Cheap Insurance Car

Obtaining affordable car insurance is a goal for many drivers, especially those on a budget or new to the world of insurance. The concept of cheap car insurance can be alluring, but it's essential to understand the factors that influence premiums and how to navigate the market effectively. This comprehensive guide aims to provide an in-depth exploration of cheap car insurance, offering practical tips, industry insights, and a detailed analysis of what makes an insurance policy truly affordable.

Understanding Cheap Car Insurance

The term cheap car insurance is often subjective, as what constitutes an affordable policy can vary based on individual circumstances and expectations. However, at its core, cheap insurance refers to coverage that provides adequate protection at a price point that aligns with an individual’s financial means.

To comprehend the landscape of affordable car insurance, it's crucial to delve into the factors that influence premiums. These include, but are not limited to:

- Location: Insurance rates can vary significantly based on where you live. Urban areas with higher traffic density and crime rates often result in increased premiums.

- Age and Driving Experience: Younger drivers, especially those under 25, tend to face higher premiums due to their perceived higher risk on the road. Conversely, experienced drivers with a clean record may benefit from lower rates.

- Vehicle Type: The make, model, and year of your vehicle play a role in insurance costs. Sports cars and luxury vehicles, for instance, may incur higher premiums due to their repair costs.

- Coverage Type and Limits: The type of coverage you choose (e.g., liability-only, comprehensive, collision) and the coverage limits you select can significantly impact your premium.

- Claims History: A clean claims history can lead to lower premiums, as it indicates a lower risk to the insurer.

- Discounts and Bundles: Many insurers offer discounts for various factors, such as safe driving records, good student status, or bundling multiple policies (e.g., home and auto insurance) with the same provider.

Strategies for Securing Cheap Car Insurance

While the factors mentioned above can impact your insurance premiums, there are several strategies you can employ to potentially reduce the cost of your car insurance:

Shop Around and Compare

One of the most effective ways to find cheap car insurance is to compare quotes from multiple insurers. Each company uses its own formula to calculate premiums, so the rates can vary significantly. By obtaining quotes from various providers, you can identify the most affordable option for your specific circumstances.

Consider using online comparison tools, which can provide a quick and convenient way to view rates from several insurers at once. However, it's essential to note that these tools may not always offer the most accurate quotes, and it's beneficial to follow up with individual insurers to ensure you receive precise, tailored quotes.

Review Your Coverage Needs

Take the time to carefully assess your coverage requirements. While it’s essential to have adequate protection, overinsuring yourself can lead to unnecessary expenses. Consider your financial situation and the value of your vehicle when determining the appropriate level of coverage.

For example, if you own an older vehicle with a low resale value, you may opt for liability-only coverage rather than comprehensive or collision insurance, which can be more expensive. Additionally, review your deductible options. A higher deductible can lead to lower premiums, but it's crucial to ensure you can afford the out-of-pocket expense should you need to file a claim.

Utilize Discounts

Insurers offer a variety of discounts that can significantly reduce your premiums. Some common discounts include:

- Safe Driver Discount: If you have a clean driving record, you may be eligible for a safe driver discount. This reward for responsible driving can lead to substantial savings.

- Good Student Discount: Many insurers offer discounts to students who maintain a certain GPA. This incentive encourages academic achievement and can provide financial relief to young drivers.

- Bundling Discounts: Insurers often provide discounts when you bundle multiple policies (e.g., auto and home insurance) with them. This strategy can be particularly effective if you're a homeowner.

- Loyalty Discounts: Some insurers reward long-term customers with loyalty discounts. While this may not be an immediate savings strategy, it can lead to reduced premiums over time.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept that uses telematics to monitor your driving habits. Insurers then use this data to calculate your premiums, potentially offering savings to safe drivers.

While usage-based insurance may not be suitable for everyone, it can be an attractive option for those who drive infrequently or have a consistently safe driving record. It's worth exploring this option to determine if it aligns with your driving habits and financial goals.

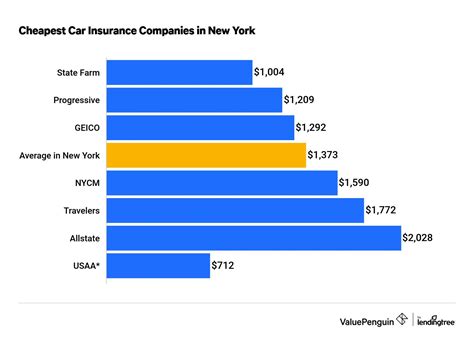

Performance Analysis: Evaluating Cheap Car Insurance Providers

When searching for cheap car insurance, it’s essential to consider not only the cost but also the performance and reputation of the insurance provider. Here’s a performance analysis of several well-known insurers, focusing on their affordability, coverage options, and customer satisfaction:

State Farm

Affordability: State Farm is known for its competitive rates, especially for those with a clean driving record. They offer a range of discounts, including a good student discount and a loyalty discount, making them an attractive option for long-term customers.

Coverage Options: State Farm provides comprehensive coverage options, including liability, collision, comprehensive, and personal injury protection (PIP). They also offer specialized coverages for classic cars and rideshare drivers.

