Georgia Marketplace Insurance

Navigating the Georgia Marketplace for Affordable Health Insurance

The Georgia Marketplace, officially known as the Georgia Health Insurance Marketplace, is a vital platform for residents of the state to access affordable health insurance options. This article aims to provide a comprehensive guide to navigating the marketplace, exploring its benefits, and offering expert insights to help individuals and families make informed decisions about their healthcare coverage.

Understanding the Georgia Health Insurance Marketplace

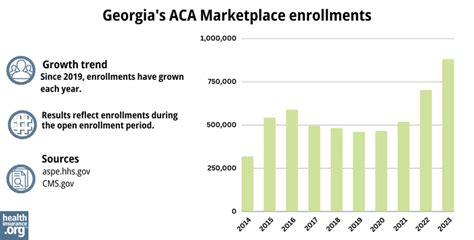

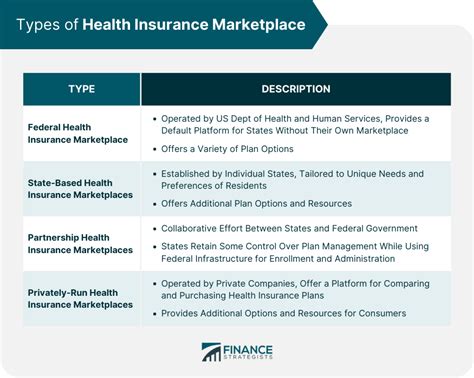

The Georgia Marketplace is a key component of the Affordable Care Act (ACA), also known as Obamacare. It serves as an online platform where individuals, families, and small businesses can shop for and enroll in health insurance plans. The marketplace offers a range of options, including major medical plans, dental coverage, and vision plans, ensuring that Georgians have access to comprehensive healthcare services.

One of the primary advantages of the Georgia Marketplace is the availability of subsidies and tax credits for eligible individuals and families. These financial aids can significantly reduce the cost of health insurance premiums, making quality healthcare more affordable and accessible. The marketplace calculates these subsidies based on income, family size, and other factors, ensuring that those who need assistance can receive it.

Key Features of the Georgia Marketplace

- Plan Comparison Tools: The marketplace provides easy-to-use tools that allow users to compare different health insurance plans based on factors such as cost, coverage, and provider networks. This feature empowers individuals to make informed choices that align with their specific healthcare needs and budget.

- Open Enrollment Period: Each year, the Georgia Marketplace has a designated open enrollment period, typically lasting from November to December. During this time, individuals can enroll in new plans or make changes to their existing coverage. Outside of this period, enrollment is generally limited to special enrollment periods triggered by qualifying life events.

- Assistance with Enrollment: Recognizing that navigating the health insurance landscape can be complex, the Georgia Marketplace offers various resources and support. This includes access to trained navigators who can provide personalized assistance, answer questions, and guide individuals through the enrollment process.

| Metric | Value |

|---|---|

| Number of Qualified Health Plans (QHPs) | 103 |

| Average Premium for Silver Plans (2023) | $620.57/month |

| Percentage of Georgians Eligible for Subsidies | 60% |

Exploring Plan Options and Coverage

The Georgia Marketplace offers a diverse range of health insurance plans to cater to the varying needs and preferences of its residents. These plans are categorized into different metal tiers, each with its own cost-sharing structure and level of coverage.

Metal Tiers and Their Characteristics

- Bronze Plans: These plans typically have the lowest monthly premiums but higher out-of-pocket costs. They are ideal for individuals who prioritize lower monthly payments and anticipate few healthcare expenses.

- Silver Plans: Silver plans strike a balance between premiums and out-of-pocket costs. They often offer a good balance of affordability and coverage, making them a popular choice for many Georgians.

- Gold Plans: Gold plans usually have higher premiums but offer more extensive coverage and lower out-of-pocket costs. They are suitable for individuals with chronic conditions or those who anticipate frequent use of healthcare services.

- Platinum Plans: Platinum plans provide the most comprehensive coverage with the lowest out-of-pocket costs. While they have the highest premiums, they are designed for individuals who require extensive medical care and want maximum financial protection.

