Cheap In Insurance

In the realm of financial planning and risk management, insurance plays a pivotal role in safeguarding individuals and businesses against unforeseen events and financial losses. However, the cost of insurance coverage can often be a daunting factor, leading many to seek affordable alternatives. This comprehensive guide aims to delve into the strategies and insights that can help individuals secure cheap insurance options without compromising on the essential protection they need.

Understanding the Landscape of Affordable Insurance

The insurance market is vast and diverse, offering a myriad of options tailored to different needs and budgets. For those on a tight budget, navigating this landscape can be challenging. But with the right knowledge and approach, securing cheap insurance becomes an achievable goal.

Assessing Your Insurance Needs

Before embarking on the quest for affordable insurance, it’s imperative to understand your specific needs. Consider the types of insurance coverage that are essential for your circumstances. For instance, health insurance is a priority for many, especially in regions without universal healthcare. Likewise, auto insurance is a legal requirement in most places, and home insurance is vital for homeowners and renters alike. Assessing these fundamental needs is the first step towards finding suitable, cost-effective solutions.

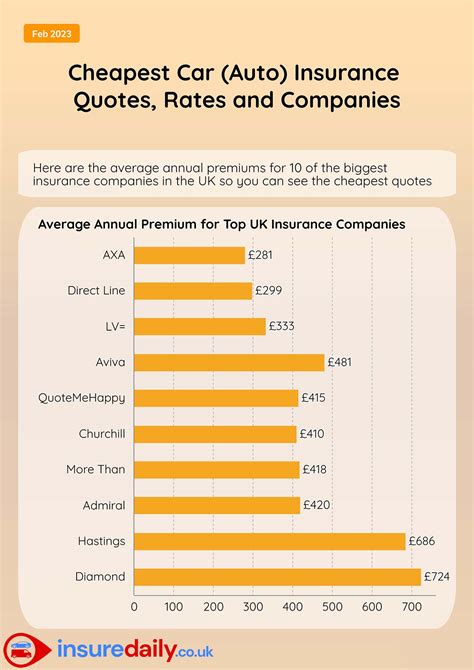

Comparing Quotes and Providers

The insurance industry is highly competitive, and this competition often translates into varying prices for similar coverage. Taking the time to compare quotes from multiple providers can yield significant savings. Online platforms and insurance brokers can be invaluable tools in this process, allowing you to quickly and easily obtain quotes from a range of insurers. Moreover, consider the reputation and financial stability of the providers, as this can impact the long-term value and reliability of your coverage.

| Insurance Type | Average Cost | Potential Savings |

|---|---|---|

| Health Insurance | $400 - $1,200/month | Up to 25% with comparative shopping |

| Auto Insurance | $500 - $1,500/year | Discounts for safe driving, multi-policy, etc. |

| Home Insurance | $500 - $2,000/year | Up to 15% with safety features and higher deductibles |

Strategies for Obtaining Affordable Insurance Coverage

Securing cheap insurance isn’t just about finding the lowest prices; it’s about understanding the nuances of insurance policies and leveraging strategies to optimize coverage and costs. Here are some effective approaches to consider:

Bundling Policies

One of the most effective ways to reduce insurance costs is by bundling or combining multiple policies with the same insurer. Many insurance companies offer discounts when you purchase multiple types of coverage from them. For example, you could bundle your home insurance with your auto insurance or life insurance with your disability insurance. This not only simplifies your insurance management but also leads to significant savings.

Increasing Deductibles

In most types of insurance, especially health insurance and home insurance, the deductible is the amount you pay out of pocket before the insurance coverage kicks in. By increasing your deductible, you can often reduce your premium. This strategy works best for those who can afford to pay a higher deductible in the event of a claim. It’s a trade-off between lower monthly premiums and higher potential out-of-pocket expenses.

Exploring Discounts and Special Offers

Insurance providers frequently offer discounts and special deals to attract new customers and retain existing ones. These discounts can be significant and are often based on various factors, including age, occupation, membership in certain organizations, and the presence of safety features (like security systems or smoke detectors). Don’t hesitate to inquire about these discounts when shopping for insurance, as they can substantially reduce your overall costs.

Utilizing Government Programs and Subsidies

In many countries, governments offer subsidized insurance programs or provide financial assistance for specific types of insurance. For instance, in the United States, the Affordable Care Act (ACA) provides health insurance subsidies to eligible individuals and families. Similarly, some countries offer subsidized home insurance or auto insurance for certain demographic groups. Staying informed about these programs and ensuring you meet the eligibility criteria can lead to substantial savings.

Tips for Maintaining Affordable Insurance

Securing cheap insurance is just the first step. To truly benefit from affordable coverage, it’s crucial to maintain your policies and manage costs effectively over the long term. Here are some essential tips to consider:

Regularly Review and Update Your Policies

Insurance needs can change over time due to life events such as marriage, the birth of a child, or a career change. It’s important to review your policies annually to ensure they still meet your needs and to update them as necessary. This proactive approach can help you avoid overpaying for coverage you no longer require or missing out on additional coverage you now need.

Understand Policy Exclusions and Limitations

Insurance policies often come with exclusions and limitations, which are specific situations or circumstances that are not covered by the policy. Being aware of these can help you avoid costly surprises in the event of a claim. For example, standard home insurance policies often exclude damage caused by floods or earthquakes, requiring additional coverage for these perils.

Consider Alternative Insurance Options

In some cases, alternative insurance options can provide more affordable coverage than traditional policies. For instance, high-deductible health plans (HDHPs) often come with lower premiums and can be paired with a health savings account (HSA) to help cover out-of-pocket expenses. Similarly, usage-based auto insurance policies, which base premiums on your actual driving behavior, can be a cost-effective option for safe drivers.

Maintain a Good Credit Score

Your credit score can have a significant impact on the cost of your insurance premiums, especially for auto insurance and home insurance. Insurance companies often use credit-based insurance scores to assess the risk of insuring an individual. A higher credit score can lead to lower premiums, as it indicates a lower risk of filing a claim. Therefore, it’s crucial to maintain a good credit score to keep your insurance costs down.

Conclusion: The Power of Affordable Insurance

Securing cheap insurance is not just about saving money; it’s about empowering individuals and businesses to protect their financial well-being without breaking the bank. By understanding the insurance landscape, leveraging effective strategies, and maintaining a proactive approach, it’s possible to find affordable coverage that meets your unique needs. With the right approach, insurance can be a powerful tool for managing risk and achieving financial security.

How can I find the cheapest insurance quotes online?

+To find the cheapest insurance quotes online, use comparison websites or insurance brokers that allow you to compare multiple providers at once. Ensure you provide accurate and detailed information about your needs and circumstances to get precise quotes. Additionally, don’t hesitate to negotiate with insurers or inquire about discounts to get the best rates.

What are some common discounts offered by insurance companies?

+Common insurance discounts include safe driving discounts for auto insurance, loyalty discounts for long-term customers, multi-policy discounts when you bundle multiple types of insurance with the same provider, and discounts for certain professions or membership in specific organizations. Some insurers also offer discounts for having safety features or taking preventive measures.

Can I switch insurance providers to save money?

+Absolutely! Switching insurance providers can often lead to significant savings, especially if you’ve been with the same company for a long time or if your circumstances have changed. When shopping for new insurance, always compare quotes from multiple providers to find the best deal. Just ensure that there are no gaps in coverage during the transition period.