How Do I Get Pet Insurance

Pet insurance is a valuable tool for pet owners to ensure the well-being of their furry companions. It provides financial coverage for unexpected veterinary expenses, making it easier to provide the best care for your pets. However, navigating the process of getting pet insurance can be a bit daunting, especially with the myriad of options available. In this comprehensive guide, we'll break down the steps to help you understand how to get pet insurance and make an informed decision for your beloved pets.

Understanding Pet Insurance Basics

Pet insurance operates similarly to human health insurance, offering coverage for various veterinary services and treatments. It aims to reduce the financial burden of unexpected illnesses, accidents, or routine care. Here’s a breakdown of the key aspects to consider when exploring pet insurance options:

Types of Pet Insurance Plans

Pet insurance plans typically fall into two main categories: accident-only and comprehensive coverage. Accident-only plans cover injuries and accidents, while comprehensive plans offer broader coverage, including illnesses, routine care, and sometimes even wellness services. It’s essential to assess your pet’s needs and your financial capabilities to choose the right plan.

| Plan Type | Coverage |

|---|---|

| Accident-only | Injuries and accidents |

| Comprehensive | Illnesses, routine care, and wellness services |

Policy Exclusions and Limitations

While pet insurance offers extensive coverage, it’s crucial to understand the exclusions and limitations of each policy. These may include pre-existing conditions, breed-specific disorders, and certain procedures or treatments. Reviewing these details ensures you know exactly what is and isn’t covered by your chosen plan.

Enrollment and Eligibility

Most pet insurance companies have age limits for enrolling pets. Typically, you can insure pets from a few weeks old up to a certain age, often around 10 years old. However, some companies may have different requirements, so it’s best to check the specific guidelines for each provider.

Researching and Comparing Pet Insurance Providers

With numerous pet insurance providers in the market, conducting thorough research is essential to find the best fit for your pet’s needs and your budget. Here’s a step-by-step guide to help you navigate this process effectively:

Identify Your Pet’s Needs

Start by evaluating your pet’s unique requirements. Consider factors such as age, breed, pre-existing conditions, and your pet’s overall health. This assessment will help you determine the level of coverage you need.

Check Provider Reputation and Reliability

Research the reputation and reliability of potential providers. Look for customer reviews and ratings to gauge their level of service and responsiveness. Additionally, check if the provider is accredited by reputable organizations, ensuring they meet certain standards.

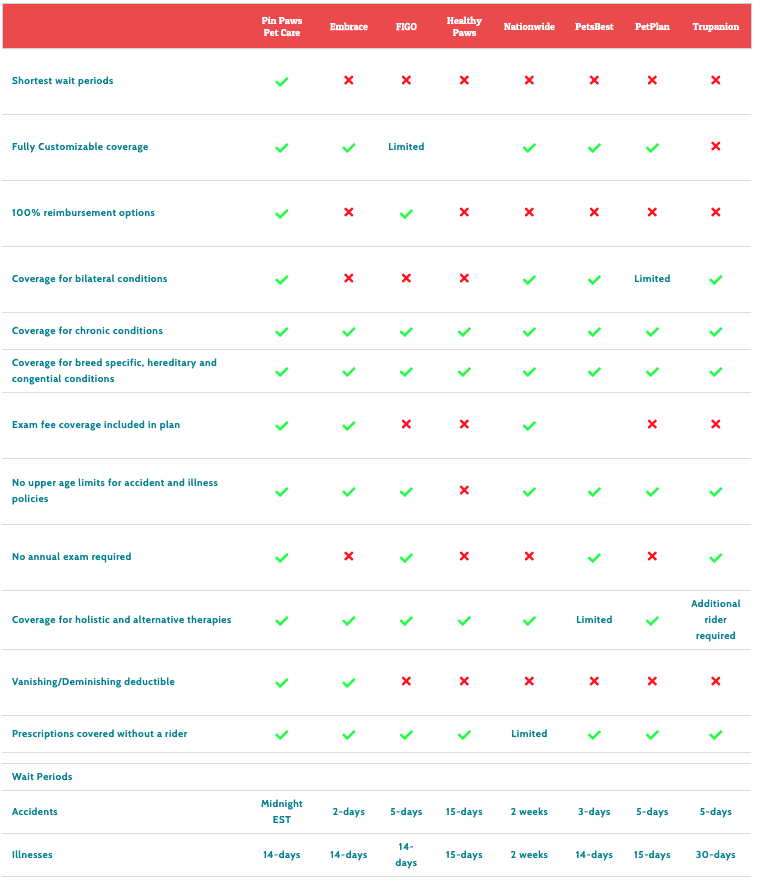

Compare Plans and Coverage

Examine the plans offered by different providers, comparing their coverage, exclusions, and limitations. Pay attention to details like reimbursement rates, deductibles, and annual or lifetime coverage limits. Some plans may offer more flexibility or specialized coverage for certain conditions.

