California Wildfire Insurance

California's wildfire season has become an increasingly pressing concern for residents, with devastating fires impacting communities and causing significant property damage. The threat of wildfires has led to a surge in demand for wildfire insurance, a specialized form of coverage that provides financial protection against the devastating consequences of these natural disasters. In this comprehensive guide, we will delve into the world of California wildfire insurance, exploring the challenges, the available options, and the strategies to ensure your property is adequately protected.

Understanding the Wildfire Risk in California

California’s unique geography and climate make it particularly susceptible to wildfires. The state’s Mediterranean climate, characterized by hot, dry summers and mild, wet winters, creates an environment conducive to the rapid spread of fires. Add to this the state’s diverse topography, with its vast forests, rugged mountains, and urban areas, and you have a recipe for catastrophic wildfires.

The past decade has seen some of the most destructive wildfires in California's history, with the Camp Fire in 2018 being the deadliest and most destructive wildfire in the state's history. It devastated the town of Paradise, killing 85 people and destroying over 18,000 structures. Other notable fires, such as the Carr Fire, the Mendocino Complex Fire, and the Kincade Fire, have caused billions of dollars in damage and displaced thousands of residents.

The increasing frequency and intensity of these wildfires have not only taken a toll on lives and property but have also presented a significant challenge to the insurance industry. Insurance companies have had to adapt their policies and rates to account for the rising risk, leading to a complex and ever-evolving landscape of wildfire insurance options.

The Complexity of Wildfire Insurance

Securing adequate insurance coverage for wildfire risks is a multifaceted challenge. Unlike traditional property insurance, which primarily focuses on structural damage, wildfire insurance must account for a broader range of risks. These include not only the direct damage caused by flames but also the destructive force of flying embers, smoke inhalation, and the potential for prolonged evacuation periods.

Furthermore, the dynamic nature of wildfires poses a unique challenge. Unlike predictable perils such as floods or earthquakes, wildfires can spread rapidly and unpredictably, influenced by factors such as wind direction, terrain, and vegetation. This unpredictability makes it difficult for insurance companies to accurately assess risk and set appropriate premiums.

The Role of Underwriting and Risk Assessment

Insurance companies utilize sophisticated underwriting processes to assess the risk associated with each property. This involves analyzing various factors, including the property’s location, proximity to fire-prone areas, the type of vegetation surrounding it, and the local fire department’s response capabilities.

Advanced technologies, such as satellite imagery and geographic information systems (GIS), play a crucial role in this assessment. By analyzing historical fire patterns, terrain data, and even weather patterns, insurers can gain a more accurate understanding of the wildfire risk associated with a particular property.

However, despite these advanced tools, the nature of wildfires makes risk assessment a complex and challenging task. The ever-changing landscape of fire-prone areas, coupled with the potential for rapid and unexpected fire growth, means that even the most sophisticated risk models may not always capture the full extent of the risk.

Challenges in the Insurance Market

The increasing severity and frequency of wildfires in California have had a significant impact on the insurance market. In response to the rising risk, insurance companies have had to adapt their policies and premiums, leading to a landscape that can be challenging for homeowners to navigate.

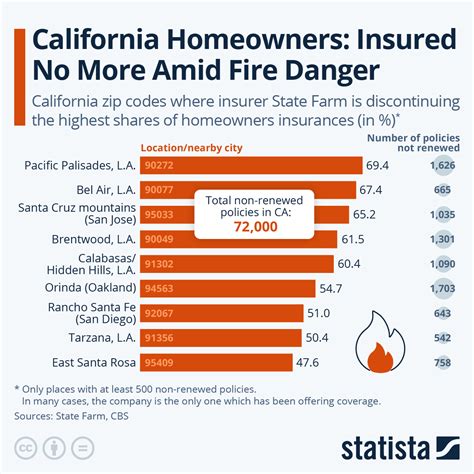

One of the key challenges is the availability of coverage. As wildfires become more prevalent, some insurance companies have chosen to restrict coverage or even withdraw from high-risk areas altogether. This has left many homeowners struggling to find adequate insurance options, particularly those in fire-prone regions.

