California Insurance Requirements

Understanding the insurance requirements in the state of California is crucial for both residents and visitors alike. California, known for its diverse landscape and bustling cities, has a comprehensive set of regulations governing the insurance industry. This article aims to provide an in-depth exploration of these requirements, offering valuable insights into the state's insurance landscape.

California’s Insurance Landscape

California, being the most populous state in the United States, boasts a dynamic insurance market. The state’s Department of Insurance plays a pivotal role in regulating and overseeing insurance practices, ensuring the protection of consumers and promoting a fair and competitive market.

One of the key areas of focus for the state is auto insurance. With its extensive network of highways and roads, California recognizes the importance of mandatory auto insurance coverage. Let's delve into the specific requirements and considerations for motorists in the Golden State.

Auto Insurance Requirements in California

California’s Vehicle Code Section 16020 outlines the compulsory auto insurance coverage for all registered vehicles. The state mandates a minimum level of liability insurance to protect against bodily injury and property damage in the event of an accident.

Minimum Liability Coverage

The minimum liability limits in California are as follows:

- Bodily Injury Liability: 15,000 per person and 30,000 per accident

- Property Damage Liability: $5,000 per accident

These limits are designed to provide a basic level of protection for motorists involved in accidents. However, it's important to note that many experts recommend carrying higher liability limits to ensure adequate coverage in case of severe accidents or injuries.

Additional Coverage Options

While the minimum liability coverage is mandatory, California residents have the flexibility to tailor their auto insurance policies to meet their specific needs. Some common additional coverage options include:

- Collision Coverage: Pays for repairs or replacement of your vehicle in case of an accident, regardless of fault.

- Comprehensive Coverage: Covers damages caused by non-collision events like theft, vandalism, natural disasters, or animal collisions.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re involved in an accident with a driver who has insufficient or no insurance.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

Special Considerations for High-Risk Drivers

California has specific provisions for drivers considered high-risk due to their driving history or vehicle usage. High-risk drivers may be required to obtain a SR-22 certificate, which serves as proof of financial responsibility. This certificate is often mandated for drivers with DUI convictions, multiple traffic violations, or accidents without sufficient insurance coverage.

Insurance Rates and Discounts

California’s insurance rates can vary significantly based on factors such as the driver’s age, driving record, vehicle type, and location. To encourage safe driving and cost-effectiveness, many insurance providers offer a range of discounts. These may include discounts for safe driving records, multiple-policy bundling, good student status, and anti-theft devices.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Offers reduced rates for drivers with clean driving records. |

| Multi-Policy Discount | Rewards policyholders who bundle their auto and home insurance. |

| Good Student Discount | Provides savings for young drivers who maintain good academic standing. |

| Anti-Theft Device Discount | Reduces premiums for vehicles equipped with approved anti-theft devices. |

Health Insurance Requirements

California is at the forefront of promoting access to healthcare through its health insurance mandates. The state’s Individual Mandate, as part of the Affordable Care Act, requires most residents to have qualifying health insurance coverage or face a tax penalty. Let’s explore the specifics of health insurance requirements in California.

Minimum Essential Coverage

California residents are required to have minimum essential coverage to comply with the state’s Individual Mandate. This coverage can be obtained through various means, including employer-sponsored plans, individual market policies, Medicaid, Medicare, or other qualifying health plans.

Covered Benefits

Health insurance plans in California must adhere to the Essential Health Benefits outlined by the Affordable Care Act. These benefits include:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services

- Preventive and wellness services

- Pediatric services

Medicaid and Medicare

California’s Medicaid program, known as Medi-Cal, provides health coverage for low-income individuals and families. It is a crucial safety net for those who may not be able to afford private insurance. Additionally, the state’s Medicare program offers healthcare coverage for seniors and individuals with certain disabilities.

