Employment Insurance Benefits

Employment Insurance (EI) benefits are a vital part of Canada's social safety net, providing financial support to individuals who find themselves temporarily unemployed. These benefits play a crucial role in helping Canadians navigate periods of job loss and transition, offering stability and resources during challenging times. This comprehensive guide aims to explore the intricacies of EI benefits, delving into eligibility criteria, application processes, benefit calculation methods, and the various programs available under the EI umbrella.

Understanding Eligibility for EI Benefits

EI benefits are not accessible to all; certain criteria must be met to qualify. Generally, to be eligible, an individual must have worked a minimum number of hours in an insurable job within a specific time frame, known as the qualifying period. The qualifying period is typically the 52 weeks preceding the date of unemployment.

Additionally, individuals must be available for work, actively seeking employment, and ready to accept suitable job offers. Those who voluntarily leave their jobs without just cause or who are dismissed for misconduct may face challenges in meeting the eligibility requirements.

It's essential to note that specific EI programs may have additional eligibility criteria. For instance, the Maternity and Parental Benefits program has different rules regarding the number of hours worked and the timing of the application.

| EI Program | Qualifying Period | Additional Criteria |

|---|---|---|

| Regular Benefits | 600 hours in the last 52 weeks | Unemployed through no fault of your own |

| Maternity and Parental Benefits | 600 hours in the last 52 weeks | Pregnant or adopting a child |

| Sick Benefits | 600 hours in the last 52 weeks | Certified illness or injury |

| Compassionate Care Benefits | 600 hours in the last 52 weeks | Need to care for a gravely ill family member |

EI benefits are designed to support individuals through various life events, and understanding the eligibility criteria is the first step in accessing these vital resources.

Navigating the Application Process

Applying for EI benefits involves several steps, each crucial to ensuring a smooth and successful process. The first step is to determine eligibility by reviewing the criteria outlined earlier and confirming your status. Once eligibility is established, the next step is to gather the necessary documentation. This typically includes:

- Social Insurance Number (SIN)

- Proof of identity (driver's license, passport, etc.)

- Recent pay stubs or Record of Employment (ROE)

- Bank information for direct deposit

- Any other relevant documentation, such as medical certificates or adoption papers.

With the required documentation in hand, the next step is to complete the application. This can be done online through the Service Canada website or by visiting a Service Canada office. The application process involves providing personal and employment details, selecting the applicable EI program, and confirming the information's accuracy.

Once the application is submitted, Service Canada will review it and determine the claim's validity. This process can take several weeks, during which applicants may be contacted for additional information or to clarify certain details. It's crucial to respond promptly to any requests to avoid delays in processing.

After the claim is approved, benefits will be paid out according to the selected EI program and the individual's circumstances. Payments are typically made bi-weekly via direct deposit or mailed cheque. It's essential to keep Service Canada informed of any changes in personal or employment status to ensure uninterrupted benefits.

Calculating EI Benefits: A Comprehensive Guide

The amount of EI benefits an individual receives is calculated based on their previous earnings and the EI benefit rate, which is subject to change annually. The benefit rate is determined by the government and is typically around 55% of the individual's average insurable earnings.

To calculate the exact benefit amount, the following steps are taken:

- Determine the highest-paid 14 weeks within the qualifying period. This period is known as the best weeks and is used to calculate the individual's average insurable earnings.

- Calculate the average weekly insurable earnings by adding the total earnings from the best weeks and dividing by 14.

- Multiply the average weekly insurable earnings by the EI benefit rate to determine the maximum weekly benefit amount.

- Ensure the maximum weekly benefit amount does not exceed the maximum yearly EI benefit amount, which is set by the government.

It's important to note that the benefit calculation may differ slightly for certain EI programs, such as Maternity and Parental Benefits, which offer a flat rate regardless of previous earnings.

Example Benefit Calculation

Let's illustrate the benefit calculation process with an example. Assume an individual has the following earnings over the last 52 weeks:

| Week | Earnings |

|---|---|

| 1 | $1,200 |

| 2 | $1,100 |

| 3 | $1,300 |

| ... | ... |

| 14 | $1,050 |

The highest-paid 14 weeks would be used to calculate the average insurable earnings. Assuming the EI benefit rate is 55%, the calculation would proceed as follows:

- Total earnings from the best weeks: $1,200 + $1,100 + $1,300 + ... + $1,050 = $14,600

- Average weekly insurable earnings: $14,600 / 14 = $1,042.86

- Maximum weekly benefit amount: $1,042.86 x 0.55 = $573.57

This individual would be eligible for a maximum weekly benefit of $573.57, subject to the maximum yearly EI benefit amount.

