Health Insurance Coverage Tax Form

In the complex landscape of healthcare and taxation, the Health Insurance Coverage Tax Form stands as a critical yet often misunderstood aspect. This comprehensive guide aims to unravel the intricacies of this tax form, providing a detailed analysis of its purpose, functionality, and implications. By delving into specific examples and real-world scenarios, we aim to offer a clear understanding of this essential tax document.

Understanding the Health Insurance Coverage Tax Form

The Health Insurance Coverage Tax Form, often referred to as Form 1095, is a crucial document in the U.S. tax system. Issued by employers, insurance companies, and government agencies, this form plays a pivotal role in ensuring compliance with the Affordable Care Act (ACA) and facilitating the accurate reporting of health insurance coverage.

Form 1095 comes in three variations, each serving a distinct purpose:

- Form 1095-A: Issued by the Marketplace (Health Insurance Marketplace) to individuals who purchase health insurance through the Marketplace. It provides essential information about the taxpayer's coverage, including the type of plan, duration, and any applicable premium tax credits or reductions.

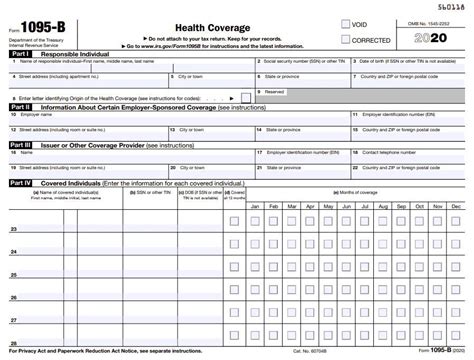

- Form 1095-B: Sent by insurance providers to policyholders, this form details the type of health coverage offered, the coverage period, and the names of the covered individuals. It is an essential tool for individuals to verify their insurance status and ensure accurate tax reporting.