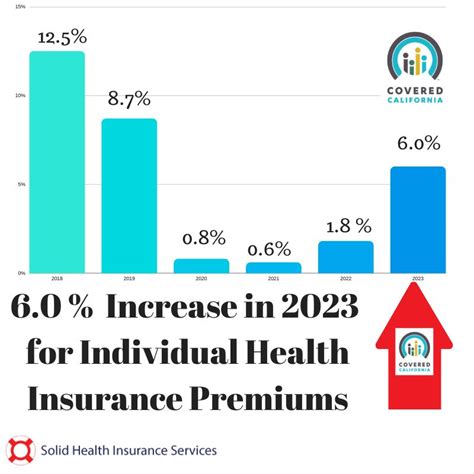

Health Insurance Exchanges

California operates a state-based health insurance marketplace, known as Covered California. This marketplace allows individuals and small businesses to compare and purchase qualified health plans. It provides a user-friendly platform to navigate the complex world of health insurance options.

Penalties for Non-Compliance

Individuals who do not maintain minimum essential coverage in California may face a tax penalty. The penalty amount is calculated based on household income and the number of months without coverage. However, certain exemptions may apply, such as financial hardship or religious objections.

Other Insurance Requirements

In addition to auto and health insurance, California residents should be aware of other insurance requirements specific to their circumstances.

Homeowner’s Insurance

While homeowner’s insurance is not mandatory in California, it is highly recommended. Given the state’s susceptibility to natural disasters like earthquakes and wildfires, comprehensive coverage can provide crucial protection for homeowners.

Renter’s Insurance

Renter’s insurance is not a legal requirement in California, but it offers valuable protection for tenants. It covers personal belongings and provides liability coverage in case of accidents or injuries that occur within the rented property.

Business Insurance

California’s diverse business landscape means that specific insurance requirements may vary depending on the industry and nature of the business. Common types of business insurance include general liability, professional liability (errors and omissions), workers’ compensation, and commercial property insurance.

Insurance Regulations and Consumer Protection

California’s Department of Insurance is committed to protecting consumers and ensuring fair practices in the insurance industry. The department enforces regulations and provides resources to help consumers understand their rights and make informed decisions.

Consumer Resources

The Department of Insurance offers a wealth of resources for consumers, including:

- Consumer Guides: Comprehensive guides on various insurance topics, helping consumers navigate the complex world of insurance.

- Complaint Process: Information on how to file a complaint against an insurance company or agent, ensuring fair resolution of disputes.

- Rate Filing and Approval: Details on how insurance rates are regulated and approved, ensuring transparency and affordability.

Enforcement and Penalties

The Department of Insurance has the authority to investigate and enforce regulations against insurance companies and agents. Penalties for non-compliance may include fines, license suspensions, or revocations.

Conclusion

California’s insurance requirements are designed to protect residents and promote a stable and competitive insurance market. From auto insurance to health coverage, understanding these requirements is essential for individuals and businesses alike. By staying informed and seeking expert advice, Californians can navigate the insurance landscape with confidence, ensuring they have the coverage they need to protect their assets, health, and well-being.

What happens if I don’t have auto insurance in California?

+Driving without insurance in California is illegal and can result in severe consequences. You may face penalties, including fines, license suspension, and even vehicle impoundment. Additionally, if you’re involved in an accident, you’ll be personally liable for any damages, which can be financially devastating.

How do I find affordable health insurance in California?

+California’s health insurance marketplace, Covered California, is a great resource for finding affordable health plans. You can compare various options based on your income, family size, and preferred healthcare providers. Additionally, you may qualify for financial assistance or tax credits to reduce your monthly premiums.

Are there any discounts available for auto insurance in California?

+Yes, California offers a range of auto insurance discounts. These may include safe driver discounts, multi-policy discounts, good student discounts, and anti-theft device discounts. It’s worth shopping around and comparing quotes from different insurers to find the best rates and discounts tailored to your specific circumstances.

What should I do if I receive a notice of non-compliance with the Individual Mandate in California?

+If you receive a notice of non-compliance, it’s crucial to take immediate action. Review your insurance coverage and ensure it meets the minimum essential coverage requirements. If you’ve had a qualifying life event, such as a job loss or change in family status, you may be eligible for a Special Enrollment Period to obtain coverage outside of the open enrollment period. Consult with a qualified insurance agent or the Department of Insurance for guidance.