Homeowners Insurance Meaning

Homeowners insurance, a vital component of financial protection, is a cornerstone of modern living, especially for homeowners and those seeking to safeguard their investments. This insurance policy serves as a safety net, offering coverage for a range of potential damages and losses that homeowners may face. Understanding the intricacies of homeowners insurance is key to making informed decisions about protecting one's home and assets.

The Fundamentals of Homeowners Insurance

Homeowners insurance is a contract between a policyholder and an insurance company, where the company promises to compensate the policyholder for covered losses in exchange for regular premium payments. This policy provides financial protection for the structure of the home and its contents, as well as for liability claims and additional living expenses that may arise due to covered incidents.

The scope of coverage in a homeowners insurance policy can vary significantly, depending on the specific policy and the optional add-ons chosen by the policyholder. These policies typically cover a wide range of risks, including fire, lightning, windstorms, hail, explosions, riots, vandalism, and more. However, it's important to note that certain natural disasters like floods and earthquakes are often not included in standard policies and require additional coverage.

Understanding the Policy Components

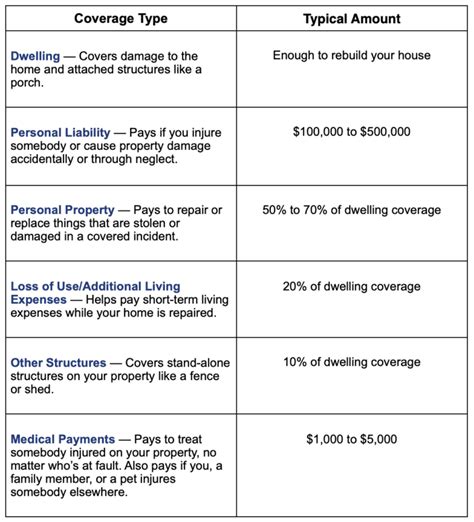

A homeowners insurance policy typically consists of several key components, each covering different aspects of the home and its surroundings.

- Dwelling Coverage: This covers the physical structure of the home, including walls, floors, ceilings, and any attached structures like a garage or patio.

- Personal Property Coverage: Provides coverage for belongings within the home, such as furniture, appliances, clothing, and electronics.

- Liability Coverage: Protects against lawsuits and medical bills if someone is injured on the insured property.

- Additional Living Expenses: Covers the costs of temporary housing and other necessary expenses if the home becomes uninhabitable due to a covered loss.

The level of coverage for each of these components can be customized based on the policyholder's needs and the value of their home and belongings. It's crucial to review these components thoroughly and ensure they align with the specific risks and values associated with the insured property.

| Policy Component | Coverage Details |

|---|---|

| Dwelling Coverage | Covers the physical structure and any attached structures. |

| Personal Property Coverage | Protects belongings within the home, with limits based on the policy. |

| Liability Coverage | Provides financial protection against lawsuits and medical claims. |

| Additional Living Expenses | Covers temporary living costs if the home becomes uninhabitable. |

The Benefits and Peace of Mind

Homeowners insurance provides significant benefits, offering peace of mind to policyholders. In the event of a covered loss, the insurance policy can help cover the costs of repairing or rebuilding the home, replacing damaged possessions, and managing liability claims. This financial protection can be crucial in ensuring that a homeowner’s life isn’t devastated by an unexpected event.

One of the key advantages of homeowners insurance is the flexibility it offers. Policyholders can choose the level of coverage they need, based on the value of their home and its contents, as well as the specific risks they face in their area. This allows for a customized insurance plan that suits the unique needs of each homeowner.

Protection Against Unforeseen Circumstances

Homeowners insurance policies are designed to provide coverage for a wide range of unexpected events. From natural disasters like hurricanes and wildfires to accidental damage caused by perils such as burst pipes or electrical fires, homeowners insurance can offer vital financial support when it’s needed most.

Furthermore, homeowners insurance can also provide coverage for personal liability, which can be a significant benefit. If someone is injured on the insured property, the policy can help cover medical expenses and potential legal fees, protecting the policyholder from financial hardship due to a lawsuit.

In addition to the standard coverage options, homeowners insurance policies often offer additional endorsements or riders that can be added to the policy to provide more specialized coverage. These endorsements can cover specific items or situations that may not be included in a standard policy, such as high-value items like jewelry or fine art, or unique situations like identity theft.

The Future of Homeowners Insurance

The homeowners insurance landscape is evolving, driven by advancements in technology and changing consumer needs. Insurers are increasingly leveraging data and analytics to offer more tailored and efficient coverage options. For instance, the use of smart home technology is becoming a key factor in homeowners insurance, with insurers offering discounts for homes equipped with advanced security systems and fire prevention devices.

Moreover, the rise of shared economy platforms like Airbnb and VRBO has led to a surge in demand for short-term rental insurance. Insurers are adapting to this trend by offering specific policies that cater to the unique risks associated with short-term rentals, such as guest injuries and property damage.

Adapting to a Changing Environment

As climate change continues to impact weather patterns, the frequency and severity of natural disasters are expected to increase. This trend poses significant challenges for the homeowners insurance industry, particularly in high-risk areas. To address this, insurers are investing in risk assessment and mitigation strategies, using advanced modeling techniques to more accurately assess the risk of natural disasters and develop policies that provide adequate coverage for these increasingly common events.

Additionally, the insurance industry is embracing digital transformation, leveraging technology to enhance the customer experience and streamline processes. Online platforms and mobile apps are becoming the preferred channels for policyholders to manage their insurance, from policy purchases to claims submissions. Insurers are also utilizing artificial intelligence and machine learning to automate routine tasks and improve the accuracy and speed of claims processing.

In conclusion, homeowners insurance is an essential component of financial planning for homeowners, offering protection against a wide range of risks. With the right policy, homeowners can enjoy peace of mind, knowing they are protected from the financial impact of unexpected events. As the insurance landscape continues to evolve, it's important for homeowners to stay informed and work with their insurance providers to ensure their policies are up-to-date and provide the coverage they need.

What is the average cost of homeowners insurance?

+

The average cost of homeowners insurance can vary significantly based on factors like location, home value, and coverage limits. On average, policyholders can expect to pay anywhere from 300 to 1,500 annually for basic coverage. However, this can increase or decrease based on individual circumstances and the specific coverage needs.

Does homeowners insurance cover flood damage?

+

Standard homeowners insurance policies typically do not cover flood damage. To protect against floods, a separate flood insurance policy is usually required. This can be obtained through the National Flood Insurance Program (NFIP) or private insurers, depending on the specific circumstances.

What is the process for filing a claim with homeowners insurance?

+

The process for filing a claim with homeowners insurance can vary slightly between insurers, but generally, it involves the following steps: notifying the insurer of the claim, providing detailed information about the incident and any damages, and working with the insurer to assess and process the claim. It’s important to review the specific policy and guidelines for filing a claim with your insurer.