Car Rental Insurance Usa

Car rental insurance is an essential consideration when planning a trip in the United States. With a vast network of roads and diverse landscapes, exploring the country by car is a popular choice for many travelers. However, navigating the intricacies of car rental insurance can be a complex task, often leaving travelers with more questions than answers.

This comprehensive guide aims to shed light on the often-confusing world of car rental insurance in the USA. We will delve into the different types of insurance coverage, explore the unique challenges and considerations specific to the American market, and provide practical advice to help you make informed decisions when renting a car in the United States.

Understanding the Basics: Car Rental Insurance in the USA

In the United States, car rental companies offer a range of insurance options to protect both the vehicle and the renter. These insurance policies are designed to mitigate financial risks associated with accidents, theft, or damage to the rental car. Understanding the basics of car rental insurance is crucial to ensure you are adequately covered during your travels.

The Different Types of Car Rental Insurance

When renting a car in the USA, you will typically encounter the following types of insurance coverage:

- Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW): This coverage waives your responsibility for any damage to the rental car in the event of an accident. It protects you from paying high repair costs, which can be particularly beneficial if you are not used to driving in the USA.

- Liability Insurance: Liability insurance covers any damage or injury you may cause to a third party while driving the rental car. It is essential to have adequate liability coverage to protect yourself financially.

- Personal Accident Insurance (PAI): PAI provides coverage for medical expenses and lost wages in the event of an accident. It is designed to protect you and your passengers in the event of an injury.

- Personal Effects Coverage (PEC): PEC covers the loss or damage of personal belongings left in the rental car. This coverage is especially important if you are traveling with valuable items.

- Supplemental Liability Insurance (SLI): SLI offers additional liability coverage beyond what is provided by the basic policy. It is an optional add-on that can provide extra peace of mind for those concerned about potential legal liabilities.

The Importance of Understanding Your Own Insurance Coverage

Before renting a car in the USA, it is crucial to understand your existing insurance coverage. Many travelers assume that their personal auto insurance or credit card benefits will automatically cover them when renting a car. However, this is not always the case.

Your personal auto insurance may have limitations or exclusions when it comes to rental cars. Additionally, credit card benefits often have specific requirements and restrictions that must be met to trigger coverage. It is essential to review your insurance policies and contact your providers to understand the extent of your coverage when renting a car in the USA.

Navigating the Unique Challenges of Car Rental Insurance in the USA

The USA has a unique car rental market with diverse regulations and practices across different states. This can make navigating car rental insurance a complex task. Here are some key challenges and considerations to keep in mind:

State-Specific Laws and Regulations

Each state in the USA has its own set of laws and regulations governing car rentals and insurance. These variations can impact the coverage options available and the overall cost of insurance. It is important to research the specific regulations of the state you will be renting a car in to ensure you are complying with local requirements.

Uninsured/Underinsured Motorist Coverage

In the USA, there is a risk of encountering uninsured or underinsured motorists on the road. Uninsured/Underinsured Motorist Coverage (UM/UIM) provides protection in such cases. This coverage can be crucial, especially in states with a high percentage of uninsured drivers. It is recommended to consider adding UM/UIM coverage to your rental insurance to protect yourself financially.

Excessive Waiver Fees

Car rental companies in the USA often charge high fees for collision damage waivers and liability insurance. These fees can significantly increase the overall cost of renting a car. It is important to compare prices and shop around for the best deals. Additionally, consider using a trusted car rental broker or comparison website to find competitive rates and bundle insurance packages.

Depreciation and Deductibles

When purchasing collision damage waivers, it is important to understand the concept of depreciation and deductibles. Depreciation refers to the decrease in value of the rental car over time. In the event of an accident, the rental company may charge you for the depreciated value of the vehicle. Deductibles, on the other hand, are the amount you agree to pay out of pocket before the insurance coverage kicks in. Understanding these terms is crucial to avoid unexpected costs.

Tips and Strategies for Saving on Car Rental Insurance in the USA

Renting a car in the USA can be an expensive endeavor, especially when considering insurance costs. Here are some practical tips and strategies to help you save money on car rental insurance:

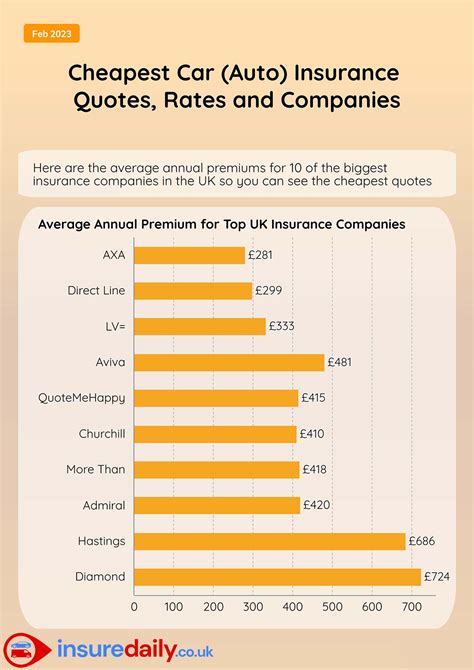

Shop Around and Compare Prices

Take the time to compare prices from different car rental companies and brokers. Prices can vary significantly, so it pays to shop around. Look for bundle deals that include insurance coverage, as this can often result in significant savings.

