Call State Farm Insurance Company

In the world of insurance, having a reliable and trusted partner is essential for individuals and businesses alike. Among the numerous insurance providers, State Farm Insurance Company stands out as a prominent and widely recognized name. With a rich history and a comprehensive range of insurance services, State Farm has become a go-to choice for many seeking financial protection and peace of mind.

This article delves into the realm of State Farm Insurance, exploring its origins, services, and the reasons why countless individuals and businesses choose to "Call State Farm."

A Legacy of Trust: The State Farm Story

State Farm Insurance Company is an American insurance provider with a legacy spanning over a century. Founded in 1922 by George J. Mecherle, a former farmer and insurance salesman, State Farm was established with a vision to provide affordable and accessible auto insurance to farmers and rural residents. Mecherle’s innovative approach and commitment to customer service laid the foundation for what would become one of the largest insurance providers in the United States.

Over the years, State Farm expanded its offerings to include not only auto insurance but also a diverse range of insurance products and financial services. Today, the company boasts a comprehensive portfolio, catering to the diverse needs of its customers. From auto and home insurance to life insurance, health insurance, and even banking services, State Farm has become a one-stop shop for all insurance-related needs.

Services and Benefits: Why Choose State Farm

State Farm’s success and popularity can be attributed to its wide-ranging services and a customer-centric approach. Here’s an in-depth look at some of the key services and benefits that make State Farm a preferred choice for millions:

Auto Insurance

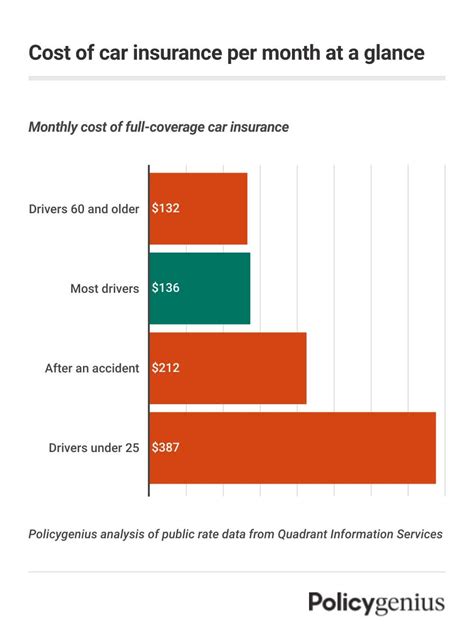

State Farm’s auto insurance offerings are comprehensive and tailored to meet the unique needs of its customers. The company provides coverage for various vehicles, including cars, motorcycles, and even classic cars. Policies can be customized with additional features such as rental car coverage, roadside assistance, and accident forgiveness, ensuring a personalized insurance experience.

One of the standout features of State Farm's auto insurance is its Drive Safe & Save™ program, which rewards safe driving habits with potential discounts on insurance premiums. This innovative program utilizes technology to monitor driving behavior, encouraging safer driving practices and providing customers with an opportunity to save on their insurance costs.

| Auto Insurance Coverage Options | Key Benefits |

|---|---|

| Liability Coverage | Protects against bodily injury and property damage claims. |

| Collision Coverage | Covers repairs or replacement costs after an accident. |

| Comprehensive Coverage | Provides protection against theft, vandalism, and natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects against accidents with drivers who lack sufficient insurance. |

Home Insurance

State Farm offers a range of home insurance policies to protect homeowners and renters. These policies cover a variety of perils, including fire, theft, and natural disasters. State Farm’s home insurance policies can be tailored to include additional coverage for specific needs, such as jewelry, fine art, or personal liability.

The company's State Farm HomeMonitor™ program is a unique offering that provides customers with an advanced home monitoring system. This system helps detect and prevent potential issues, such as water leaks or extreme temperatures, offering homeowners an added layer of protection and peace of mind.

| Home Insurance Coverage Options | Key Benefits |

|---|---|

| Dwelling Coverage | Protects the physical structure of the home. |

| Personal Property Coverage | Covers the contents of the home, including furniture and personal belongings. |

| Liability Coverage | Protects against lawsuits arising from accidents on the property. |

| Additional Living Expenses | Provides coverage for temporary living expenses if the home becomes uninhabitable due to a covered loss. |

Life Insurance

State Farm’s life insurance policies are designed to provide financial security and peace of mind to individuals and their families. The company offers a range of life insurance options, including term life insurance, whole life insurance, and universal life insurance.

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It is an affordable option for those seeking temporary coverage to protect their loved ones during critical stages of life, such as raising children or paying off a mortgage. On the other hand, whole life and universal life insurance policies offer permanent coverage, building cash value over time, and providing flexibility in policy customization.

