Get Quotes For Car Insurance

Securing affordable and comprehensive car insurance is a crucial aspect of responsible vehicle ownership. With the right coverage, you can protect yourself financially in the event of accidents, theft, or other unforeseen circumstances. However, finding the best car insurance quotes can be a daunting task, especially with the plethora of options and variables involved. This comprehensive guide will take you through the process of getting quotes for car insurance, ensuring you make an informed decision and find the coverage that suits your needs and budget.

Understanding Your Car Insurance Needs

Before you begin your search for car insurance quotes, it’s essential to understand your specific needs and the various coverage options available. Car insurance policies can vary significantly, and it’s crucial to tailor your coverage to your unique situation. Here are some key factors to consider:

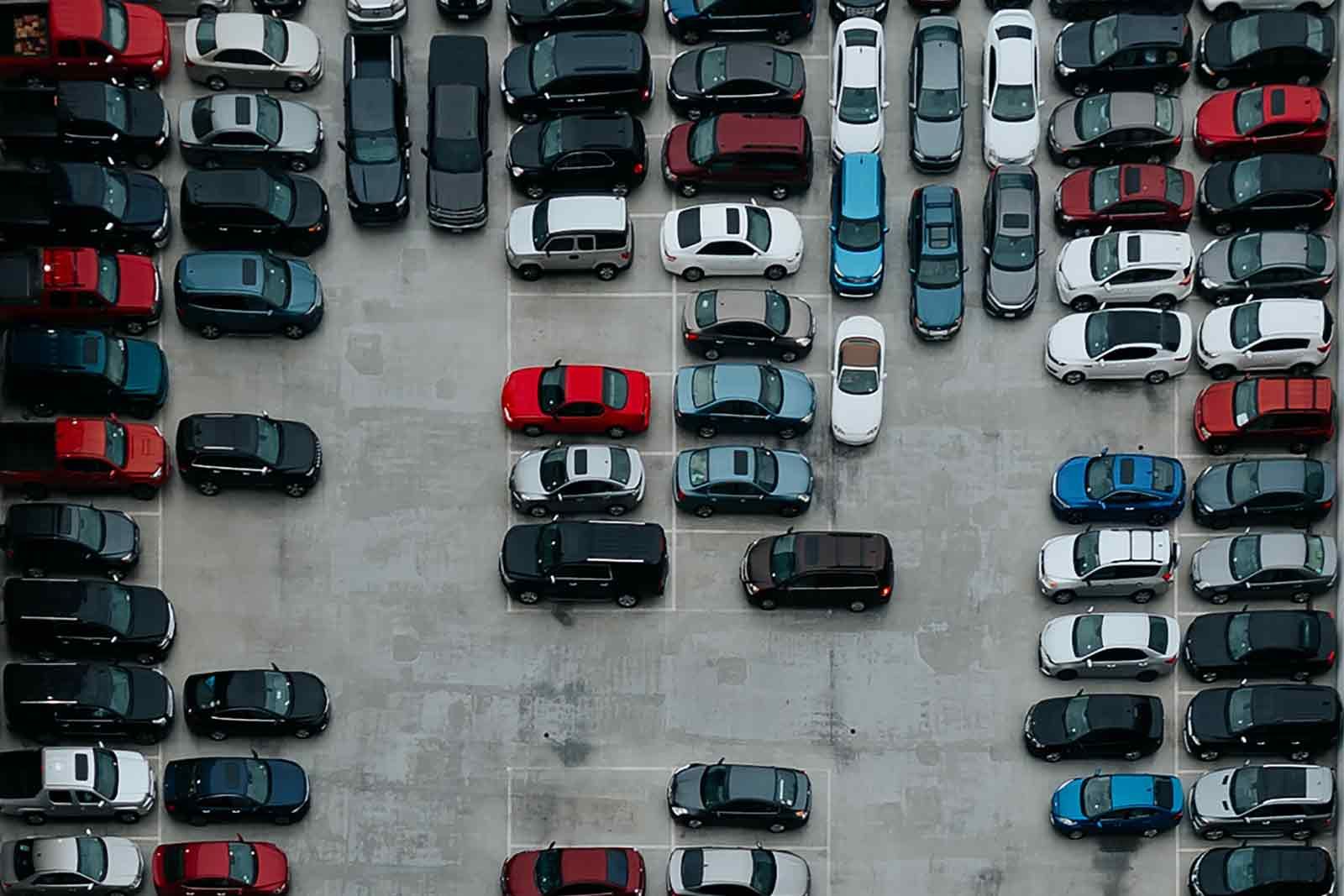

- Vehicle Type and Usage: The type of car you drive and how you use it can impact your insurance rates. Factors like make, model, age, and mileage can influence your premium. Additionally, consider whether you use your vehicle for personal, business, or pleasure purposes.

