Filing An Insurance Claim

Navigating the process of filing an insurance claim can be a complex and sometimes daunting task, but it's an essential step in ensuring you receive the coverage and support you're entitled to. Whether you've been involved in a car accident, experienced property damage, or encountered a medical emergency, understanding the ins and outs of the insurance claims process is crucial. This comprehensive guide will walk you through the key steps, considerations, and best practices to make the process as smooth and successful as possible.

Understanding the Insurance Claims Process

The insurance claims process involves several critical steps that, when executed properly, can lead to a successful outcome. Here’s a detailed breakdown of each step, along with practical advice and insights to help you navigate this journey.

Step 1: Assessing Your Situation

The first step in filing an insurance claim is to carefully assess your situation. This initial evaluation is crucial as it sets the foundation for your entire claims process. Here are some key considerations:

- Type of Claim: Determine the nature of your claim. Is it a property damage claim, a liability claim, or a personal injury claim? Understanding the type of claim will guide you towards the appropriate coverage and help you gather the necessary documentation.

- Policy Details: Familiarize yourself with your insurance policy. Review the coverage limits, deductibles, and any specific exclusions or conditions. This knowledge will help you understand what is and isn't covered, ensuring you take the right steps to maximize your claim.

- Timelines: Insurance policies often have specific timelines for reporting and filing claims. Ensure you are aware of these deadlines to avoid any potential complications or delays in the claims process.

For instance, if you've been in a car accident, immediately assess the extent of the damage. Take photos of the vehicles involved, note down any visible injuries, and gather contact information from the other party. This initial documentation can be crucial in supporting your claim.

Step 2: Reporting the Claim

Once you’ve assessed your situation, it’s time to report your claim to your insurance provider. This step is critical as it officially initiates the claims process.

- Contact Your Insurer: Reach out to your insurance company's claims department. Most providers offer multiple channels for reporting claims, including phone, email, or online forms. Choose the method that best suits your needs and preferences.

- Provide Accurate Information: When reporting your claim, be as detailed and accurate as possible. Provide all the relevant information about the incident, including dates, times, locations, and any potential witnesses. Accuracy at this stage is crucial to avoid complications later in the process.

- Document the Conversation: Keep a record of your interaction with the insurer. Note down the date, time, and name of the representative you spoke with. If possible, request a reference number or confirmation of your claim being filed.

After reporting your claim, you might receive a claim number or reference, which will be used for all future correspondence. Keep this information handy as it can speed up the process and ensure your claim is handled efficiently.

Step 3: Gathering Documentation

Documentation is a critical aspect of the insurance claims process. The more detailed and comprehensive your documentation, the stronger your claim becomes. Here’s what you need to consider:

- Incident-Related Documents: Collect and organize all relevant documents related to the incident. This could include police reports, medical records, repair estimates, or any other official documentation that supports your claim.

- Policy Documents: Have your insurance policy readily available. This ensures you can quickly access the relevant coverage details and any specific requirements or conditions outlined in your policy.

- Photographic Evidence: Photos and videos can be powerful evidence in support of your claim. Take clear and detailed images of any damage, injuries, or the scene of the incident. Ensure the photos capture the extent of the damage and any unique circumstances.

For example, if you're filing a property damage claim due to a storm, take photos of the damage from multiple angles. Include close-ups of any broken items, such as a shattered window, and wide-angle shots to capture the overall scene. This comprehensive documentation will help your insurer understand the extent of the damage and support your claim.

Step 4: Working with Your Insurer

Once you’ve reported your claim and gathered the necessary documentation, you’ll begin working closely with your insurance provider. This collaboration is crucial to ensuring your claim is processed smoothly and efficiently.

- Communication: Maintain open and regular communication with your insurer. Respond promptly to any requests for information or documentation. If you have any questions or concerns, don't hesitate to reach out to your claims representative.

- Adherence to Policy Terms: Ensure you're adhering to the terms and conditions outlined in your insurance policy. This includes any specific requirements for documentation, evidence, or timelines. Following these guidelines will help expedite the claims process.

- Consideration of Options: Your insurer may present you with various options or recommendations for resolving your claim. Carefully consider these options, weighing the benefits and potential drawbacks. If you're unsure, seek advice from a trusted source or legal professional.

During this stage, your insurer may assign an adjuster to your claim. The adjuster's role is to evaluate the claim, assess the damage, and determine the appropriate compensation. Cooperate fully with the adjuster, providing any additional information or documentation they request.

