Do I Need Home Insurance

Home insurance is an essential consideration for every homeowner, as it provides financial protection and peace of mind in the face of unexpected events. This article aims to delve into the world of home insurance, exploring its necessity, benefits, and key aspects to help you make an informed decision about whether you need it.

Understanding Home Insurance

Home insurance, also known as homeowner’s insurance, is a type of property insurance designed to protect your home and its contents against a variety of risks. It offers coverage for both the structure of your home and your personal belongings, ensuring that you are financially covered in the event of damage, loss, or liability claims.

The primary purpose of home insurance is to safeguard your investment and provide compensation for repairs or replacements when unforeseen incidents occur. These incidents can range from natural disasters like hurricanes and floods to accidents such as fire, theft, or vandalism.

Key Components of Home Insurance

Dwelling Coverage

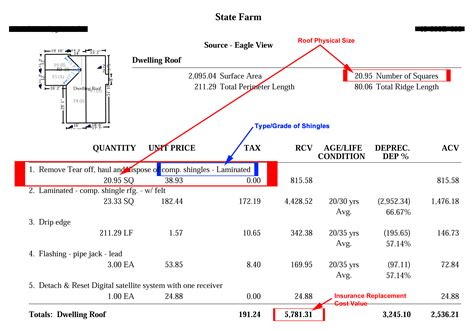

Dwelling coverage is the cornerstone of any home insurance policy. It provides protection for the physical structure of your home, including the walls, roof, foundation, and permanent fixtures. This coverage ensures that you can repair or rebuild your home if it suffers damage due to a covered event.

| Coverage Type | Description |

|---|---|

| Replacement Cost | Pays the full cost to rebuild your home, regardless of the original cost. |

| Actual Cash Value | Covers the cost of repairs minus depreciation. |

Personal Property Coverage

Personal property coverage is an essential aspect of home insurance as it protects your belongings inside the home. This coverage includes items like furniture, electronics, clothing, and valuable possessions. It provides financial assistance in the event of theft, damage, or loss due to a covered peril.

Liability Protection

Liability protection is a critical component of home insurance, offering coverage for legal and medical expenses if someone is injured on your property or if you are found liable for an accident that causes property damage or bodily harm to others.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, additional living expenses coverage provides compensation for temporary housing, meals, and other necessary expenses until you can return to your home.

Benefits of Home Insurance

Home insurance offers numerous benefits that go beyond the financial protection it provides. Here are some key advantages:

- Peace of Mind: Knowing that your home and belongings are insured gives you peace of mind, allowing you to focus on enjoying your home without worrying about unexpected costs.

- Financial Security: In the event of a covered loss, home insurance provides the financial means to repair or replace your home and possessions, ensuring your investment is protected.

- Legal Protection: Liability coverage safeguards you from potential lawsuits and provides legal defense if necessary.

- Personal Belongings Coverage: Personal property coverage ensures that your valuable possessions are protected, providing compensation for their replacement or repair.

- Discounts and Savings: Many insurance companies offer discounts for bundled policies (combining home and auto insurance), as well as for safety features like smoke detectors and security systems.

Factors to Consider When Determining Your Need for Home Insurance

Location and Climate

The location of your home and the climate it is subjected to can significantly impact your need for home insurance. If you live in an area prone to natural disasters like hurricanes, tornadoes, or floods, having adequate insurance coverage is crucial.

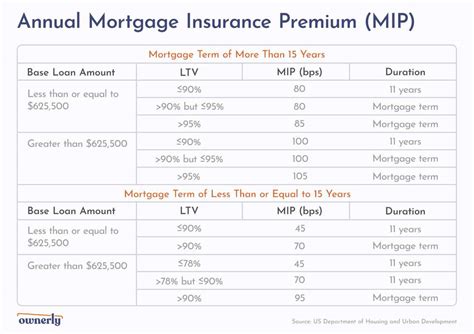

Value of Your Home and Possessions

The value of your home and the contents within it should be carefully considered. If you have a mortgage, your lender may require you to have home insurance to protect their investment. Additionally, the cost of replacing your possessions can be substantial, making insurance coverage a wise decision.

Personal Liability Risks

Evaluating the potential liability risks associated with your home is essential. If someone were to sustain an injury on your property, you could be held responsible for their medical expenses and potential legal fees. Home insurance provides coverage for these situations.

Local Laws and Regulations

Some regions may have specific laws or regulations mandating certain types of insurance coverage for homeowners. It is crucial to understand the legal requirements in your area to ensure compliance.

Choosing the Right Home Insurance Policy

When selecting a home insurance policy, it is important to consider the following factors:

- Coverage Limits: Ensure that the policy provides adequate coverage limits for your home and possessions. Review the policy's limits and compare them to the actual value of your property.

- Perils Covered: Different policies cover different perils. Make sure the policy you choose covers the specific risks relevant to your area and personal circumstances.

- Deductibles: Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Consider your financial situation and choose a deductible that you can afford in the event of a claim.

- Additional Coverages: Some policies offer optional additional coverages, such as flood insurance or earthquake coverage. Evaluate your needs and consider adding these coverages if necessary.

Common Myths and Misconceptions

There are several myths surrounding home insurance that can lead to misconceptions. Let’s address a few of them:

- Myth: Home Insurance is Expensive - While home insurance may seem costly, it is important to consider the potential financial consequences of not having coverage. The peace of mind and financial protection it provides often outweigh the cost.

- Myth: My Homeowner's Association (HOA) Insurance Covers Me - HOA insurance typically only covers common areas and shared amenities. It does not provide coverage for your individual unit or personal belongings. You still need a separate home insurance policy.

- Myth: I Don't Need Home Insurance if I Rent - While renters insurance is essential for tenants, homeowners have different needs. Home insurance covers the structure and your belongings, providing more comprehensive protection.

Frequently Asked Questions

What is the difference between home insurance and homeowners insurance?

+Home insurance and homeowners insurance are often used interchangeably, but they refer to the same type of insurance policy. Both terms describe the coverage provided for your home and its contents.

Can I customize my home insurance policy?

+Yes, most insurance providers offer customizable policies. You can choose the coverage limits, deductibles, and additional coverages that best fit your needs and budget.

What happens if I don’t have home insurance and my home is damaged?

+Without home insurance, you would be responsible for covering the costs of repairs or replacements out of your own pocket. This could result in significant financial hardship, especially for major losses.

Is home insurance mandatory for homeowners?

+While home insurance is not legally required in all regions, many lenders mandate it as a condition of a mortgage loan. Even if it is not required, having home insurance is strongly recommended to protect your investment.