Additionally, the cost of insurance has become a significant concern. With the rising risk, insurance companies have had to increase premiums to account for the potential losses. This has led to a situation where many homeowners are facing significant increases in their insurance costs, making it challenging to maintain adequate coverage.

Navigating the Options: A Comprehensive Guide

Securing the right wildfire insurance coverage is a critical step in protecting your property and ensuring your financial well-being. Here’s a detailed guide to help you navigate the options and make informed decisions.

Standard Homeowners Insurance

Standard homeowners insurance policies typically include some level of coverage for wildfire-related losses. However, it’s important to carefully review your policy to understand the extent of this coverage.

Most standard policies provide coverage for damage to the structure of your home caused by direct fire, as well as personal property losses resulting from the fire. This coverage often extends to additional living expenses if you are temporarily displaced from your home due to a wildfire.

However, there may be limitations and exclusions to this coverage. For instance, some policies may have deductibles specifically for wildfires, which can be significantly higher than those for other perils. Additionally, coverage for smoke damage, ashfall, and emberson may be limited or excluded altogether.

Enhanced Wildfire Coverage

For homeowners seeking more comprehensive protection against wildfires, enhanced coverage options are available. These policies often provide broader coverage limits and lower deductibles specifically for wildfire-related losses.

Enhanced wildfire coverage typically includes coverage for damage to structures and personal property, as well as additional living expenses during displacement. Additionally, these policies often provide coverage for debris removal, temporary repairs, and alternative accommodation if your home is uninhabitable due to wildfire damage.

Some enhanced policies may also include coverage for losses not typically covered by standard policies, such as smoke damage, ashfall, and emberson damage. This can be particularly valuable, as these types of losses can be significant yet often go uninsured under standard policies.

Wildfire-Specific Policies

In some cases, standard homeowners insurance policies and even enhanced coverage options may not provide sufficient protection against the unique risks posed by wildfires. In such situations, wildfire-specific policies may be the best option.

These policies are designed specifically to address the unique challenges and risks associated with wildfires. They often provide comprehensive coverage for a wide range of wildfire-related losses, including damage to structures, personal property, additional living expenses, and alternative accommodation during displacement.

Wildfire-specific policies may also include coverage for loss of use, which can be crucial if you need to temporarily relocate due to a wildfire threat. Additionally, these policies often have lower deductibles and higher coverage limits compared to standard policies, providing greater financial protection in the event of a wildfire.

Understanding Policy Exclusions

While wildfire insurance policies offer a range of coverage options, it’s crucial to understand the exclusions and limitations that may apply. Here are some common exclusions to be aware of:

- Earth Movement: Some policies may exclude damage caused by earth movement, such as landslides or mudslides, which can be triggered by wildfires.

- Water Damage: While wildfires can cause water damage through firefighting efforts, some policies may exclude this type of damage.

- Governmental Actions: Policies may exclude losses resulting from governmental actions, such as mandatory evacuations or the denial of access to your property during a wildfire.

- Pollution: Coverage for pollution, including smoke and ash, may be limited or excluded in some policies.

- War and Terrorism: Wildfire-related losses resulting from acts of war or terrorism may not be covered by certain policies.

It's essential to carefully review your policy's exclusions and limitations to ensure you have a clear understanding of the coverage you're entitled to.

Mitigating Your Wildfire Risk

While insurance is a crucial component of protecting your property against wildfires, it’s equally important to take proactive steps to mitigate your risk. Here are some strategies to help reduce the likelihood and impact of wildfire damage.

Home Hardening

Home hardening involves making physical modifications to your home to make it more resistant to wildfires. This can include:

- Using Fire-Resistant Materials: Opt for fire-resistant roofing materials, such as metal or tile, and consider fire-resistant siding and windows.

- Sealing Vents and Openings: Ensure that all vents and openings are properly sealed to prevent embers from entering your home.

- Creating Defensible Space: Clear vegetation and debris from around your home to create a buffer zone, reducing the fuel available for a fire.