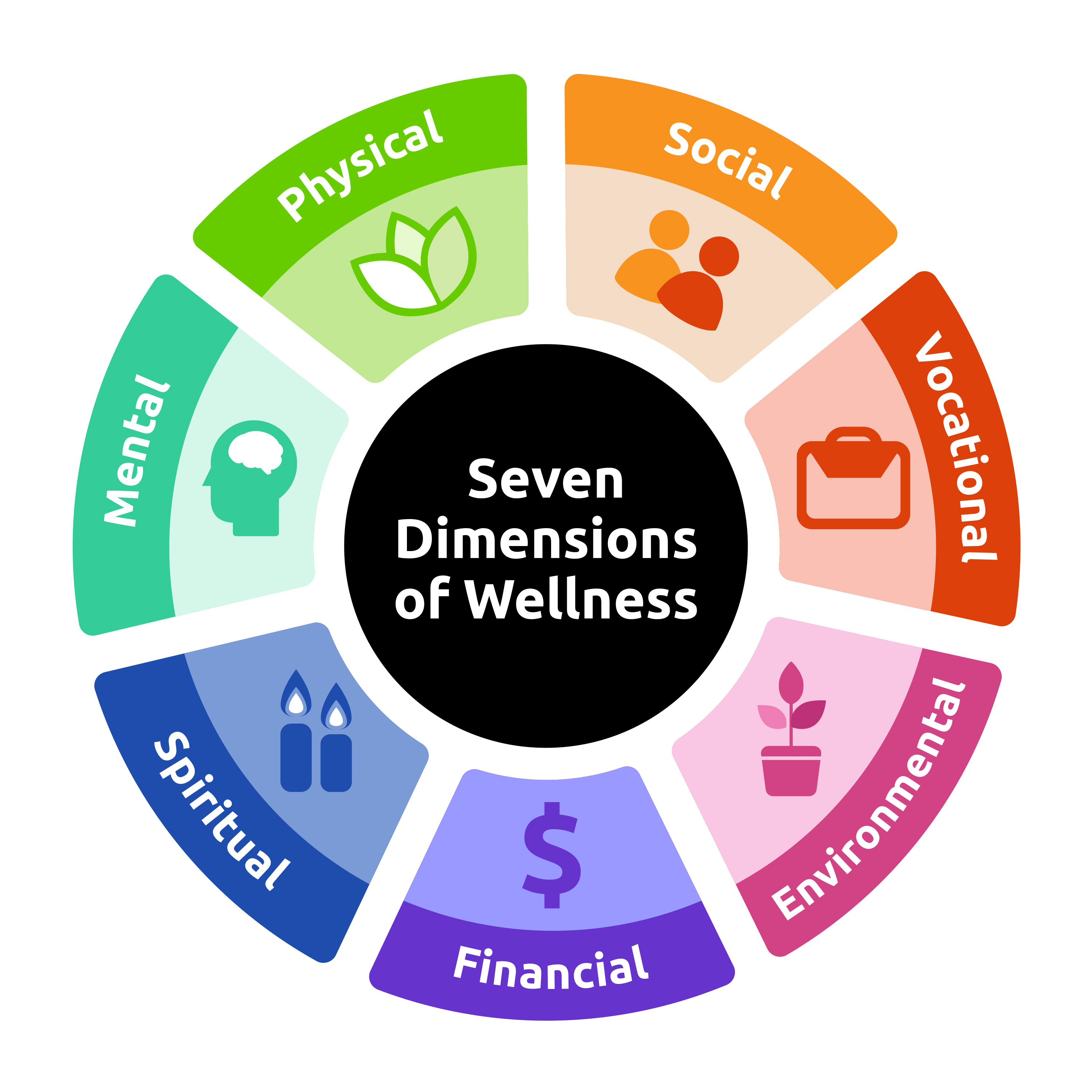

Each metal tier plan includes essential health benefits, such as ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and chronic disease management. These benefits ensure that Georgians have access to a comprehensive range of healthcare services.

Additional Coverage Options

Beyond the metal tier plans, the Georgia Marketplace also offers other types of coverage to meet specific needs:

- Dental and Vision Plans: These plans provide coverage for dental and vision care, which are often not included in standard health insurance plans. They can be purchased separately or as part of a bundle with a medical plan.

- Short-Term Health Insurance: Short-term plans offer temporary coverage for those who may be between jobs, waiting for a new employer’s plan to start, or seeking coverage for a specific period. These plans typically have more limited benefits and may not comply with ACA requirements.

- Medicaid and CHIP: The Georgia Marketplace also assists with enrollment in Medicaid and the Children’s Health Insurance Program (CHIP). These programs provide low-cost or free healthcare coverage for eligible low-income individuals and families.

