Full Coverage Car Insurance California

In the realm of automotive safety and financial protection, the term "Full Coverage Car Insurance" holds significant importance, especially in the state of California. This type of insurance is designed to offer comprehensive protection for vehicle owners, providing a safety net in the event of accidents, theft, or other unforeseen circumstances. As one of the most populous and diverse states in the US, California presents a unique set of challenges and considerations when it comes to auto insurance.

Understanding the nuances of full coverage car insurance in California is crucial for residents seeking to safeguard their vehicles and themselves. This guide aims to delve into the specifics of full coverage car insurance, exploring its benefits, costs, and how it can be tailored to meet the diverse needs of California drivers. By the end of this article, readers should have a comprehensive understanding of full coverage car insurance and be equipped to make informed decisions regarding their automotive insurance needs.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a comprehensive insurance policy that offers a wide range of protections for vehicle owners. It is designed to provide financial security and peace of mind by covering various potential risks and liabilities associated with owning and operating a motor vehicle.

The term "full coverage" is often used to describe a policy that includes both liability coverage and comprehensive coverage. Liability coverage is a fundamental aspect of any auto insurance policy, as it protects the policyholder from financial losses in the event they are found at fault for an accident that causes injury or property damage to others. On the other hand, comprehensive coverage offers protection for the policyholder's own vehicle, covering damages resulting from incidents other than collisions, such as theft, vandalism, natural disasters, or collisions with animals.

In essence, full coverage car insurance aims to provide a complete package of protections, ensuring that policyholders are financially shielded from a wide array of potential risks and liabilities. By combining liability and comprehensive coverage, full coverage policies offer a higher level of protection compared to basic liability-only policies.

However, it's important to note that the term "full coverage" can be somewhat misleading, as it doesn't imply that every possible risk is covered. Each insurance provider offers different policy options and coverage levels, and it's essential for policyholders to carefully review their policies to understand exactly what is and isn't covered.

The Benefits of Full Coverage Car Insurance in California

California, with its diverse landscapes, bustling cities, and varied driving conditions, presents a unique set of challenges and opportunities when it comes to auto insurance. Full coverage car insurance offers several key benefits that can be particularly advantageous for California drivers.

Comprehensive Protection for a Variety of Risks

California's diverse geography and climate expose vehicles to a wide range of potential hazards. From wildfires in the dry summer months to heavy rainfall and floods during the winter, the state's natural environment can pose significant risks to vehicles. Full coverage car insurance provides protection against these natural disasters, ensuring that policyholders are financially prepared to handle any damage caused by such events.

In addition to natural disasters, California is also known for its vibrant wildlife, which can sometimes lead to unexpected encounters on the road. Full coverage insurance typically includes coverage for collisions with animals, offering peace of mind to drivers who frequently travel through areas with high wildlife populations.

Protection Against Theft and Vandalism

California's larger cities, such as Los Angeles and San Francisco, are notorious for their high rates of vehicle theft and vandalism. Full coverage car insurance policies typically include comprehensive coverage, which protects policyholders against losses resulting from theft, attempted theft, or vandalism. This can provide significant financial relief for victims of such crimes, helping them to recover more quickly and easily.

Legal and Financial Peace of Mind

California has strict laws regarding auto insurance, with minimum liability requirements that must be met to legally operate a vehicle on state roads. Full coverage car insurance policies often exceed these minimum requirements, providing policyholders with added protection and peace of mind. By opting for full coverage, drivers can rest assured that they are adequately insured against a wide range of potential liabilities, reducing the risk of legal and financial complications in the event of an accident.

Additional Benefits and Services

Many full coverage car insurance policies in California offer a range of additional benefits and services that can enhance the overall insurance experience. These may include:

- Roadside Assistance: Coverage for emergency roadside services, such as towing, flat tire changes, and fuel delivery.

- Rental Car Reimbursement: Financial assistance for rental car expenses if a policyholder's vehicle is in the shop for repairs covered by the insurance policy.

- Glass Coverage: Protection for windshield and window repairs or replacements, often with no deductible.

- Accident Forgiveness: A feature that prevents a single at-fault accident from increasing insurance rates, provided the policyholder maintains a clean driving record.

