Car Insurance Rate Hikes

The cost of car insurance is a topic that often sparks concern among drivers, especially when faced with the reality of rate hikes. While insurance companies regularly adjust their rates, it can be jarring to receive a renewal notice with a higher premium. Understanding the factors that contribute to these rate adjustments is crucial for drivers, allowing them to make informed decisions about their coverage and potentially mitigate future increases.

Understanding Car Insurance Rate Hikes

Insurance rates are subject to change for a variety of reasons, and these adjustments are a common practice in the industry. Insurers continuously evaluate risk profiles, claim frequencies, and market conditions to determine the appropriate premiums for their policyholders. While some rate changes are minimal, others can be more substantial, leading to noticeable increases in monthly or annual premiums.

One of the primary drivers of rate hikes is the cost of claims. When insurance companies experience an increase in claim payouts, they may need to adjust their rates to maintain solvency. This is particularly relevant in regions where natural disasters, such as hurricanes or wildfires, are prevalent, as these events can result in a surge of costly claims.

Furthermore, changes in state regulations or industry standards can also impact insurance rates. For instance, if a state mandates an increase in minimum coverage limits, insurers must adjust their policies and pricing to comply with the new requirements. Similarly, advancements in automotive technology, such as the introduction of autonomous driving features, can influence rates as insurers assess the potential impact on accident rates and claim costs.

Analyzing Factors Behind Rate Increases

To better understand the factors that contribute to car insurance rate hikes, let’s delve into some specific examples and data. In the past year, several regions have experienced notable increases in insurance premiums due to a combination of factors.

| Region | Rate Increase (%) | Primary Factors |

|---|---|---|

| Florida | 15% | Hurricane damage and increased litigation costs |

| California | 12% | Wildfires and rising repair costs |

| Midwest | 8% | Severe winter storms and increased claim frequency |

| Northeast | 6% | Rising healthcare costs and higher bodily injury claim settlements |

These rate hikes are not solely driven by external factors; insurance companies also consider the specific risk profiles of individual policyholders. For instance, a driver's accident history, traffic violations, and credit score can significantly impact their insurance rates. Insurers use these factors to assess the likelihood of future claims and adjust premiums accordingly.

In addition to external factors and individual risk profiles, insurers also monitor market conditions and competitor pricing. If the market experiences a shift towards higher premiums, insurers may need to adjust their rates to remain competitive and financially stable.

Mitigating Rate Hikes: Tips for Drivers

While drivers cannot control all the factors that influence insurance rates, there are steps they can take to potentially mitigate future rate hikes. Here are some strategies to consider:

- Maintain a Clean Driving Record: Avoid traffic violations and accidents, as these can lead to increased premiums. A clean driving record demonstrates lower risk to insurers and may result in more favorable rates.

- Improve Credit Score: Many insurers use credit-based insurance scores to assess risk. Improving your credit score can positively impact your insurance rates, as it indicates financial stability and responsible behavior.

- Bundle Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Insurers often offer discounts for multiple policies, which can offset potential rate hikes.

- Shop Around: Regularly compare insurance rates from different providers. Rates can vary significantly between companies, so shopping around can help you find more competitive options.

- Increase Deductibles: Opting for a higher deductible can lower your premium. However, ensure that the deductible amount is manageable in case of an accident or claim.

By implementing these strategies, drivers can potentially reduce their insurance costs and minimize the impact of future rate hikes. It's important to note that insurance rates are personalized, and the effectiveness of these strategies may vary depending on individual circumstances and the insurer's specific policies.

The Future of Car Insurance Rates

Looking ahead, the insurance industry is poised for continued evolution, driven by technological advancements and changing consumer preferences. One of the key trends is the increasing use of telematics and usage-based insurance (UBI) programs. These programs utilize real-time data from vehicles to assess driving behavior and reward safe drivers with lower premiums.

Additionally, the rise of electric vehicles (EVs) and autonomous driving technologies is expected to influence insurance rates in the coming years. Insurers are actively studying the impact of these innovations on accident rates and claim costs to determine appropriate pricing strategies. As the market for EV insurance develops, we can anticipate specialized coverage options and potentially lower premiums for environmentally conscious drivers.

Furthermore, the insurance industry is embracing digital transformation, with a focus on streamlining processes and enhancing customer experiences. This includes the adoption of artificial intelligence (AI) and machine learning algorithms to automate claim processing and risk assessment. While these technologies may not directly impact insurance rates, they contribute to overall efficiency and cost savings for insurers, which can indirectly benefit policyholders.

FAQ

How often do insurance companies adjust their rates?

+Insurance companies typically review and adjust their rates on an annual basis. However, some insurers may make more frequent adjustments, particularly in response to significant changes in claim costs or market conditions.

Can I negotiate my insurance rates with the company?

+While insurance rates are generally non-negotiable, you can discuss your specific circumstances and request a review of your policy. Insurance companies may consider your loyalty, driving record, and other factors to offer discounts or alternative coverage options.

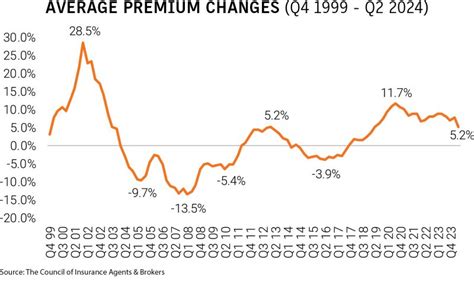

What is the average car insurance rate increase per year?

+The average annual car insurance rate increase varies by state and insurer. However, according to industry data, the average increase over the past five years has been approximately 5% to 8% per year. It’s important to note that individual experiences may differ based on personal risk factors and market conditions.