Navigating the Enrollment Process

Enrolling in a health insurance plan through the Georgia Marketplace involves a few key steps. Here’s a simplified guide to help you through the process:

Step 1: Determine Eligibility

Before enrolling, it’s crucial to understand your eligibility for subsidies and tax credits. The Georgia Marketplace uses a combination of factors, including income, family size, and household composition, to determine eligibility. You can use the marketplace’s eligibility tool to assess your qualifications.

Step 2: Compare Plans

Once you’ve established your eligibility, it’s time to explore the available plans. Use the marketplace’s plan comparison tools to evaluate different options based on your specific needs and budget. Consider factors such as premium costs, out-of-pocket expenses, provider networks, and covered services.

Step 3: Apply and Enroll

When you’ve found the plan that best suits your needs, it’s time to apply. The application process typically involves providing personal and household information, income details, and other relevant data. Once your application is approved, you can finalize your enrollment and select your preferred coverage start date.

Step 4: Manage Your Coverage

After enrollment, it’s important to stay informed and manage your coverage effectively. This includes understanding your benefits, knowing your provider network, and keeping track of any changes to your plan or eligibility. Regularly review your coverage and make adjustments during the open enrollment period to ensure it continues to meet your needs.

Expert Insights and Tips

Navigating the Georgia Marketplace and choosing the right health insurance plan can be a complex process. Here are some expert tips and insights to guide you along the way:

- Understand Your Healthcare Needs: Before selecting a plan, take time to assess your healthcare needs. Consider your medical history, any ongoing treatments or conditions, and your anticipated healthcare expenses. This will help you choose a plan that provides adequate coverage without unnecessary costs.

- Consider Network Providers: Pay close attention to the provider networks included in each plan. Ensure that your preferred doctors, specialists, and hospitals are in-network to avoid higher out-of-pocket costs. If you have a specific provider in mind, verify their network status before finalizing your plan choice.

- Review Out-of-Pocket Costs: While premiums are an essential consideration, don't overlook out-of-pocket costs. These include deductibles, copayments, and coinsurance. Understanding these costs can help you manage your healthcare expenses more effectively and avoid surprises when utilizing healthcare services.

- Explore Additional Benefits: Beyond the standard health insurance coverage, consider the added benefits that some plans offer. These may include wellness programs, telemedicine services, or access to fitness discounts. These additional perks can enhance your overall healthcare experience and provide value beyond basic coverage.

- Stay Informed About Changes: The healthcare landscape is dynamic, and plans can evolve from year to year. Stay updated with any changes to the marketplace, including new plans, modified benefits, or updated eligibility criteria. This ensures that you can make informed decisions during the open enrollment period.

Frequently Asked Questions

When is the open enrollment period for the Georgia Marketplace?

+The open enrollment period typically runs from November 1st to December 15th each year. During this time, individuals can enroll in new plans or make changes to their existing coverage. It’s important to mark these dates on your calendar to ensure you don’t miss the opportunity to secure the coverage you need.

Can I enroll outside of the open enrollment period?

+Yes, you can enroll outside of the open enrollment period if you experience a qualifying life event. These events include marriage, divorce, birth or adoption of a child, loss of other health coverage, or changes in income or household size. In such cases, you may be eligible for a special enrollment period to enroll in a new plan.

How do I know if I’m eligible for subsidies or tax credits?

+Eligibility for subsidies and tax credits is determined based on your income, family size, and other factors. You can use the Georgia Marketplace’s eligibility tool to assess your qualifications. If you meet the criteria, you may be able to access financial assistance to reduce your health insurance premiums.

What happens if I miss the open enrollment period?

+If you miss the open enrollment period and don’t qualify for a special enrollment period, you may need to wait until the next open enrollment period to enroll in a new plan. However, it’s important to note that you can still access emergency services and receive treatment for life-threatening conditions regardless of your insurance status.

How can I get help with the enrollment process?

+The Georgia Marketplace offers various resources and support to assist with the enrollment process. You can connect with trained navigators who can provide personalized guidance and answer your questions. Additionally, you can access online tools, brochures, and other educational materials to help you understand your options and make informed choices.

The Georgia Marketplace plays a crucial role in ensuring that Georgians have access to affordable and comprehensive health insurance options. By understanding the marketplace, exploring plan options, and following expert guidance, individuals and families can navigate the healthcare landscape with confidence and secure the coverage they need to protect their well-being.