- Discounts: Many insurance providers offer discounts for safe driving, multiple vehicles insured, or other factors, helping to reduce the overall cost of full coverage insurance.

The Cost of Full Coverage Car Insurance in California

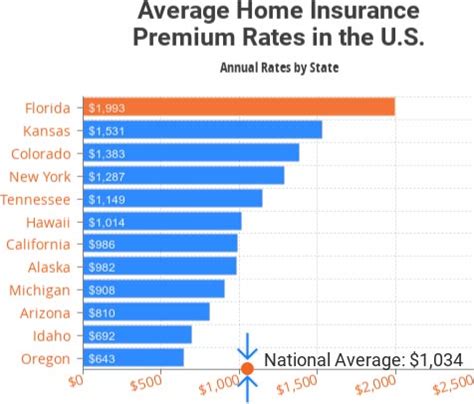

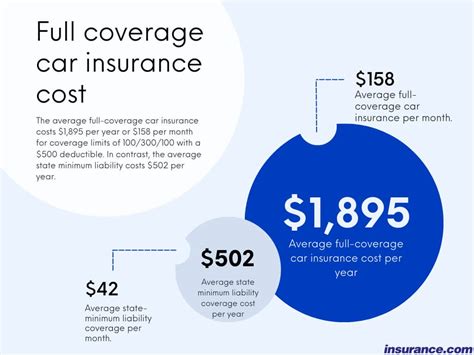

The cost of full coverage car insurance in California can vary significantly depending on several factors, including the policyholder's location, driving record, and the type of vehicle insured. California is known for having some of the highest auto insurance rates in the nation, with an average annual premium of approximately $1,500. However, it's important to note that this average can vary widely, and some drivers may pay significantly more or less depending on their individual circumstances.

Factors Influencing Cost

Several key factors can impact the cost of full coverage car insurance in California:

- Location: The cost of insurance can vary greatly between different regions of California. Urban areas, such as Los Angeles and San Francisco, tend to have higher insurance rates due to increased traffic congestion, higher accident rates, and a higher risk of theft and vandalism.

- Driving Record: Insurance providers take a close look at a policyholder's driving history. A clean driving record with no accidents or traffic violations can lead to lower insurance rates, while a history of accidents or violations can significantly increase the cost of insurance.

- Vehicle Type: The make, model, and year of a vehicle can impact insurance rates. High-performance vehicles, luxury cars, and SUVs often have higher insurance costs due to their higher replacement and repair costs, as well as their increased risk of theft.

- Coverage Level: The level of coverage chosen by a policyholder will directly impact the cost of their insurance. Higher coverage limits and additional benefits, such as roadside assistance or rental car reimbursement, will generally increase the overall cost of the policy.

- Deductibles: Choosing a higher deductible (the amount the policyholder pays out of pocket before the insurance coverage kicks in) can lower the monthly insurance premium. However, it's important to carefully consider the financial implications of a higher deductible, as it means the policyholder will have to pay more out of pocket in the event of a claim.

Average Costs and Savings Opportunities

According to recent data, the average cost of full coverage car insurance in California is approximately $1,500 per year. However, it's important to note that this is just an average, and individual policyholders may pay significantly more or less depending on their specific circumstances.

There are several strategies that California drivers can employ to potentially save on their full coverage car insurance costs:

- Shop Around: Insurance rates can vary significantly between different providers. It's important to compare quotes from multiple insurance companies to find the best deal.

- Bundle Policies: Many insurance providers offer discounts when policyholders bundle multiple insurance policies, such as auto insurance with homeowners or renters insurance.

- Maintain a Clean Driving Record: A clean driving record can lead to significant savings on insurance premiums. Avoid accidents and traffic violations to keep your insurance rates as low as possible.

- Choose a Higher Deductible: As mentioned earlier, opting for a higher deductible can lower your monthly insurance premium. However, be sure to carefully consider the financial implications of this decision.

- Consider Telematics-Based Insurance: Some insurance providers offer telematics-based insurance programs that use data from a device installed in your vehicle to track your driving habits. If you drive safely and responsibly, you may be eligible for lower insurance rates.