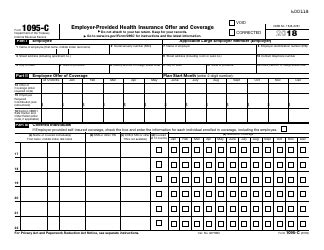

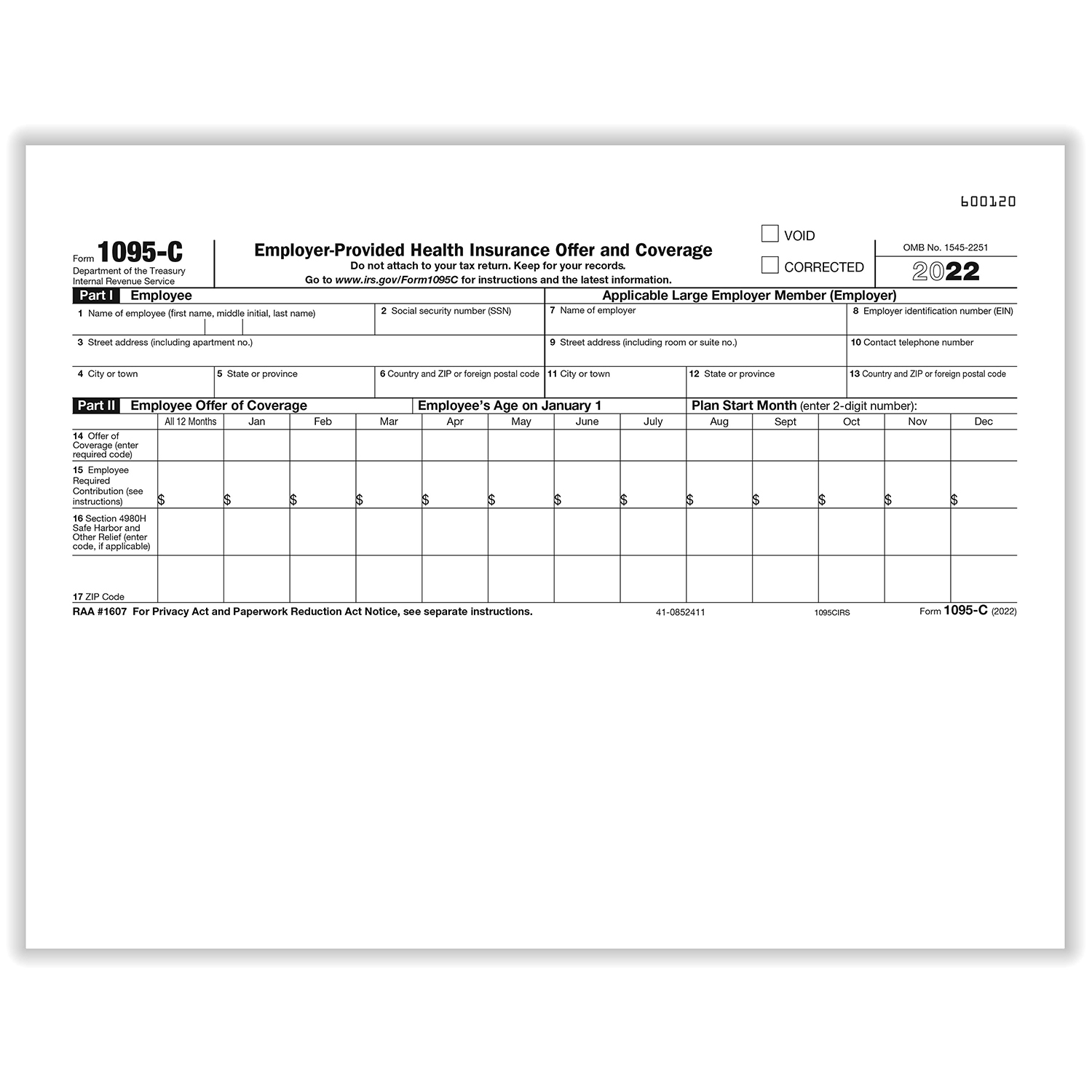

- Form 1095-C: Specifically designed for employers to provide to their employees, this form certifies the health coverage offered by the employer. It includes details such as the employee's name, coverage period, and the employer's offer of affordable coverage. This form is vital for employees to claim tax benefits and for employers to demonstrate compliance with the ACA's employer mandate.

Each of these forms serves as a critical link between health insurance coverage and the tax system, ensuring that individuals and businesses alike can navigate the complex landscape of healthcare and taxation with clarity and confidence.

The Importance of Health Insurance Coverage Reporting

Accurate reporting of health insurance coverage is a cornerstone of the U.S. tax system, particularly in the context of the Affordable Care Act (ACA). This reporting mechanism serves several crucial purposes:

Ensuring Compliance with the ACA

The ACA, enacted in 2010, introduced significant reforms to the U.S. healthcare system. One of its key provisions is the individual mandate, which requires most Americans to have qualifying health insurance coverage or face a tax penalty. The Health Insurance Coverage Tax Form plays a vital role in enforcing this mandate by providing a clear record of an individual’s insurance status.

By requiring individuals to report their health insurance coverage on their tax returns, the IRS can effectively enforce the individual mandate. Those who fail to maintain minimum essential coverage may be subject to the shared responsibility payment, which is calculated based on household income and family size. The Health Insurance Coverage Tax Form serves as proof of compliance or non-compliance with this mandate.

Verifying Eligibility for Premium Tax Credits

Another critical function of the Health Insurance Coverage Tax Form is to verify eligibility for premium tax credits (PTCs). PTCs are a form of financial assistance offered to individuals and families who purchase health insurance through the Marketplace. These credits help reduce the cost of monthly premiums, making healthcare more accessible.

Form 1095-A, issued by the Marketplace, provides essential information about an individual's or family's eligibility for PTCs. This form details the monthly premium amounts, any advance payments of the premium tax credit, and the total amount of the credit received during the year. This information is crucial for taxpayers to accurately calculate their tax liability and determine if they qualify for a refund or owe additional taxes.

Promoting Transparency and Accountability

The reporting of health insurance coverage promotes transparency and accountability in the healthcare system. By requiring individuals and employers to report their insurance status, the government can track the effectiveness of the ACA and identify any potential gaps in coverage. This data-driven approach allows for continuous improvement and adjustment of healthcare policies.

Furthermore, the reporting process helps prevent fraud and abuse. It ensures that individuals and employers are truthful about their insurance coverage, reducing the risk of tax evasion or improper claims for tax benefits.

