Errors And Omissions Insurance Policy

Unveiling the Importance of Errors and Omissions Insurance: A Comprehensive Guide

In the world of professional services, where expertise and precision are paramount, errors and omissions (E&O) insurance emerges as a critical safeguard for businesses and individuals alike. This specialized form of liability insurance provides a safety net, offering protection against potential claims arising from mistakes, errors, or omissions in the course of delivering professional services. As industries evolve and the legal landscape becomes increasingly complex, the significance of E&O insurance cannot be overstated. In this comprehensive guide, we will delve into the intricacies of Errors and Omissions Insurance, exploring its relevance, benefits, and implications for professionals across various sectors.

Understanding Errors and Omissions Insurance

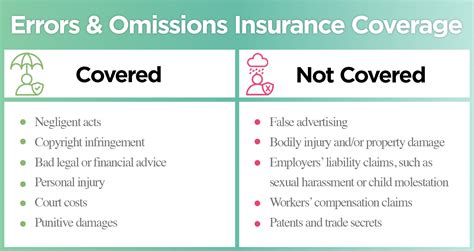

Errors and Omissions Insurance, often referred to as Professional Liability Insurance, is a specialized type of coverage designed to protect professionals from financial losses resulting from errors, mistakes, or omissions in their work. Unlike general liability insurance, which covers bodily injury or property damage claims, E&O insurance focuses specifically on the professional services rendered.

The policy is tailored to address the unique risks faced by professionals in various fields, including but not limited to: accountants, consultants, engineers, architects, real estate agents, and technology professionals. Each industry has its own set of complexities and potential pitfalls, making E&O insurance an essential tool for mitigating the financial impact of professional liability claims.

Key Components of E&O Insurance

Errors and Omissions Insurance policies typically include several critical components, each playing a vital role in providing comprehensive coverage. These components include:

- Coverage for Errors and Omissions: The primary purpose of E&O insurance is to cover legal expenses and potential damages arising from claims of professional negligence or mistakes. This coverage extends to a wide range of errors, from miscalculations to oversight in the delivery of professional services.

- Defense Costs: In the event of a claim, E&O insurance often covers the legal defense costs incurred by the insured, regardless of the outcome of the case. This provision ensures that professionals can access the necessary legal support without bearing the full financial burden.

- Indemnification: E&O insurance policies provide indemnification, meaning the insurance company agrees to reimburse the insured for any damages or settlements paid as a result of a covered claim. This protection safeguards the financial well-being of professionals, especially in cases where substantial compensation is awarded.

- Prior Acts Coverage: Many E&O policies offer prior acts coverage, which extends protection to claims arising from work performed before the policy's effective date. This is particularly crucial for professionals who have changed insurance carriers, ensuring continuity of coverage.