Tailoring Full Coverage Car Insurance to Your Needs

Full coverage car insurance policies are highly customizable, allowing policyholders to choose the level of coverage and additional benefits that best suit their individual needs and circumstances. By carefully reviewing their options and understanding the potential risks and liabilities they face, California drivers can tailor their full coverage policies to ensure they have the right level of protection at a price they can afford.

Customizing Your Coverage

When customizing your full coverage car insurance policy, it's important to consider the specific risks and liabilities you may face as a California driver. For example, if you live in an area prone to natural disasters such as wildfires or floods, you may want to ensure your policy includes comprehensive coverage with high limits to adequately protect your vehicle.

Similarly, if you frequently drive through areas with high wildlife populations, such as rural regions or national parks, you may want to prioritize collision coverage to protect against potential animal-related incidents. Additionally, if you regularly drive in high-traffic urban areas, you may want to consider adding optional coverages like rental car reimbursement or roadside assistance to further enhance your protection.

Understanding Your Deductibles

Deductibles are an important consideration when tailoring your full coverage car insurance policy. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly insurance premium, but it's crucial to carefully consider your financial situation and the potential risks you face.

If you're a cautious driver with a low risk of accidents and live in an area with a low risk of theft or vandalism, a higher deductible may be a suitable choice. However, if you frequently drive in high-risk areas or have a history of accidents, a lower deductible may be more appropriate to ensure you have the financial protection you need in the event of a claim.

Optional Coverages and Add-Ons

Full coverage car insurance policies often come with a range of optional coverages and add-ons that can further enhance your protection. It's important to carefully review these options and consider which ones are most relevant to your needs and circumstances.

Some common optional coverages and add-ons include:

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers in the event of an accident, regardless of who is at fault.

- Gap Insurance: This coverage fills the "gap" between the actual cash value of your vehicle and the amount you still owe on your car loan, providing financial protection if your vehicle is totaled or stolen.

- Custom Parts and Equipment Coverage: If you've made significant modifications to your vehicle, this coverage can help protect your investment by covering the cost of repairs or replacements for custom parts and equipment.

Making an Informed Decision

Choosing the right full coverage car insurance policy is a crucial decision that can have a significant impact on your financial well-being and peace of mind. By understanding the key components of full coverage insurance, the benefits it offers, and the factors that influence its cost, you can make an informed decision that best suits your needs and circumstances.

Remember, when comparing full coverage car insurance policies, it's essential to consider not only the cost but also the level of coverage, additional benefits, and the financial stability and reputation of the insurance provider. A comprehensive and well-tailored full coverage policy can provide you with the protection you need to drive confidently and safely on California's roads.

FAQ

What is the difference between full coverage and liability-only car insurance?

+Full coverage car insurance includes both liability coverage (which protects you from financial losses in the event you’re at fault for an accident) and comprehensive coverage (which protects your own vehicle from non-collision incidents like theft or natural disasters). Liability-only insurance, on the other hand, only provides coverage for the damages you cause to others, and does not cover damage to your own vehicle.

How much does full coverage car insurance cost in California?

+The cost of full coverage car insurance in California can vary widely depending on factors such as location, driving record, and vehicle type. On average, California residents pay around $1,500 per year for full coverage insurance, but this can range from a few hundred dollars to several thousand dollars.

Are there any ways to save on full coverage car insurance in California?

+Yes, there are several strategies to potentially save on full coverage car insurance in California. These include shopping around for the best rates, bundling policies, maintaining a clean driving record, choosing a higher deductible, and considering telematics-based insurance programs.

What optional coverages and add-ons are available with full coverage car insurance?

+Full coverage car insurance policies often come with a range of optional coverages and add-ons, such as uninsured/underinsured motorist coverage, medical payments coverage, gap insurance, and custom parts and equipment coverage. These optional features can further enhance your protection, but they may also increase the cost of your insurance policy.

How can I choose the right full coverage car insurance policy for my needs in California?

+To choose the right full coverage car insurance policy in California, carefully consider your individual needs and circumstances. Review the specific risks and liabilities you face as a California driver, and tailor your coverage accordingly. Compare quotes from multiple insurance providers, and consider factors such as coverage levels, deductibles, and additional benefits. Finally, ensure you understand the financial stability and reputation of the insurance provider before making your decision.