Costco Connect Auto Insurance

Welcome to a comprehensive guide exploring Costco Connect Auto Insurance, a unique insurance offering available exclusively to Costco members. In this article, we will delve into the specifics of this insurance program, its benefits, coverage options, and how it compares to traditional auto insurance providers. By the end, you'll have a thorough understanding of Costco Connect Auto Insurance and whether it's the right choice for your vehicle and your wallet.

Understanding Costco Connect Auto Insurance

Costco Connect Auto Insurance is a collaboration between Costco Wholesale, the well-known membership-only warehouse club, and American Family Insurance, a prominent insurance provider in the United States. This partnership aims to provide Costco members with exclusive benefits and savings on their auto insurance policies.

The insurance program is designed to cater to the needs of Costco's vast member base, offering a range of coverage options and additional benefits that are tailored to their specific requirements. With Costco Connect Auto Insurance, members can enjoy the convenience of a trusted brand and potentially significant savings on their insurance premiums.

Eligibility and Requirements

To be eligible for Costco Connect Auto Insurance, you must meet the following requirements:

- Costco Membership: Active membership in Costco Wholesale is a prerequisite. This means you need to have a valid membership card and be in good standing with the club.

- Vehicle Ownership: The program is designed for personal vehicle owners. Whether you own a car, truck, SUV, or even a motorcycle, Costco Connect Auto Insurance can provide coverage.

- Geographical Restrictions: While Costco Connect Auto Insurance is available across the United States, certain coverage options and benefits may vary by state. It’s essential to check the availability and specifics for your region.

The Benefits of Costco Connect Auto Insurance

Costco Connect Auto Insurance offers a range of advantages that set it apart from traditional insurance providers. Here are some key benefits:

- Discounts and Savings: As a Costco member, you are eligible for exclusive discounts on your auto insurance premiums. These savings can be substantial, making Costco Connect Auto Insurance a cost-effective choice.

- Convenience: The program is designed with simplicity and ease of use in mind. Members can easily manage their insurance policies online, making it convenient to update coverage, make payments, and access policy information.

- Bundling Options: Costco Connect Auto Insurance encourages members to bundle their insurance policies. By combining auto insurance with other types of insurance, such as homeowners or renters insurance, members can often qualify for additional discounts and simplified policy management.

- Additional Benefits: Costco Connect Auto Insurance provides a variety of additional perks, including roadside assistance, accident forgiveness, and rental car coverage. These benefits enhance the overall value of the insurance program.

Coverage Options and Customization

Costco Connect Auto Insurance offers a comprehensive range of coverage options to ensure that members can tailor their policies to their specific needs. Here’s an overview of the available coverage types:

Liability Coverage

Liability coverage is a fundamental aspect of auto insurance, protecting you in the event of an accident where you are found to be at fault. Costco Connect Auto Insurance offers both bodily injury liability and property damage liability coverage. This coverage pays for the costs associated with injuries and property damage caused to others in an accident.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by the policyholder. |

| Property Damage Liability | Pays for repairs or replacement of property damaged in an accident caused by the policyholder. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are essential for protecting your vehicle. Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damages resulting from non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a type of coverage that provides additional medical and disability benefits to the policyholder and their passengers in the event of an accident. This coverage can include medical expenses, lost wages, and funeral costs, ensuring that you and your loved ones are financially protected in the event of an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage protects you in the event of an accident with a driver who either lacks insurance or has insufficient coverage to pay for the damages. This coverage ensures that you’re not left financially burdened if an uninsured or underinsured driver causes an accident.

Customizable Add-Ons

Costco Connect Auto Insurance allows members to further customize their policies with a variety of add-ons. These optional coverages can include:

- Rental Car Coverage: Provides reimbursement for rental car expenses while your vehicle is being repaired or replaced after an insured accident.

- Roadside Assistance: Offers 24⁄7 emergency roadside services, including towing, flat tire changes, battery jump-starts, and more.

- Gap Coverage: Protects you if your vehicle is totaled or stolen, covering the difference between the actual cash value of the vehicle and the remaining balance on your loan or lease.

- Accident Forgiveness: Prevents your insurance rates from increasing after your first at-fault accident, ensuring that one mistake doesn’t impact your future premiums.

Comparative Analysis: Costco Connect vs. Traditional Auto Insurance

When considering Costco Connect Auto Insurance, it’s essential to understand how it stacks up against traditional auto insurance providers. Here’s a comparative analysis to help you make an informed decision:

Pricing and Discounts

Costco Connect Auto Insurance often offers competitive pricing due to the exclusive discounts available to Costco members. These savings can result in significant reductions in your annual insurance premiums, making it a cost-effective option. However, it’s important to note that pricing can vary based on individual factors such as driving history, credit score, and the specific coverage options chosen.

Coverage Options

Costco Connect Auto Insurance provides a comprehensive range of coverage options, similar to what you would find with traditional insurance providers. From liability coverage to collision and comprehensive coverage, Costco Connect ensures that members can obtain the necessary protection for their vehicles. Additionally, the program’s customizable add-ons allow members to further tailor their policies to their specific needs.