Health Insurance

State Farm’s health insurance plans aim to provide comprehensive coverage for medical expenses. The company offers a variety of plans, including individual and family health insurance, as well as Medicare supplement insurance for seniors. State Farm’s health insurance plans often include additional benefits such as dental and vision coverage, ensuring a holistic approach to healthcare.

One of the unique aspects of State Farm's health insurance is its Wellness Rewards program. This program encourages policyholders to maintain a healthy lifestyle by offering discounts and rewards for participating in wellness activities, such as gym memberships or completing health assessments. By promoting healthy habits, State Farm aims to not only provide financial protection but also improve the overall well-being of its customers.

Banking Services

State Farm’s foray into banking services has expanded its offerings beyond traditional insurance. Through its partnership with Bank of America, State Farm provides a range of banking products, including checking and savings accounts, credit cards, and mortgages. This integration of insurance and banking services offers customers the convenience of managing their financial needs under one roof.

The State Farm Bank® Cash Back Rewards Visa® credit card is a notable offering, providing cardholders with cash back rewards on eligible purchases. This card not only offers financial benefits but also aligns with State Farm's commitment to customer service, providing a seamless and rewarding banking experience.

Customer Service Excellence

State Farm’s commitment to customer service is a cornerstone of its success. The company has a vast network of local agents who are dedicated to providing personalized support and guidance to customers. These agents are readily available to answer queries, assist with policy adjustments, and offer expert advice tailored to individual needs.

State Farm's customer service extends beyond its agents. The company's website and mobile app offer a user-friendly interface, allowing customers to manage their policies, make payments, and access important information at their convenience. Additionally, State Farm's 24/7 customer service hotline provides prompt assistance for emergencies and non-emergency inquiries, ensuring customers can reach out whenever needed.

Financial Strength and Stability

Financial stability is a critical factor when choosing an insurance provider. State Farm’s financial strength is a testament to its long-term viability and ability to fulfill its insurance obligations. The company consistently receives high ratings from leading insurance rating agencies, such as A.M. Best and Standard & Poor’s, affirming its financial stability and solvency.

State Farm's strong financial position allows it to offer competitive rates and provide financial security to its policyholders. The company's reserves and surplus are well-managed, ensuring that it can withstand market fluctuations and economic downturns, a critical aspect for long-term policyholders.

Community Engagement and Giving Back

Beyond its insurance and financial services, State Farm is actively involved in community initiatives and charitable endeavors. The company’s State Farm Good Neighbor Citizenship program focuses on four key areas: education, safety and preparedness, community development, and youth leadership. Through this program, State Farm supports various initiatives, including educational scholarships, disaster relief efforts, and youth development programs.

State Farm's commitment to community engagement is evident in its sponsorship of various events and organizations. The company has a long-standing partnership with Little League Baseball and Softball, supporting youth sports and promoting the values of teamwork and sportsmanship. Additionally, State Farm is involved in numerous other community initiatives, demonstrating its dedication to making a positive impact beyond its core business.

Conclusion: The State Farm Advantage

State Farm Insurance Company has established itself as a leader in the insurance industry, offering a comprehensive suite of services and a customer-centric approach. From its humble beginnings as an auto insurance provider for farmers to its current status as a multifaceted financial services company, State Farm has continually evolved to meet the changing needs of its customers.

The company's wide range of insurance products, coupled with its commitment to customer service, financial stability, and community engagement, makes it a trusted partner for individuals and businesses seeking comprehensive protection. When it comes to insurance, "Calling State Farm" is not just a catchy slogan but a testament to the company's legacy of trust and excellence.

How can I contact State Farm for insurance inquiries or quotes?

+You can reach out to State Farm by visiting their official website, where you can find contact information for their customer service department. Additionally, you can locate a local State Farm agent near you for personalized assistance. State Farm’s agents are well-equipped to provide quotes and answer any insurance-related questions you may have.

What sets State Farm apart from other insurance providers?

+State Farm’s commitment to customer service and its comprehensive range of insurance products set it apart. The company’s focus on personalized service, innovative programs like Drive Safe & Save™ and State Farm HomeMonitor™, and its financial stability make it a trusted choice for many.

Does State Farm offer discounts on insurance premiums?

+Yes, State Farm offers a variety of discounts on insurance premiums. These discounts can be based on factors such as driving behavior, safety features in your vehicle or home, multiple policy discounts, and more. It’s best to discuss these potential discounts with a State Farm agent to understand which ones you may qualify for.

How does State Farm handle claims and customer support after an incident?

+State Farm is known for its efficient claims process and dedicated customer support. The company has a 24⁄7 claims hotline, and local agents are available to guide you through the claims process. State Farm aims to provide prompt and personalized support to ensure a smooth experience during challenging times.