- Installing Fire-Resistant Landscaping: Choose fire-resistant plants and maintain your landscaping to reduce the risk of fire spread.

Wildfire Mitigation Programs

Various government and community programs are available to help homeowners mitigate their wildfire risk. These programs often provide resources, guidance, and even financial assistance to help you make your home more fire-resistant.

For instance, the California Fire Safe Council offers a range of resources and grants to help communities and individuals reduce their wildfire risk. Similarly, the Firewise USA® program provides guidance and resources to help homeowners and communities create defensible space and reduce the risk of wildfire damage.

Community Fire Safety Initiatives

Working together with your community can significantly enhance your wildfire mitigation efforts. Collaborating with neighbors to create a community wildfire protection plan can help identify and address common vulnerabilities and develop a coordinated response strategy.

Additionally, participating in community fire drills and training programs can help ensure that everyone is prepared and knows what to do in the event of a wildfire. By fostering a culture of fire safety and preparedness, your community can significantly reduce the risk and impact of wildfires.

The Future of Wildfire Insurance in California

As California continues to grapple with the increasing threat of wildfires, the landscape of wildfire insurance is likely to evolve further. Here are some key trends and developments to watch for in the coming years.

Increased Use of Technology

Advanced technologies, such as satellite imagery, GIS, and predictive analytics, are likely to play an even more significant role in the future of wildfire insurance. These tools can help insurers more accurately assess risk, identify high-risk areas, and develop more precise underwriting models.

Additionally, the use of technology can help streamline the claims process, allowing for faster and more efficient assessments of wildfire-related losses. This can be particularly valuable in the aftermath of a major wildfire event, when timely and accurate claims processing is crucial.

Collaborative Risk Assessment

Insurers, government agencies, and wildfire experts are increasingly recognizing the value of collaborative risk assessment. By working together to share data, insights, and best practices, these stakeholders can develop more comprehensive and accurate risk models.

This collaborative approach can lead to a better understanding of wildfire risk, more effective mitigation strategies, and ultimately, more affordable and accessible insurance options for homeowners.

Incentives for Mitigation

As the insurance industry continues to adapt to the increasing wildfire risk, there is a growing recognition of the importance of homeowner mitigation efforts. As a result, insurance companies may increasingly offer incentives and discounts to homeowners who take proactive steps to reduce their wildfire risk.

These incentives could include lower premiums, reduced deductibles, or even additional coverage for homeowners who implement fire-resistant materials, create defensible space, or participate in community wildfire protection initiatives.

Community-Based Insurance Solutions

In areas where wildfire risk is particularly high and traditional insurance options are limited, community-based insurance solutions may emerge as a viable alternative. These solutions could involve pooling resources within a community to provide mutual insurance coverage, similar to the concept of a mutual aid society.

By sharing the risk within a community, these solutions could provide more affordable and accessible insurance coverage for homeowners, particularly in high-risk areas where traditional insurance may be unavailable or prohibitively expensive.

How do I know if my homeowners insurance covers wildfires?

+Review your policy carefully to understand the extent of your wildfire coverage. Most standard homeowners insurance policies include some level of coverage for wildfire-related losses, but it’s important to note any exclusions or limitations. Consider speaking with your insurance agent or broker to clarify any doubts you may have about your coverage.

What should I do if my insurance company denies my wildfire claim?

+If your insurance company denies your wildfire claim, it’s essential to understand the reason for the denial. Review your policy and the denial letter carefully. If you believe the denial is unjustified, consider seeking legal advice or contacting your state’s insurance department for guidance on the appeals process.

Are there any government programs that can help with wildfire insurance costs?

+Yes, there are government programs that can provide financial assistance for wildfire insurance. For instance, the California Fair Access to Insurance Requirements (FAIR) Plan offers insurance coverage to property owners who cannot obtain coverage through the voluntary market due to high wildfire risk. Additionally, the California Wildfire Fund provides a financial backstop for insurance companies, helping to stabilize insurance rates and availability.