Understand Your Credit Card Benefits

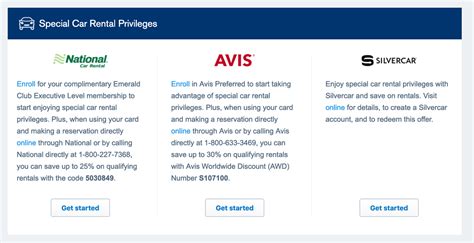

Many credit cards offer rental car insurance benefits as a perk. However, these benefits often come with specific requirements and restrictions. Carefully review the terms and conditions of your credit card's rental car insurance coverage to understand the extent of protection it provides. Some credit cards may require you to use the card to pay for the entire rental to trigger the insurance coverage.

Consider Pre-Paying for Insurance

Some car rental companies offer the option to pre-pay for insurance coverage. Pre-paying can often result in substantial savings compared to purchasing insurance at the rental counter. It is worth considering this option, especially if you have a fixed budget for your trip.

Explore Rental Car Insurance Apps and Websites

Several dedicated rental car insurance apps and websites have emerged in recent years. These platforms often provide competitive rates and allow you to compare insurance options from various providers. By using these tools, you can find the best insurance coverage for your needs at an affordable price.

The Future of Car Rental Insurance in the USA: Trends and Innovations

The car rental industry in the USA is evolving, and so is the approach to insurance. Here are some trends and innovations that are shaping the future of car rental insurance in the country:

Telematics and Usage-Based Insurance

Telematics technology is gaining traction in the car rental industry. This technology uses sensors and GPS tracking to monitor driving behavior and provide usage-based insurance. By analyzing driving patterns, telematics can offer personalized insurance rates based on individual driving habits. This trend is expected to revolutionize the way insurance is priced and offered to rental car customers.

Peer-to-Peer Car Rental and Insurance

The rise of peer-to-peer car rental platforms, such as Turo and Getaround, has introduced new insurance models. These platforms often provide comprehensive insurance coverage as part of the rental agreement. This shift towards peer-to-peer car rental and insurance offers travelers an alternative to traditional rental companies, providing flexibility and potentially lower insurance costs.

In-Vehicle Technology and Safety Features

Advancements in in-vehicle technology and safety features are shaping the future of car rental insurance. Modern rental cars are equipped with advanced driver assistance systems (ADAS) and safety technologies. These features can reduce the likelihood of accidents and minimize the severity of claims, potentially leading to lower insurance premiums for renters.

Digital Insurance and Claims Processing

The insurance industry is embracing digital transformation, and this extends to car rental insurance. Digital insurance policies and claims processing are becoming more prevalent, offering renters convenience and efficiency. Digital platforms allow for seamless policy management, real-time claim reporting, and faster claim settlements, enhancing the overall customer experience.

Frequently Asked Questions

Can I rely solely on my personal auto insurance when renting a car in the USA?

+While your personal auto insurance may provide some coverage when renting a car, it is important to carefully review your policy and understand any limitations or exclusions. Some personal auto insurance policies may not cover rental cars, or they may have restrictions on the duration or location of the rental. It is always recommended to contact your insurance provider to confirm the extent of your coverage.

What happens if I decline the car rental insurance offered at the rental counter?

+Declining car rental insurance at the rental counter means you assume full financial responsibility for any damage or liability claims. If an accident occurs, you will be liable for the full cost of repairs, and your personal assets may be at risk. It is important to carefully consider your existing insurance coverage and assess the potential risks before declining insurance.

Are there any alternative insurance options besides the ones offered by the rental company?

+Yes, there are alternative insurance options available. You can explore purchasing standalone rental car insurance policies from third-party providers, often available at lower rates. Additionally, some travel insurance policies include rental car coverage as an add-on. It is worth researching and comparing these options to find the best fit for your needs.

What should I do if I’m involved in an accident while renting a car in the USA?

+If you’re involved in an accident, it is crucial to remain calm and follow these steps: exchange contact and insurance information with the other party, take photos of the damage, notify the rental company immediately, and file a police report if necessary. Documenting the accident thoroughly will help streamline the insurance claims process.

How can I ensure I’m getting the best value for my car rental insurance in the USA?

+To ensure you’re getting the best value for your car rental insurance, it is advisable to shop around and compare prices from different rental companies and brokers. Consider using rental car insurance apps or websites to find competitive rates. Additionally, understanding your existing insurance coverage and exploring alternative insurance options can help you make an informed decision.