How Are Insurance Rates Determined

Understanding how insurance rates are determined is crucial for both policyholders and those seeking insurance coverage. Insurance rates, also known as premiums, are the amounts individuals or entities pay to insurance companies for various types of insurance policies. These rates are carefully calculated and influenced by a multitude of factors, ensuring that insurance providers can adequately assess risk and provide financial protection.

Risk Assessment: The Foundation of Insurance Rates

At its core, insurance is a mechanism to mitigate financial risks. Insurance companies assess the likelihood of specific events occurring and the potential costs associated with them. This assessment forms the basis for determining insurance rates.

Individual Factors

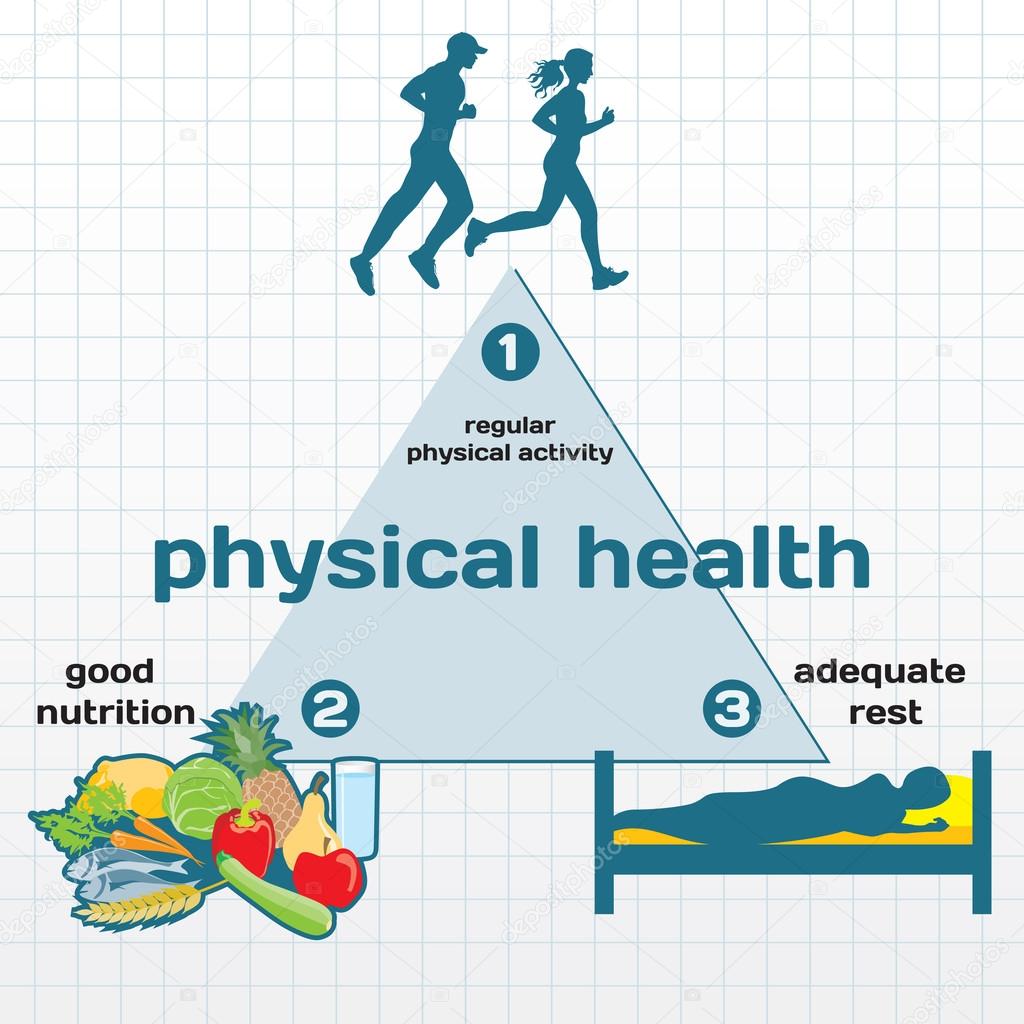

When it comes to personal insurance policies, such as health, life, or auto insurance, several individual characteristics come into play:

- Age: Younger individuals are generally considered lower risk for certain types of insurance, as they are less likely to have developed health issues or engage in risky behaviors.

