Cost Of Liability Insurance For A Small Business

Small businesses are the backbone of many economies, and understanding the financial aspects, especially the cost of liability insurance, is crucial for their success and longevity. This comprehensive guide aims to demystify the expenses associated with liability coverage, offering a detailed analysis to help small business owners make informed decisions.

In today's dynamic business landscape, liability insurance is not just an option but a necessity. It provides a safety net against potential legal and financial risks, ensuring that small businesses can operate with confidence and focus on growth. However, the cost of this protection can be a significant concern for entrepreneurs. This article aims to shed light on the various factors influencing these costs, providing an in-depth understanding to assist small business owners in managing their expenses effectively.

Understanding Liability Insurance Costs

The cost of liability insurance for a small business can vary widely, influenced by a multitude of factors. It's an investment in the business's future, safeguarding against unforeseen events that could lead to costly legal battles or compensation claims. By understanding these costs, business owners can make strategic decisions to mitigate risks and ensure the financial stability of their enterprises.

Factors Influencing Insurance Premiums

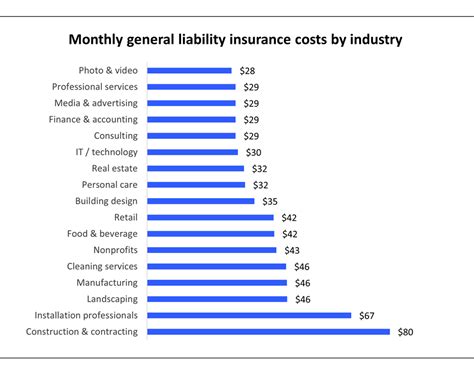

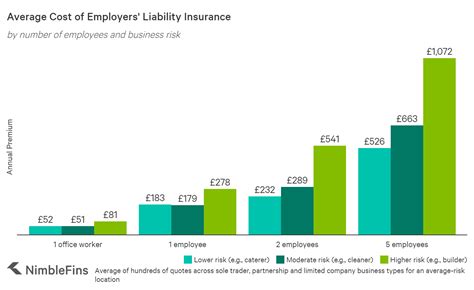

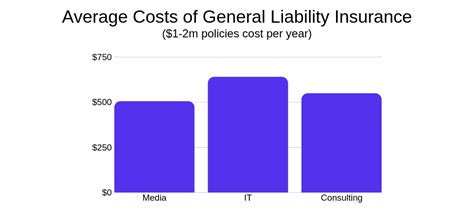

The premium for liability insurance is determined by a complex interplay of variables. These include the nature of the business, with certain industries facing higher risks and therefore higher premiums. The size and location of the business also play a role, as larger companies or those in high-risk areas may incur greater costs. Additionally, the number of employees and the coverage limits chosen can significantly impact the overall premium.

Furthermore, the claims history of the business is a critical factor. Insurers consider past claims to assess the potential risk associated with the business, which can directly influence the premium. A business with a history of frequent or large claims may face higher costs, reflecting the increased risk they pose to the insurer.

| Factor | Impact on Premium |

|---|---|

| Business Nature | Higher risk industries lead to higher premiums. |

| Business Size & Location | Larger businesses and those in high-risk areas face increased costs. |

| Number of Employees | More employees can mean a higher premium. |

| Coverage Limits | Higher limits provide more protection but cost more. |

| Claims History | A history of frequent or large claims can result in higher premiums. |

Common Types of Liability Insurance

Small businesses typically require a range of liability insurance policies to cover different aspects of their operations. These include:

- General Liability Insurance: Covers a broad range of claims, including bodily injury, property damage, and advertising injuries.

- Product Liability Insurance: Essential for businesses selling goods, protecting against claims arising from defective products.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, it protects professionals against negligence claims.

- Cyber Liability Insurance: Crucial in today's digital age, covering data breaches and cyber attacks.

- Employment Practices Liability Insurance: Provides coverage for claims arising from employment practices, such as discrimination or wrongful termination.

Strategies to Manage Liability Insurance Costs

While liability insurance is essential, the cost can be a significant overhead for small businesses. However, there are strategies to manage these expenses effectively. By implementing these measures, business owners can strike a balance between comprehensive coverage and financial sustainability.

Risk Assessment and Mitigation

Conducting a thorough risk assessment is the first step in managing liability insurance costs. This involves identifying potential risks unique to the business and implementing measures to mitigate them. By reducing the likelihood of incidents, businesses can lower their insurance premiums.

For instance, a restaurant might assess the risk of food contamination and implement rigorous food safety protocols. By demonstrating a commitment to reducing these risks, the restaurant could negotiate lower premiums with its insurer. Similarly, a small retail store might assess the risk of slip and fall accidents and take preventive measures, such as regular floor inspections and maintenance, to reduce the likelihood of such incidents.