Navigating the Health Insurance Coverage Tax Form

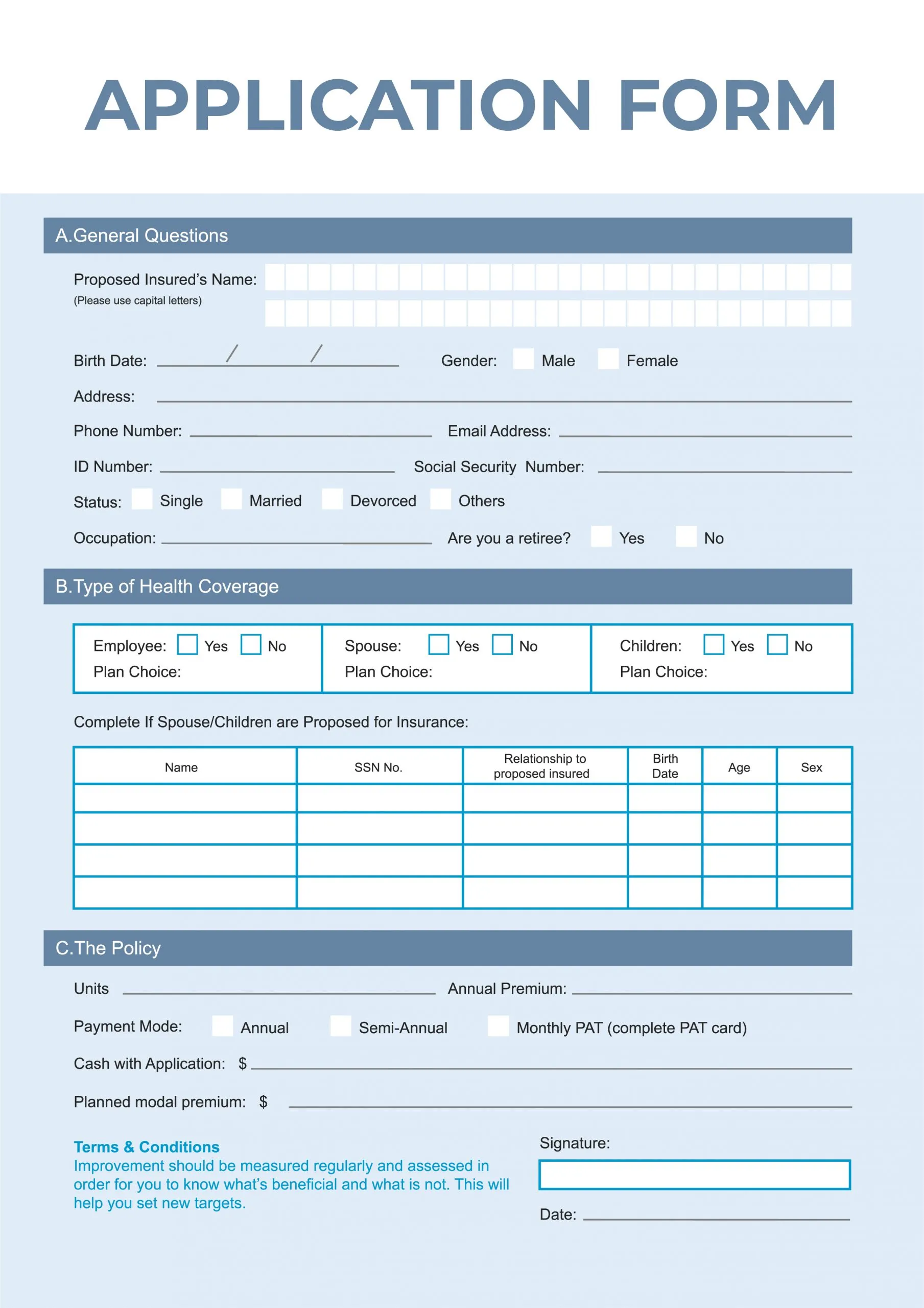

Completing the Health Insurance Coverage Tax Form can be a complex process, especially for those who are new to the ACA or have multiple sources of insurance coverage. Here’s a step-by-step guide to help you navigate this process effectively:

Step 1: Receive Your Forms

The first step is to ensure you receive the correct forms from your insurance provider, employer, or the Marketplace. If you purchased insurance through the Marketplace, you should receive Form 1095-A. Employers will typically provide Form 1095-C, and insurance companies will send Form 1095-B. Keep these forms in a safe place and review them carefully.

Step 2: Understand the Form’s Contents

Each section of the Health Insurance Coverage Tax Form contains specific information. Familiarize yourself with the form’s layout and the meaning of each section. Here’s a brief overview:

| Section | Description |

|---|---|

| Personal Information | This section includes your name, address, and tax identification number (TIN). Ensure that this information is accurate and matches your tax records. |

| Coverage Information | Details the type of coverage you had during the year, including the plan name, coverage period, and any applicable premiums. This section is crucial for verifying your insurance status. |

| Employer Information (Form 1095-C only) | Provides details about your employer, including their name, address, and employer identification number (EIN). This section is essential for employees to verify their employer's offer of coverage. |

| Premium Tax Credits (Form 1095-A only) | Outlines the amount of premium tax credit you received and any advance payments made on your behalf. This information is vital for calculating your tax liability accurately. |

Step 3: Report Your Coverage on Your Tax Return

When filing your tax return, you must report your health insurance coverage accurately. Depending on your situation, you may need to attach one of the Health Insurance Coverage Tax Forms to your return. Here’s a breakdown:

- If you received Form 1095-A (Marketplace coverage), you will need to complete Form 8962, Premium Tax Credit, to calculate and claim your premium tax credit.