- Health Status: In the case of health insurance, pre-existing conditions or overall health can significantly impact rates. Insurers may require medical examinations or reviews of medical history.

- Lifestyle Choices: Activities like smoking, excessive alcohol consumption, or engaging in extreme sports can increase insurance rates due to the associated health risks.

- Driving Record: For auto insurance, a clean driving record with no accidents or violations can lead to lower premiums.

- Credit Score: In some cases, insurers use credit scores as an indicator of financial responsibility, which can affect rates.

Policy-Specific Factors

The type of insurance and the coverage limits also play a crucial role:

- Coverage Level: Higher coverage limits often result in higher premiums. For example, a health insurance policy with a high annual limit will cost more than one with a lower limit.

- Deductibles: Choosing a higher deductible (the amount the insured pays before the insurance coverage kicks in) can lower premiums.

- Add-Ons and Riders: Additional coverage options, like rental car coverage in auto insurance, can increase rates.

Statistical Analysis and Actuarial Science

Insurance companies employ actuarial science, a discipline that uses mathematics, statistics, and financial theory to assess risk. Actuaries analyze vast amounts of data to predict the likelihood of various events and the potential costs associated with them.

| Data Analyzed | Impact on Rates |

|---|---|

| Historical Claims Data | Insurers study past claims to understand common risks and average costs. For example, auto insurers analyze accident data to identify high-risk areas or common causes of accidents. |

| Demographic Information | Demographics like age, gender, and location can influence rates. For instance, certain areas may have higher crime rates, affecting home insurance rates. |

| Medical Records (for Health Insurance) | Health insurers analyze medical histories to assess the risk of future health issues. Pre-existing conditions or a history of chronic illnesses can impact rates. |

| Market Trends and Economic Factors | Economic conditions and market trends can affect insurance rates. Inflation, for example, may lead to higher healthcare costs and, subsequently, higher health insurance premiums. |

Regulation and Standardization

Insurance rates are not solely determined by insurance companies. Government regulations and industry standards play a significant role in ensuring fairness and transparency.

Regulatory Bodies

Each country or region has its own regulatory body overseeing the insurance industry. These bodies ensure that insurance rates are:

- Non-discriminatory: Rates cannot be based on factors like race, gender (except in certain limited cases), or marital status.

- Actuarily Sound: Rates must be based on sound actuarial principles and reflect the actual risk being insured.

- Approved: Insurance companies must submit their rate structures for approval, ensuring they are fair and reasonable.

Standard Rating Systems

To maintain consistency and comparability, many insurance companies use standard rating systems. These systems categorize risks based on predefined criteria, making it easier for insurers to set rates and for consumers to understand and compare policies.

Dynamic Nature of Insurance Rates

Insurance rates are not static. They can change over time due to various factors, including:

- Changes in Personal Circumstances: Life events like getting married, having children, or moving to a new location can affect insurance rates.

- Policy Adjustments: Insurers may adjust rates annually based on claim experience and market conditions.

- Competitive Landscape: The insurance market is competitive, and companies may adjust rates to remain competitive or attract new customers.

Shopping for Insurance: Tips for Consumers

When shopping for insurance, it’s essential to:

- Compare rates from multiple insurers.

- Understand the coverage limits and any exclusions.

- Review policy documents thoroughly.

- Consider bundled policies for potential discounts.

- Explore options for lowering premiums, such as increasing deductibles or taking advantage of discounts (e.g., safe driver discounts for auto insurance).

How do insurance companies calculate rates for business insurance?

+Business insurance rates are calculated based on the specific risks associated with the business. Factors include the industry, location, size of the business, number of employees, and the type of coverage needed. For example, a manufacturing business may face higher workers’ compensation risks than a digital marketing agency.

Can insurance rates be negotiated?

+While insurance rates are primarily based on actuarial science and regulations, there may be some room for negotiation, especially for business insurance or specialized policies. However, for personal insurance, rates are often standardized and non-negotiable.

What is the impact of inflation on insurance rates?

+Inflation can significantly affect insurance rates, especially in industries where costs are tied to the general economy. For instance, rising healthcare costs due to inflation may lead to higher health insurance premiums.