Comparing Quotes and Shopping Around

Obtaining multiple quotes from different insurers is a fundamental strategy in managing insurance costs. Each insurer has its own risk assessment methodology and pricing structure, so comparing quotes can reveal significant variations in premiums. By shopping around, small business owners can identify the most competitive offers and negotiate better rates.

Additionally, it's beneficial to review insurance needs annually and re-evaluate existing policies. Market conditions, business growth, and changes in regulations can all impact insurance requirements. Regularly reviewing coverage ensures that businesses are neither overinsured nor underinsured, helping to optimize costs.

Bundling Insurance Policies

Bundling multiple insurance policies with the same insurer can often result in cost savings. Insurers often provide discounts when businesses purchase multiple policies, as it simplifies administration and reduces acquisition costs for the insurer. This strategy is particularly effective for small businesses with a range of insurance needs.

For example, a small business owner might bundle general liability, professional liability, and cyber liability insurance policies with the same insurer. By doing so, they could qualify for a package discount, reducing the overall cost of their insurance coverage.

Case Study: Managing Liability Insurance Costs

To illustrate these strategies, consider the case of EcoFresh Farms, a small organic produce delivery service. EcoFresh Farms faced increasing liability insurance costs, prompting them to review their insurance strategy.

They began by conducting a comprehensive risk assessment, identifying areas where they could enhance safety protocols. For instance, they introduced rigorous vehicle maintenance checks to reduce the risk of accidents during deliveries. This not only improved safety but also helped lower their insurance premiums, as insurers recognized their commitment to risk mitigation.

EcoFresh Farms then obtained quotes from several insurers, comparing coverage and premiums. By shopping around, they were able to negotiate a more competitive rate, saving a significant amount on their annual insurance costs. Furthermore, they bundled their general liability and product liability insurance policies, taking advantage of package discounts to further reduce their expenses.

Through these strategies, EcoFresh Farms successfully managed their liability insurance costs, allowing them to reinvest savings into business growth and development.

The Impact of Claims on Future Premiums

It's important to understand that the cost of liability insurance is not static. It can be influenced by claims made under the policy. A single large claim or multiple smaller claims can lead to increased premiums in the future. Insurers assess the risk associated with each business, and a history of claims can indicate a higher likelihood of future incidents, leading to higher premiums.

However, this relationship also highlights the importance of comprehensive insurance coverage. By having adequate coverage, businesses can ensure they are protected against a wide range of potential risks. This not only provides peace of mind but also helps to manage future costs effectively. A well-managed insurance portfolio can help small businesses balance the need for protection with the desire to control expenses.

The Future of Liability Insurance for Small Businesses

The landscape of liability insurance for small businesses is evolving. As technology advances and new risks emerge, insurers are adapting their offerings to provide more tailored and comprehensive coverage. This includes the development of new insurance products to address specific risks, such as those associated with emerging technologies and changing consumer behaviors.

Additionally, the rise of digital platforms and online marketplaces is transforming the way small businesses operate and exposing them to new types of liability risks. Insurers are increasingly offering coverage options that address these emerging risks, helping small businesses stay protected in the digital age.

Conclusion

Understanding the cost of liability insurance is a critical aspect of running a successful small business. By recognizing the factors that influence premiums and implementing strategies to manage these costs, business owners can ensure their operations remain protected while maintaining financial stability. As the business landscape continues to evolve, staying informed about insurance options and risk management strategies will be key to long-term success.

FAQ

What is the average cost of liability insurance for a small business?

+

The average cost of liability insurance can vary widely depending on the nature of the business, its size, location, and other factors. It’s recommended to obtain multiple quotes to get an accurate estimate for your specific business.

How can I reduce my liability insurance costs as a small business owner?

+

You can reduce costs by conducting a risk assessment, implementing safety measures to mitigate risks, shopping around for competitive quotes, and bundling insurance policies with the same insurer.

What happens if I make a claim on my liability insurance policy?

+

Making a claim can lead to increased premiums in the future, as insurers assess the risk associated with your business based on its claims history. It’s important to review your coverage annually to ensure it remains adequate.

Are there any emerging risks that small businesses should be aware of regarding liability insurance?

+

Yes, with the rise of digital platforms and new technologies, small businesses are exposed to new types of liability risks. It’s crucial to stay informed about these emerging risks and ensure your insurance coverage addresses them.

How often should I review my liability insurance coverage?

+

It’s recommended to review your coverage annually to ensure it remains up-to-date and aligned with your business’s changing needs and risks. Regular reviews help you stay protected and manage costs effectively.