Customer Satisfaction: State Farm consistently ranks highly in customer satisfaction surveys, with a reputation for excellent claims handling and customer service. Their mobile app and online platform make managing policies convenient.

Geico

Affordability: Geico is renowned for its competitive pricing, often offering some of the lowest rates in the market. They cater to a wide range of drivers, including those with high-risk profiles, and provide various discounts to reduce premiums.

Coverage Options: Geico provides standard coverage options, such as liability, collision, and comprehensive insurance. They also offer additional coverages like roadside assistance and rental car reimbursement.

Customer Satisfaction: Geico is highly regarded for its digital services, with a user-friendly website and mobile app. Their claims process is generally efficient, and they offer 24/7 customer support. However, some customers have reported mixed experiences with their claims handling.

Progressive

Affordability: Progressive is known for its affordable rates and commitment to providing insurance for high-risk drivers. They offer a range of discounts, including a snapshot discount for usage-based insurance.

Coverage Options: Progressive offers a wide array of coverage options, including standard auto insurance and specialized coverages like motorcycle and RV insurance. They also provide unique products like gap insurance and rental car coverage.

Customer Satisfaction: Progressive has a strong focus on customer service, with a dedicated team of claims adjusters and a 24/7 customer support line. Their website and mobile app are highly functional, allowing for easy policy management.

Esurance

Affordability: Esurance is known for its affordable rates, especially for those who opt for online policy management and digital claims processing. They offer a range of discounts, including a safe driver discount and a multi-policy discount.

Coverage Options: Esurance provides standard auto insurance coverage, including liability, collision, and comprehensive insurance. They also offer additional coverages like rental car reimbursement and roadside assistance.

Customer Satisfaction: Esurance has a strong focus on digital services, with an intuitive website and mobile app. Their claims process is efficient, and they provide 24/7 customer support. However, some customers have reported challenges with policy cancellations and rate increases.

Evidence-Based Future Implications

The landscape of cheap car insurance is evolving, driven by technological advancements and changing consumer preferences. Here are some key trends and implications for the future of affordable car insurance:

Rise of Telematics and Usage-Based Insurance

The increasing adoption of telematics technology is expected to play a significant role in shaping the future of cheap car insurance. Usage-based insurance, which uses telematics to monitor driving behavior, is likely to become more prevalent. This shift could lead to more accurate pricing models, potentially benefiting safe drivers with lower premiums.

Digital Transformation and Customer Experience

The insurance industry is undergoing a digital transformation, with a focus on enhancing the customer experience. Insurers are investing in user-friendly websites, mobile apps, and digital claims processing to streamline interactions. This shift is likely to continue, making it easier for consumers to manage their policies and file claims, potentially reducing costs associated with manual processes.

Personalized Insurance Products

As data analytics and machine learning capabilities advance, insurers are increasingly able to offer personalized insurance products. This trend could lead to more tailored coverage options, potentially reducing costs for individuals with unique needs. For example, insurers may develop products specifically for low-mileage drivers or those who only use their vehicles for short commutes.

Collaborative Insurance Models

The concept of collaborative insurance, where risk is shared among a group of individuals, is gaining traction. This model, often facilitated by technology, allows for more flexible and affordable coverage options. While still in its early stages, collaborative insurance has the potential to disrupt the traditional insurance market, offering an alternative for those seeking cheap car insurance.

Conclusion

Cheap car insurance is an attainable goal for many drivers, but it requires a thoughtful approach and an understanding of the factors that influence premiums. By comparing quotes, assessing coverage needs, utilizing discounts, and considering innovative options like usage-based insurance, individuals can find affordable coverage that meets their specific requirements.

As the insurance industry continues to evolve, the landscape of cheap car insurance is likely to become more dynamic and consumer-friendly. The rise of telematics, digital transformation, personalized products, and collaborative models are shaping a future where affordable car insurance is not only accessible but also tailored to individual needs and preferences.

How can I find the cheapest car insurance for my specific needs?

+To find the cheapest car insurance, it’s essential to compare quotes from multiple insurers, assess your coverage needs, and explore available discounts. Online comparison tools can be a great starting point, but be sure to follow up with individual insurers for precise quotes. Additionally, consider usage-based insurance if your driving habits align with this model.

What factors can impact my car insurance premiums the most?

+The factors that can have the most significant impact on your car insurance premiums include your driving record, the make and model of your vehicle, your location, and your coverage choices. A clean driving record, a low-risk vehicle, and a safe neighborhood can lead to lower premiums. Additionally, choosing appropriate coverage limits and deductibles can affect your costs.

Are there any hidden costs associated with cheap car insurance?

+While cheap car insurance can be a great way to save money, it’s important to be aware of potential hidden costs. Some insurers may charge fees for policy changes, late payments, or even canceling your policy. It’s crucial to review the fine print and understand any additional fees that may apply to your policy.

How can I improve my chances of getting cheap car insurance as a young driver?

+As a young driver, you may face higher insurance premiums due to your perceived higher risk. However, there are ways to reduce these costs. Maintain a clean driving record, consider a usage-based insurance policy if your driving habits are safe, and explore discounts for good students or those with a safe driving course completion certificate. Additionally, if you’re a student, consider bundling your auto insurance with your parents’ policy, as this can often lead to significant savings.