and negotiating with insurance companies.

Proactive Risk Management

Taking proactive measures to minimize the risk of accidents can help policyholders maintain a lower-risk profile. This includes practices such as defensive driving, regular vehicle maintenance, and avoiding high-risk behaviors like distracted or aggressive driving.

Additionally, policyholders can consider enrolling in defensive driving courses or utilizing telematics devices that track driving behavior. These measures not only improve safety but can also demonstrate a commitment to responsible driving, which may be favorable to insurance companies during risk assessments.

Policy Adjustments and Discounts

Policyholders can explore various adjustments to their insurance policies to potentially mitigate premium increases. For instance, increasing the deductible amount can lead to lower premiums, as it reduces the insurance company’s financial exposure in the event of a claim.

Furthermore, policyholders can review their coverage limits and consider reducing unnecessary coverage. By tailoring their policy to their specific needs, policyholders can potentially save on premiums while still maintaining adequate coverage.

Negotiating with Insurance Companies

Policyholders should not hesitate to engage in open and transparent communication with their insurance companies. By discussing the accident, its circumstances, and any mitigating factors, policyholders may be able to negotiate more favorable premium adjustments.

It is important to approach these negotiations with a well-prepared case, highlighting any factors that may reduce the perceived risk associated with the accident. This could include providing evidence of mitigating circumstances, such as adverse weather conditions or unexpected road hazards.

The Long-Term Impact of Accidents on Insurance Premiums

The impact of an accident on insurance premiums extends beyond the immediate premium increase. Accidents can have long-term implications on a policyholder’s insurance costs, affecting their future premiums and potentially influencing their ability to obtain insurance coverage.

Long-Term Premium Increases

After an accident, insurance companies typically increase premiums for a certain period, often ranging from 3 to 5 years. During this time, the policyholder pays the higher premium rate, reflecting the increased risk associated with the accident. This period of increased premiums is known as the “surcharge period.”

The duration of the surcharge period can vary depending on the insurance company's policies and the severity of the accident. Policyholders may find that their premiums gradually decrease over time as they demonstrate a consistent record of safe driving and no additional accidents.

Difficulty in Obtaining Insurance

In some cases, an accident can make it more challenging for policyholders to obtain insurance coverage, especially if they are considered high-risk by multiple insurance companies. High-risk drivers may face difficulty finding affordable insurance options, as insurance companies are hesitant to insure individuals with a history of accidents or frequent claims.

In such situations, policyholders may need to explore alternative insurance options, such as high-risk insurance providers or state-sponsored insurance programs. These options often come with higher premiums and more stringent requirements, but they can provide coverage for those who may otherwise struggle to find insurance.

The Role of Insurance Brokers and Agents

Insurance brokers and agents play a crucial role in helping policyholders navigate the complex landscape of insurance premiums and accident-related adjustments. These professionals possess extensive knowledge of the insurance industry and can provide valuable guidance and support throughout the process.

Expert Advice and Support

Insurance brokers and agents are well-versed in the factors that influence insurance premiums and can offer expert advice tailored to a policyholder’s specific circumstances. They can assist in understanding the impact of an accident on premiums and provide strategies to minimize the financial burden.

Additionally, brokers and agents can help policyholders navigate the appeal process, gathering the necessary evidence and presenting a strong case to potentially reduce premium increases. Their expertise can be invaluable in ensuring that policyholders receive fair and accurate premium adjustments.

Shopping for Alternative Insurance Options

In cases where premium increases are significant or insurance coverage becomes challenging to obtain, insurance brokers and agents can be instrumental in finding alternative insurance options. They have access to a wide range of insurance providers and can compare policies to find the most suitable and affordable coverage for their clients.

By leveraging their industry connections and knowledge, brokers and agents can negotiate with insurance companies on behalf of their clients, potentially securing more favorable terms and premiums. Their assistance can be especially beneficial for high-risk drivers or those with complex insurance needs.

The Future of Insurance Premium Adjustments

The insurance industry is continually evolving, and advancements in technology and data analytics are shaping the future of premium adjustments. These developments aim to enhance the accuracy and fairness of risk assessments, providing policyholders with more transparent and equitable premium calculations.

Data Analytics and Machine Learning

Insurance companies are increasingly utilizing advanced data analytics and machine learning algorithms to assess risk and determine premiums. These technologies enable insurance companies to analyze vast amounts of data, including driving behavior, accident patterns, and claims history, to make more accurate predictions about future risk.

By leveraging data-driven insights, insurance companies can refine their risk assessments, leading to more precise premium adjustments. This shift towards data-centric approaches ensures that premiums more accurately reflect the individual risk profile of policyholders, promoting fairness and transparency.

Telematics and Usage-Based Insurance

Telematics devices, which track driving behavior and provide real-time data, are gaining popularity in the insurance industry. These devices offer insurance companies valuable insights into a policyholder’s driving habits, allowing for more accurate risk assessments.

Usage-based insurance, also known as pay-as-you-drive insurance, utilizes telematics data to calculate premiums based on actual driving behavior. This approach rewards safe drivers with lower premiums, as their driving behavior demonstrates a lower risk profile. Conversely, higher-risk drivers may face higher premiums, reflecting their increased accident likelihood.

Personalized Risk Assessments

The future of insurance premium adjustments is moving towards more personalized risk assessments. Insurance companies are developing sophisticated models that consider a wide range of factors, including demographic information, driving behavior, and even lifestyle choices, to create customized risk profiles for policyholders.

By tailoring risk assessments to individual policyholders, insurance companies can offer more accurate and equitable premiums. This shift towards personalized risk assessments ensures that policyholders are not penalized for factors beyond their control, promoting fairness and transparency in the insurance industry.

Conclusion: Navigating the Complexities of Insurance Premium Adjustments

Accidents can have a significant impact on insurance premiums, and understanding the factors and processes involved is crucial for policyholders. By recognizing the influence of accident severity, fault determination, claims history, and other factors, individuals can better anticipate and manage the financial implications of an accident.

While premium increases are often unavoidable after an accident, policyholders can take proactive measures to minimize the impact. This includes adopting safe driving practices, reviewing and adjusting insurance policies, and seeking expert advice from insurance brokers and agents. Additionally, staying informed about the latest advancements in insurance technology and data analytics can empower policyholders to make more informed decisions about their coverage.

As the insurance industry continues to evolve, the future of premium adjustments looks promising. With advancements in data analytics and personalized risk assessments, policyholders can expect more accurate and fair premium calculations. This shift towards transparency and equity ensures that insurance remains a reliable and accessible tool for individuals to manage their financial risks associated with accidents.

How long does an accident stay on my insurance record?

+Accident records typically remain on an insurance policy for a specific period, often ranging from 3 to 5 years. During this time, the accident continues to impact premium calculations. After the designated period, the accident may still be considered in the risk assessment, but its influence on premiums may diminish.

Can I negotiate with my insurance company to reduce premium increases after an accident?

+Yes, policyholders can negotiate with their insurance companies to potentially reduce premium increases. It is essential to gather evidence and present a strong case, highlighting any mitigating factors or changes in driving behavior that demonstrate a reduced risk profile.

What are some ways to save on insurance premiums after an accident?

+Policyholders can explore various strategies to save on insurance premiums after an accident. These include increasing deductibles, reducing unnecessary coverage, taking advantage of safe driver discounts, and considering usage-based insurance policies that reward safe driving behavior.