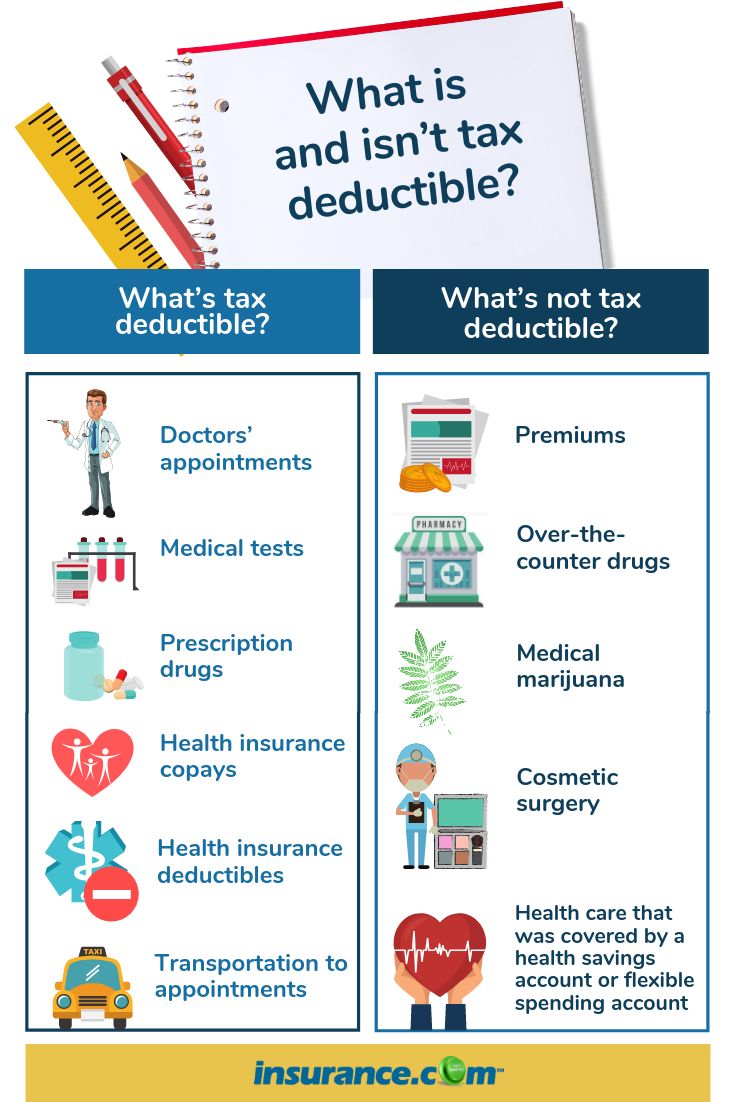

- Exclusions and Limitations: While E&O insurance provides broad coverage, it also contains exclusions and limitations. It's essential to understand these exclusions to avoid any surprises when making a claim. Common exclusions may include intentional acts, criminal conduct, or certain types of contractual liabilities.

The Need for Errors and Omissions Insurance

In today's fast-paced and highly competitive business environment, the need for Errors and Omissions Insurance is more pronounced than ever. The potential for errors, oversights, or even unintentional mistakes is inherent in the delivery of professional services. Here's why E&O insurance is a necessity for professionals:

Protecting Against Financial Losses

A single professional liability claim can result in significant financial losses. Legal expenses, settlements, and damage awards can quickly accumulate, straining the financial stability of individuals and businesses. E&O insurance acts as a financial buffer, ensuring that professionals can continue their operations without the threat of financial ruin.

Mitigating Legal Risks

Professionals across various industries face unique legal risks. From misinterpreted instructions to miscalculations or missed deadlines, the consequences can be severe. E&O insurance provides a legal safety net, allowing professionals to focus on their expertise without constant worry about potential legal repercussions.

Maintaining Client Trust

Client trust is the cornerstone of any successful professional service. By carrying E&O insurance, professionals demonstrate their commitment to ethical practices and client protection. This assurance can enhance client confidence, foster long-term relationships, and contribute to a business's overall reputation.

Meeting Industry Standards

Many industries have specific standards and regulations regarding professional liability insurance. For instance, certain professions may require E&O insurance as a condition for licensing or accreditation. Adhering to these standards not only ensures compliance but also positions professionals as trustworthy and responsible practitioners.

The Role of E&O Insurance in Different Industries

Errors and Omissions Insurance plays a critical role across a wide spectrum of industries. Let's explore how E&O insurance impacts and protects professionals in various sectors:

Accounting and Finance

In the world of accounting and finance, accuracy is non-negotiable. Errors in financial statements, tax calculations, or investment advice can have severe consequences. E&O insurance for accountants and financial advisors provides protection against claims arising from negligent advice, miscalculations, or omissions in financial reporting.

Consulting Services

Consultants, whether in management, technology, or other specialized fields, offer expert guidance to clients. However, the potential for errors or missteps in their recommendations exists. E&O insurance for consultants covers claims related to inaccurate advice, breach of confidentiality, or failure to deliver promised results.

Engineering and Architecture

Engineers and architects play a crucial role in designing and constructing buildings and infrastructure. Errors in their work can lead to costly repairs, legal battles, and even structural failures. E&O insurance for engineers and architects provides coverage for mistakes in design, miscalculations, or failures to adhere to building codes.