Assess Pricing and Payment Options

Consider the cost of the plans and the payment options available. Evaluate whether the provider offers monthly, quarterly, or annual payment plans. Compare the prices and determine if the plan’s coverage justifies the cost, considering your pet’s specific needs.

Read the Fine Print

Always review the policy documents and terms carefully. Understand the claim process, any waiting periods, and the conditions under which you can make a claim. This ensures you know exactly what to expect when the time comes to utilize your insurance coverage.

The Application and Enrollment Process

Once you’ve narrowed down your options and chosen a suitable provider, it’s time to move forward with the application and enrollment process. Here’s what you can expect:

Gather Required Information

Prepare the necessary information for your pet, including their age, breed, medical history, and any pre-existing conditions. Some providers may also require details about your personal information and financial details for billing purposes.

Complete the Application

Most providers offer online application forms, making the process convenient and efficient. Fill out the application accurately and provide all the required details. Ensure you understand the terms and conditions before submitting the application.

Waiting Periods and Pre-Existing Conditions

Be aware of any waiting periods for your chosen plan. These periods vary depending on the provider and the type of coverage. During this time, any claims related to certain conditions, especially pre-existing ones, may not be covered.

Payment and Policy Activation

After your application is approved, you’ll need to make the initial payment to activate your policy. This often involves setting up recurring payments to ensure continuous coverage. Ensure you understand the billing cycle and payment options provided by your chosen insurer.

Making Claims and Understanding the Process

Understanding how to make claims and navigate the process is crucial to ensure a smooth experience when utilizing your pet insurance. Here’s an overview of what you need to know:

Understanding Your Policy

Familiarize yourself with your policy’s details, including the coverage limits, deductibles, and any specific conditions or treatments that are covered. This knowledge will help you determine when and how to make a claim.

Collecting Necessary Documentation

When your pet requires veterinary care, ensure you keep detailed records of the visit. This includes the veterinarian’s diagnosis, treatment plan, and any relevant tests or procedures. These documents are essential for making a successful claim.

Submitting Your Claim

Follow the claim submission process outlined by your insurer. This often involves filling out a claim form and providing the necessary documentation. Some insurers offer online claim submission, making the process more convenient.

Reimbursement Process

Once your claim is submitted, the insurer will review it and determine the reimbursement amount. The timeframe for this process varies, but most insurers aim to provide a decision within a few weeks. The reimbursement is typically sent directly to you or, in some cases, to your veterinarian.

Maximizing Your Pet Insurance Benefits

To make the most of your pet insurance coverage, it’s essential to understand how to optimize your benefits. Here are some strategies to consider:

Preventive Care and Wellness Services

Explore whether your chosen plan covers preventive care and wellness services. These may include vaccinations, routine check-ups, and dental care. Utilizing these benefits can help keep your pet healthy and reduce the risk of more significant health issues down the line.

Specialty Services and Treatments

Some pet insurance plans offer coverage for specialty services, such as acupuncture, hydrotherapy, or behavioral therapy. If your pet requires such treatments, ensure they are included in your plan or consider upgrading your coverage to include these specialized services.

Network of Preferred Veterinarians

Some pet insurance providers have networks of preferred veterinarians. Utilizing these veterinarians can often result in lower out-of-pocket expenses, as the insurer may have negotiated reduced rates. Check if your chosen provider has such a network and explore the benefits it offers.

FAQs

What is the average cost of pet insurance?

+

The cost of pet insurance varies depending on factors such as your pet’s age, breed, location, and the level of coverage you choose. On average, you can expect to pay between 20 and 70 per month for basic coverage. However, the price can increase significantly for older pets or those with pre-existing conditions.

Can I get pet insurance for an older pet?

+

Yes, many providers offer insurance for older pets. However, the cost may be higher, and there may be certain limitations or exclusions. It’s best to research and compare providers to find the most suitable option for your senior pet’s needs.

Does pet insurance cover pre-existing conditions?

+

Generally, pet insurance does not cover pre-existing conditions. These are health issues or injuries that your pet had before enrolling in the insurance plan. However, some providers offer specific coverage for certain pre-existing conditions, but it may come at an additional cost.

How long does it take to receive reimbursement after submitting a claim?

+

The timeframe for receiving reimbursement varies among insurers. Some providers process claims within a week, while others may take up to several weeks. It’s best to check with your specific insurer to understand their typical processing time.

Can I switch pet insurance providers if I’m not satisfied with my current plan?

+

Yes, you have the freedom to switch pet insurance providers if you find a better plan or are not satisfied with your current coverage. However, be aware that pre-existing conditions may not be covered by the new provider, and there may be waiting periods for certain conditions.