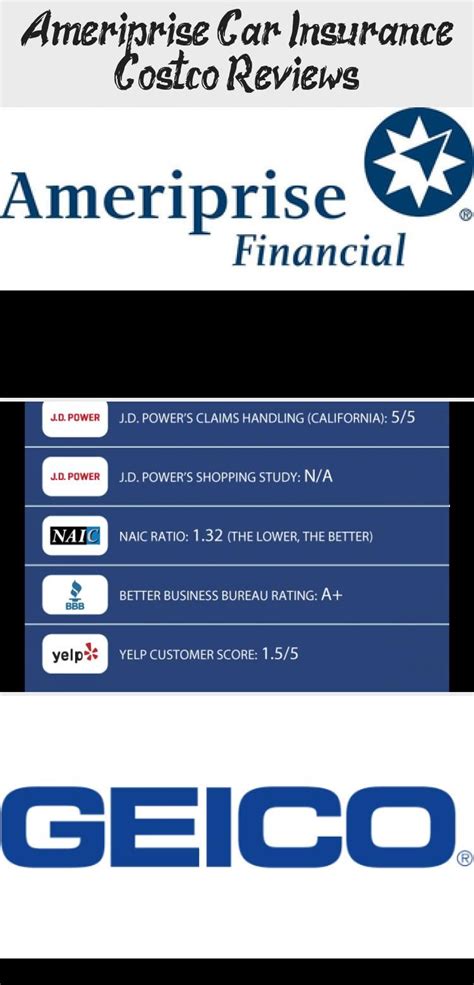

Customer Service and Claims Handling

American Family Insurance, the partner behind Costco Connect Auto Insurance, is known for its excellent customer service and claims handling. With a dedicated team of insurance professionals, Costco members can expect prompt and efficient assistance throughout the claims process. This level of service ensures that policyholders receive the support they need when it matters most.

Convenience and Accessibility

Costco Connect Auto Insurance offers a high level of convenience and accessibility. Members can easily manage their policies online, making updates, payments, and accessing policy information a breeze. Additionally, the program’s mobile app provides on-the-go access to policy details and allows for quick reporting of claims. This level of convenience can be particularly beneficial for busy individuals who value efficiency and ease of use.

Real-World Performance and Customer Satisfaction

Costco Connect Auto Insurance has consistently received positive feedback from its customers. Many members appreciate the exclusive discounts, comprehensive coverage options, and excellent customer service provided by American Family Insurance. The program’s convenience and accessibility have also been praised, making it a top choice for those seeking a seamless insurance experience.

Here are some real-world reviews from Costco Connect Auto Insurance policyholders:

"I've been a Costco member for years, and when I learned about their auto insurance program, I decided to give it a try. The process was straightforward, and I saved a significant amount on my premiums compared to my previous insurance provider. The coverage options are extensive, and I feel confident that I'm well protected. Highly recommend!" - John S., Los Angeles, CA

"As a Costco member, I value the convenience and savings that the club offers. Costco Connect Auto Insurance didn't disappoint. I was able to bundle my auto insurance with my homeowners insurance, resulting in even greater savings. The online management system is user-friendly, and I've had no issues with claims. A great choice for Costco members!" - Sarah M., Seattle, WA

Future Implications and Considerations

Costco Connect Auto Insurance continues to evolve and improve, with ongoing efforts to enhance the program’s offerings and benefits. As the program gains popularity, we can expect to see even more competitive pricing, expanded coverage options, and additional member perks. With its strong partnership between Costco and American Family Insurance, Costco Connect Auto Insurance is well-positioned to remain a top choice for Costco members seeking reliable and cost-effective auto insurance.

However, it's important to note that individual experiences may vary. While Costco Connect Auto Insurance has received positive feedback, it's essential to carefully review the policy terms, conditions, and exclusions to ensure that the coverage meets your specific needs. Additionally, comparing quotes from multiple insurance providers is always advisable to find the best fit for your budget and requirements.

Can I purchase Costco Connect Auto Insurance if I’m not a Costco member?

+No, Costco Connect Auto Insurance is exclusively available to active Costco members. To qualify, you must have a valid Costco membership and be in good standing with the club.

How do I sign up for Costco Connect Auto Insurance?

+To sign up for Costco Connect Auto Insurance, visit the Costco Insurance Services website or contact their customer service team. You’ll need to provide your membership details and information about your vehicle to obtain a quote and proceed with the enrollment process.

What types of vehicles can be insured through Costco Connect Auto Insurance?

+Costco Connect Auto Insurance covers a wide range of vehicles, including cars, trucks, SUVs, and motorcycles. Whether you own a personal vehicle or a commercial vehicle, you can find appropriate coverage through the program.

Can I bundle my auto insurance with other insurance policies through Costco Connect?

+Yes, Costco Connect Auto Insurance encourages members to bundle their policies. By combining auto insurance with other types of insurance, such as homeowners or renters insurance, you can often qualify for additional discounts and simplified policy management.

How does Costco Connect Auto Insurance compare to other insurance providers in terms of pricing?

+Costco Connect Auto Insurance often offers competitive pricing due to the exclusive discounts available to Costco members. However, pricing can vary based on individual factors, so it’s essential to obtain quotes from multiple providers to find the best deal.