- Coverage Levels: Car insurance typically offers three main types of coverage: liability, collision, and comprehensive. Liability coverage is mandatory in most states and covers damages you cause to others. Collision coverage pays for repairs to your vehicle after an accident, while comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters.

- Deductibles and Limits: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can lower your premium, but it's important to choose a deductible you can afford. Coverage limits, on the other hand, determine the maximum amount your insurance company will pay for covered claims.

- Additional Coverages: Depending on your needs, you may want to consider optional coverages like rental car reimbursement, roadside assistance, or personal injury protection (PIP). These add-ons can provide extra peace of mind but may increase your premium.

Comparing Car Insurance Quotes

Once you have a clear understanding of your insurance needs, it’s time to start comparing quotes. Here’s a step-by-step guide to help you through the process:

Gather Information

Before requesting quotes, gather all the necessary information. This includes details about your vehicle (make, model, year, and VIN), your driving history (including any accidents or violations), and your personal information (name, address, date of birth, etc.). Having this information readily available will streamline the quote process.

Choose Insurance Providers

There are numerous insurance companies offering car insurance policies. It’s beneficial to research and compare multiple providers to find the best fit for your needs. Consider factors such as reputation, financial stability, customer service, and coverage options. You can start by checking with well-known national providers, regional carriers, and even local insurance agencies.

Request Quotes

There are several ways to request car insurance quotes:

- Online Quotes: Many insurance companies offer online quote tools on their websites. These tools allow you to input your information and receive instant quotes. Online quotes are convenient and can provide a quick overview of different options.

- Agent-Based Quotes: Working with an insurance agent can offer personalized guidance. Agents can provide quotes from multiple providers and help you understand the nuances of each policy. This option is ideal if you prefer face-to-face interaction and expert advice.

- Comparison Websites: Comparison websites aggregate quotes from multiple insurance providers. These platforms can be a convenient way to compare rates and coverage options from various companies. However, be cautious of biased recommendations and ensure the website is reputable.

Evaluate the Quotes

When comparing quotes, pay attention to the following aspects:

- Premium Costs: Compare the monthly or annual premium costs across different providers. Remember that the cheapest quote may not always offer the best value, as coverage and policy terms can vary.

- Coverage Details: Carefully review the coverage limits, deductibles, and any additional benefits or exclusions. Ensure that the policies align with your specific needs and provide adequate protection.

- Discounts: Many insurance companies offer discounts for various reasons, such as safe driving records, bundling policies, or having certain safety features in your vehicle. Ask about available discounts to potentially reduce your premium.

- Customer Service and Claims Handling: Consider the reputation and customer service track record of the insurance providers. Read reviews and ask for recommendations from friends or family to gauge the quality of service and claims handling.

Consider Bundle Options

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with the same provider. Bundling can often result in significant savings and streamlined policy management.

Finalizing Your Car Insurance Decision

After thoroughly evaluating the quotes and considering your specific needs, it’s time to make a decision. Choose the insurance provider and policy that offer the best combination of coverage, price, and service. Don’t forget to review your policy annually to ensure it still meets your needs and to take advantage of any available discounts.

Additional Considerations

Keep in mind that car insurance is a legal requirement in most states, and it’s essential to have adequate coverage to protect yourself and others on the road. Always review your policy carefully and ask questions if you have any doubts or concerns. Your insurance agent or provider should be able to provide clarification and guidance.

Conclusion

Getting quotes for car insurance is a crucial step in ensuring you have the right coverage at the right price. By understanding your needs, comparing quotes from multiple providers, and evaluating the details of each policy, you can make an informed decision. Remember, car insurance is an investment in your financial security, so take the time to choose a policy that provides peace of mind and protects you in the event of an accident or other unexpected events.

What is the average cost of car insurance?

+The average cost of car insurance can vary widely depending on factors such as location, driving history, vehicle type, and coverage levels. According to recent studies, the national average for car insurance premiums is around 1,674 annually. However, rates can range from as low as 500 to over $3,000 per year. It’s important to obtain personalized quotes to get an accurate estimate for your specific situation.

How can I lower my car insurance premiums?

+There are several strategies to reduce your car insurance premiums. Some effective methods include:

- Maintaining a clean driving record by avoiding accidents and violations.

- Increasing your deductible, but ensure it’s an amount you can comfortably afford.

- Bundling your car insurance with other policies, such as home or renters insurance.

- Taking advantage of discounts for safe driving, good student grades, or loyalty.

- Comparing quotes from multiple insurance providers to find the best deal.

What factors influence car insurance rates?

+Several factors can influence car insurance rates, including:

- Age and gender: Younger drivers and males tend to have higher premiums due to their higher risk profiles.

- Driving history: A clean driving record with no accidents or violations can result in lower rates.

- Location: Insurance rates can vary significantly by state and even by specific ZIP code.

- Vehicle type: High-performance or luxury cars often have higher insurance costs.

- Credit score: Many insurance companies consider credit scores when determining rates.