Full Coverage Car Insurance Cost

Understanding the costs associated with full coverage car insurance is essential for anyone looking to protect their vehicle and finances. Full coverage insurance provides comprehensive protection, but the premiums can vary significantly based on numerous factors. This article aims to provide an in-depth analysis of the costs involved, offering valuable insights for those seeking to make informed decisions about their insurance coverage.

Decoding Full Coverage Car Insurance Costs

Full coverage car insurance is a comprehensive policy that combines collision coverage and comprehensive coverage to offer a higher level of protection. Collision coverage pays for damages to your vehicle when you’re at fault in an accident, while comprehensive coverage covers non-collision incidents like theft, vandalism, and natural disasters. The cost of full coverage insurance is influenced by a multitude of factors, including your personal details, vehicle characteristics, and the coverage limits you choose.

Personal Factors Influencing Costs

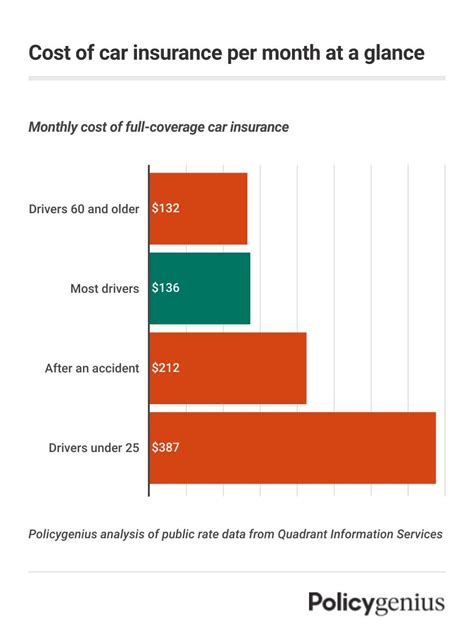

Your personal information plays a significant role in determining the cost of your full coverage insurance. Insurance providers consider factors such as your age, gender, driving history, and location. Younger drivers, especially males, often face higher premiums due to their perceived higher risk on the roads. Additionally, your credit score can impact your insurance rates, with a higher score often leading to more favorable rates.

| Factor | Impact on Premium |

|---|---|

| Age | Younger drivers (16-25) typically pay higher premiums. |

| Gender | Males often pay more due to higher perceived risk. |

| Driving History | Clean records result in lower premiums. |

| Credit Score | Better credit scores can lead to better rates. |

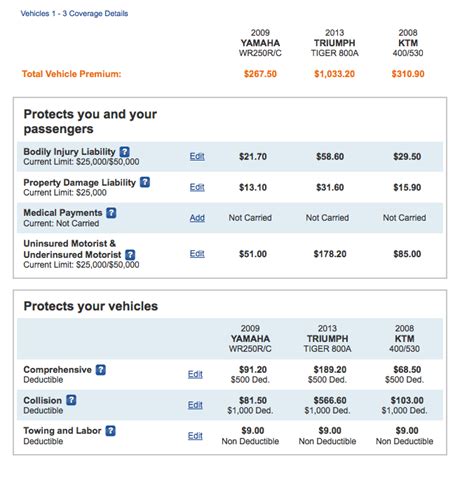

Vehicle Characteristics and Coverage Limits

The type of vehicle you own and the coverage limits you choose are other critical factors in determining your full coverage insurance costs. High-performance vehicles and luxury cars generally attract higher premiums due to their expensive repair costs. Additionally, the higher the coverage limits you opt for, the more you can expect to pay in premiums.

| Vehicle Type | Premium Impact |

|---|---|

| High-Performance Cars | Higher premiums due to costly repairs. |

| Luxury Vehicles | Expensive to insure due to replacement costs. |

| Economy Cars | Typically result in lower premiums. |

Regional Variations and Discounts

The region you live in can also affect your insurance rates. Urban areas often have higher premiums due to increased accident risks and vehicle thefts. However, insurance providers also offer various discounts that can help reduce your premiums. These discounts can be for things like safe driving records, multiple policies with the same provider, or even for vehicle safety features like anti-theft systems.