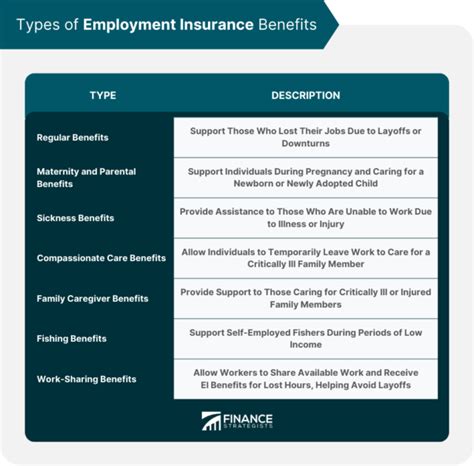

Exploring the Different EI Programs

Employment Insurance benefits encompass various programs designed to support Canadians through different life events and circumstances. Understanding these programs is crucial for individuals seeking to navigate the EI system effectively.

Regular Benefits

The Regular Benefits program is the most common form of EI support, providing income assistance to individuals who have lost their jobs through no fault of their own. This program aims to bridge the gap between employment and help individuals find new work. The duration of Regular Benefits depends on the unemployment rate in the individual's region, ranging from 14 to 45 weeks.

Maternity and Parental Benefits

The Maternity and Parental Benefits program offers financial support to new parents, enabling them to take time off work to care for their newborn or newly adopted child. This program provides up to 15 weeks of benefits for biological mothers and 35 weeks for other eligible parents, with the option to extend the parental component to a maximum of 61 weeks.

Sick Benefits

The Sick Benefits program provides income support to individuals who are unable to work due to illness, injury, or quarantine. To be eligible, individuals must have a medical certificate confirming their condition and be unable to perform their regular job duties. Sick Benefits are available for up to 15 weeks and are subject to a two-week waiting period.

Compassionate Care Benefits

The Compassionate Care Benefits program offers financial assistance to individuals who need to take time off work to care for a gravely ill family member. This program provides up to 26 weeks of benefits and requires a medical certificate confirming the family member's condition and the need for care.

Other EI Programs

In addition to the programs mentioned above, EI offers several other support initiatives, including:

- Fisheries Benefits: Support for individuals in the fishing industry during off-seasons.

- Self-Employment Benefits: Assistance for self-employed individuals starting or growing their businesses.

- Training Benefits: Funding for skills development and training to enhance employability.

- Work Sharing: A program that helps employers and employees avoid layoffs during temporary downturns.

Each EI program has its own set of eligibility criteria, application process, and benefit calculation methods. It's crucial to research and understand the specific program relevant to your circumstances to ensure a smooth and successful claim process.

Frequently Asked Questions

Can I receive EI benefits if I quit my job voluntarily?

+Generally, quitting your job voluntarily makes you ineligible for EI benefits. However, there are exceptions, such as if you quit due to illness, family responsibilities, or unacceptable work conditions. It’s important to consult with Service Canada to determine your specific eligibility.

How long does it take to receive my first EI payment after applying?

+The time it takes to receive your first EI payment can vary. It typically takes several weeks for Service Canada to process your application and determine your eligibility. Once approved, you can expect to receive your first payment within 2-3 weeks. However, factors like the volume of applications and the complexity of your claim can affect the processing time.

Can I work part-time while receiving EI benefits?

+Yes, you can work part-time while receiving EI benefits. However, your earnings from part-time work may affect the amount of your EI benefits. It’s important to report any part-time work and earnings to Service Canada to ensure your benefit amount is adjusted accordingly.

How often do I need to report my earnings to Service Canada while receiving EI benefits?

+You are required to report your earnings to Service Canada on a bi-weekly basis while receiving EI benefits. This ensures that your benefit amount is adjusted based on your actual earnings. It’s important to provide accurate and timely reports to avoid overpayment or underpayment of benefits.