Real Estate Professionals

Real estate agents, brokers, and appraisers are integral to the buying and selling of properties. E&O insurance for real estate professionals protects against claims arising from errors in property valuations, misrepresentations, or failures to disclose material facts to clients.

Technology Professionals

In the rapidly evolving technology sector, professionals face unique challenges. E&O insurance for technology professionals, including software developers and IT consultants, covers claims related to software glitches, data breaches, or failures to deliver promised solutions.

Policy Considerations and Customization

When selecting an Errors and Omissions Insurance policy, professionals must carefully consider their specific needs and industry requirements. Here are some key factors to keep in mind:

Policy Limits and Deductibles

E&O insurance policies come with different coverage limits and deductibles. It's crucial to select limits that align with the potential risks and financial exposure in your industry. Higher limits provide greater protection but may also result in higher premiums.

Policy Exclusions

Review the policy exclusions carefully to ensure that the coverage aligns with your specific needs. Some policies may exclude certain types of professional services or have limitations on coverage for specific risks. Understanding these exclusions is essential to avoid gaps in protection.

Policy Endorsements

Policy endorsements, or add-ons, can customize your E&O insurance to meet your unique requirements. These endorsements may include extended coverage for specific risks, additional insureds, or increased coverage limits for certain types of claims.

Claims Handling and Service

The claims handling process and customer service provided by the insurance company are critical factors. Choose an insurer with a strong track record of prompt and efficient claims resolution. This ensures that you receive the support you need when facing a professional liability claim.

The Future of Errors and Omissions Insurance

As industries continue to evolve and technological advancements shape the way professional services are delivered, the landscape of Errors and Omissions Insurance is also likely to transform. Here are some key considerations for the future:

Emerging Risks

The rise of new technologies and business models brings with it a host of emerging risks. For example, with the increasing reliance on artificial intelligence and automation, professionals may face new liability challenges. E&O insurance policies will need to adapt to cover these evolving risks.

Cybersecurity and Data Privacy

In an era where data breaches and cyberattacks are common, professionals must be vigilant about protecting sensitive client information. E&O insurance policies will likely expand their coverage to address cybersecurity risks and data privacy breaches, offering protection for professionals in the event of such incidents.

Collaboration and Shared Liability

As professionals increasingly collaborate across disciplines and industries, the concept of shared liability becomes more relevant. E&O insurance policies may evolve to address the complexities of joint ventures, partnerships, and inter-professional collaboration, ensuring that all parties involved are adequately protected.

Specialty Policies

The future may see the development of more specialized E&O insurance policies tailored to specific industries or niches. These policies could offer enhanced coverage and more precise risk management strategies, catering to the unique needs of professionals in highly specialized fields.

Frequently Asked Questions

What is the difference between general liability insurance and Errors and Omissions Insurance?

+General liability insurance covers bodily injury, property damage, and personal injury claims, whereas Errors and Omissions Insurance specifically addresses professional negligence, mistakes, or omissions in the delivery of professional services.

Are there any industries where E&O insurance is not necessary?

+While certain industries may have lower professional liability risks, it's important to assess the potential consequences of errors or omissions. Even in low-risk industries, a single claim can have significant financial implications, making E&O insurance a prudent choice.

How can I choose the right E&O insurance policy for my business?

+Consider your industry-specific risks, policy limits, exclusions, and the reputation of the insurance provider. Seek advice from industry peers and insurance brokers who can guide you in selecting a policy that aligns with your unique needs.

Can I customize my E&O insurance policy to meet my specific needs?

+Yes, many insurance providers offer policy endorsements or add-ons that allow you to customize your coverage. These endorsements can address specific risks or provide additional coverage for unique aspects of your professional practice.

In conclusion, Errors and Omissions Insurance is a critical component of risk management for professionals across various industries. By providing financial protection and legal support, E&O insurance empowers professionals to focus on delivering their expertise with confidence and peace of mind. As industries evolve and new challenges arise, staying informed about the latest trends in E&O insurance is essential for maintaining robust protection in an ever-changing professional landscape.