- For Form 1095-B (insurance provider coverage), you should refer to the information on the form to verify your coverage and ensure it matches your tax records. You may not need to attach this form to your return, but it's essential to keep it for your records.

- If you received Form 1095-C (employer coverage), you will need to report your insurance status on your tax return. This information is typically reported on Schedule 1 of Form 1040. You may also need to include additional forms, such as Form 8965, Health Coverage Exemptions, if you are claiming an exemption from the individual mandate.

Step 4: Verify and Reconcile

Once you have reported your insurance coverage and filed your tax return, it’s essential to verify and reconcile your information. Compare the details on your Health Insurance Coverage Tax Forms with your tax return to ensure accuracy. If you notice any discrepancies, take immediate action to correct them. This step is crucial to avoid potential penalties or audits.

Common Misconceptions and Challenges

Despite its importance, the Health Insurance Coverage Tax Form can be a source of confusion and challenge for many taxpayers. Here are some common misconceptions and challenges associated with this form:

Misunderstanding the Individual Mandate

Many individuals are unsure about the individual mandate’s requirements and penalties. While the mandate was in effect from 2014 to 2018, it was effectively eliminated for tax years 2019 and beyond. However, some states have implemented their own individual mandates, so it’s essential to stay informed about your state’s specific requirements.

Complexity of Form 1095-A

Form 1095-A, issued by the Marketplace, can be particularly complex due to its focus on premium tax credits. Taxpayers may struggle to understand the calculations and determine their eligibility for these credits. Seeking guidance from tax professionals or using reputable tax software can help navigate this complexity.

Challenges with Multiple Forms

Individuals with multiple sources of insurance coverage may receive multiple Health Insurance Coverage Tax Forms. Managing and reconciling these forms can be challenging, especially when determining which coverage takes precedence for tax purposes. Consulting with a tax advisor can help navigate these complexities.

The Future of Health Insurance Coverage Reporting

The landscape of health insurance coverage reporting is evolving, driven by ongoing policy changes and technological advancements. Here’s a glimpse into the future of this critical aspect of the U.S. tax system:

Simplification of Reporting Processes

Efforts are underway to simplify the reporting processes for both taxpayers and tax preparers. The IRS and other government agencies are exploring ways to streamline the Health Insurance Coverage Tax Form and reduce the burden on taxpayers. This may involve consolidating multiple forms or introducing digital reporting methods.

Integration with Digital Tax Systems

The integration of health insurance coverage reporting with digital tax systems is a key trend. The IRS and tax software providers are working to ensure that tax preparation software can seamlessly incorporate health insurance data, making the process more efficient and accurate. This integration will likely reduce errors and streamline the tax filing experience.

Focus on Data Analytics

The future of health insurance coverage reporting will likely involve a greater focus on data analytics. The IRS and other agencies will leverage advanced analytics techniques to identify trends, detect fraud, and improve the overall efficiency of the tax system. This data-driven approach will enable more effective policy decisions and enhance the enforcement of tax laws related to health insurance coverage.

Conclusion

The Health Insurance Coverage Tax Form is a vital component of the U.S. tax system, ensuring compliance with the Affordable Care Act and promoting transparency in healthcare. By understanding the purpose and implications of this form, taxpayers can navigate the complex landscape of healthcare and taxation with confidence. As the future of health insurance coverage reporting unfolds, staying informed and adapting to new technologies will be essential for tax professionals and taxpayers alike.

How do I know if I need to file Form 1095-A with my tax return?

+You typically need to file Form 1095-A if you purchased health insurance through the Marketplace and received advance payments of the premium tax credit. This form helps you calculate and claim your premium tax credit accurately. If you are unsure, consult a tax professional or refer to IRS guidelines.

What happens if I don’t receive my Health Insurance Coverage Tax Form on time?

+If you don’t receive your form by the deadline, contact your insurance provider, employer, or the Marketplace to request a replacement. It’s important to keep track of these deadlines to ensure you have the necessary information for filing your tax return accurately.

Can I claim an exemption from the individual mandate if I don’t have health insurance coverage?

+Yes, certain individuals may be eligible for exemptions from the individual mandate. These exemptions are typically based on financial hardship, religious beliefs, or other specific circumstances. To claim an exemption, you will need to complete Form 8965, Health Coverage Exemptions, and attach it to your tax return.