Step 5: Receiving Compensation

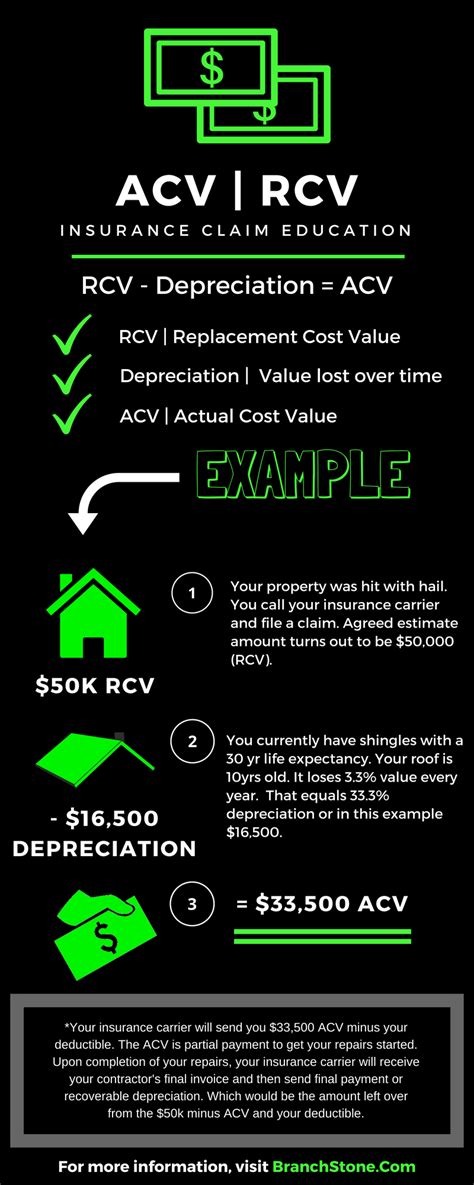

The final step in the insurance claims process is receiving the compensation you’re entitled to. This stage involves several critical steps to ensure you receive the full and fair settlement for your claim.

- Review the Offer: When your insurer presents you with a settlement offer, carefully review it. Ensure it aligns with the terms of your policy and accurately reflects the extent of your damages or losses. If you have any doubts or concerns, seek advice from a legal professional or insurance expert.

- Negotiation: In some cases, you may feel the initial offer doesn't adequately cover your damages. If so, you have the right to negotiate. Present additional evidence or arguments to support your case. Remember, negotiation is a standard part of the process, and your insurer may be open to adjusting the offer.

- Receiving Payment: Once you've agreed upon a settlement, your insurer will provide you with the payment. This can be in the form of a check, direct deposit, or other agreed-upon method. Ensure you understand the terms of the payment, including any potential tax implications.

After receiving the compensation, carefully review the payment details. Ensure the amount aligns with the agreed-upon settlement. If there are any discrepancies, contact your insurer promptly to resolve the issue.

Maximizing Your Insurance Claim

Filing an insurance claim is a complex process, but by following these steps and considerations, you can maximize your claim and ensure a smoother journey. Remember, each claim is unique, and your insurer’s approach may vary. Stay informed, ask questions, and seek professional advice when needed. With the right approach and preparation, you can navigate the insurance claims process successfully.

Common Missteps to Avoid

While the insurance claims process can be challenging, there are several common missteps that can complicate matters further. Here are some key mistakes to avoid:

- Delay in Reporting: Timely reporting is crucial. Delaying the reporting of your claim can result in missed deadlines and potential complications. Report your claim as soon as possible after the incident to ensure a smoother process.

- Inadequate Documentation: Insufficient or inaccurate documentation can weaken your claim. Ensure you gather and present all relevant documents and evidence to support your case. The more comprehensive your documentation, the stronger your claim becomes.

- Lack of Communication: Open and regular communication with your insurer is essential. Failing to respond promptly to requests for information or documentation can delay the process. Stay engaged and proactive throughout the claims journey.

Conclusion

Filing an insurance claim is a critical step in ensuring you receive the coverage and support you need. By understanding the process, staying organized, and seeking expert guidance when needed, you can navigate the journey with confidence. Remember, each claim is unique, so tailor your approach to fit your specific circumstances. With the right preparation and mindset, you can successfully navigate the insurance claims process and receive the compensation you deserve.

FAQ

How long does the insurance claims process typically take?

+The duration of the insurance claims process can vary widely depending on several factors, including the complexity of the claim, the insurer’s workload, and the nature of the incident. Simple claims with clear documentation may be resolved within a few weeks, while more complex claims could take several months. It’s essential to stay in communication with your insurer to understand the timeline for your specific claim.

What happens if I disagree with the insurer’s settlement offer?

+If you feel the insurer’s settlement offer doesn’t adequately cover your damages or losses, you have the right to negotiate. Present additional evidence, seek professional advice, and clearly articulate your reasoning. Insurers are often open to negotiation, especially if you can provide compelling arguments and supporting documentation.

Can I file a claim if I was at fault for the incident?

+Yes, you can still file a claim even if you were at fault. However, your policy’s coverage and any applicable deductibles will come into play. It’s important to review your policy and understand the specific terms and conditions related to fault. In some cases, you may be responsible for a deductible or a percentage of the claim amount.

How can I prepare for an insurance claim in advance?

+Preparation is key to a successful insurance claim. Regularly review your insurance policy to understand your coverage and any specific requirements. Keep your policy documents, including any endorsements or riders, readily accessible. Additionally, consider taking photos of your belongings or property to have a record of their condition before any incident occurs.