Average Costs and Real-World Examples

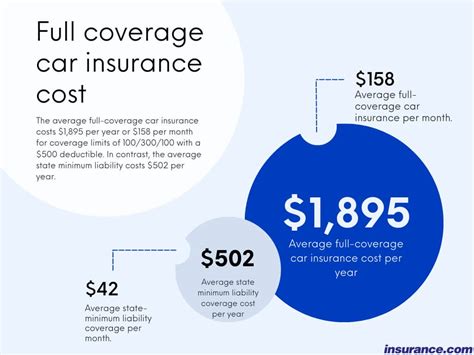

The average cost of full coverage car insurance in the United States is around 1,674 annually, according to the Insurance Information Institute (III). However, this can vary significantly based on the factors mentioned earlier. For instance, a young male driver with a sports car in an urban area could pay upwards of 2,500 annually for full coverage, while an older female driver with an economy car in a rural area might pay as little as $1,000.

Comparing Premiums for Different Scenarios

| Scenario | Estimated Annual Premium |

|---|---|

| Young Male Driver, Urban Area, Sports Car | 2,500 - 3,000 |

| Middle-Aged Female Driver, Suburban Area, Mid-Size Sedan | 1,500 - 2,000 |

| Retired Male Driver, Rural Area, Economy Car | 1,000 - 1,200 |

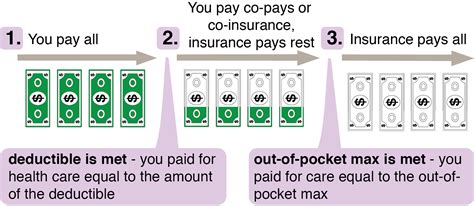

Impact of Deductibles

The deductible you choose can also affect your premium. A higher deductible means you pay more out-of-pocket when making a claim, but it can lower your monthly premiums. On the other hand, a lower deductible provides more financial protection but can increase your monthly payments.

The Benefits of Full Coverage Insurance

While full coverage insurance comes with higher premiums, it also offers extensive protection. This type of insurance provides financial peace of mind, ensuring that you’re covered for a wide range of incidents. It’s especially beneficial for those with newer or more expensive vehicles, as it can cover the full cost of repairs or replacements.

Peace of Mind and Financial Protection

Full coverage insurance provides a safety net against unexpected expenses. In the event of an accident or theft, you won’t have to worry about the financial burden, as your insurance policy will cover the costs. This can be especially crucial for those who rely heavily on their vehicles for work or daily activities.

Covering Total Loss and Theft

In the unfortunate event of a total loss or theft of your vehicle, full coverage insurance can provide significant financial relief. It ensures that you receive compensation for the actual cash value of your vehicle, helping you replace it without incurring a large financial loss.

Making Informed Decisions

Understanding the costs and benefits of full coverage car insurance is essential for making the right decision for your financial and vehicle protection needs. While the premiums can be higher, the extensive coverage it offers can provide invaluable peace of mind. It’s crucial to shop around, compare quotes, and consider your personal and vehicle circumstances when choosing an insurance policy.

What is the difference between full coverage and liability-only insurance?

+Full coverage insurance includes both collision and comprehensive coverage, offering protection for a wide range of incidents. Liability-only insurance, on the other hand, only covers damages you cause to others’ vehicles or property. It does not provide any coverage for your own vehicle.

How can I lower my full coverage insurance premiums?

+There are several ways to reduce your premiums. These include maintaining a clean driving record, improving your credit score, choosing a higher deductible, and taking advantage of any available discounts. Shopping around and comparing quotes from different insurers can also help you find the best rates.

Is full coverage insurance worth the cost for older vehicles?

+For older vehicles, the decision to opt for full coverage insurance depends on the vehicle’s value and your personal financial situation. If the vehicle is older and has a low resale value, liability-only insurance might be a more cost-effective option. However, if the vehicle is still in good condition and you rely heavily on it, full coverage can provide peace of mind and financial protection.