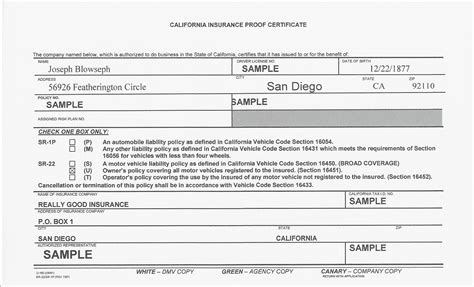

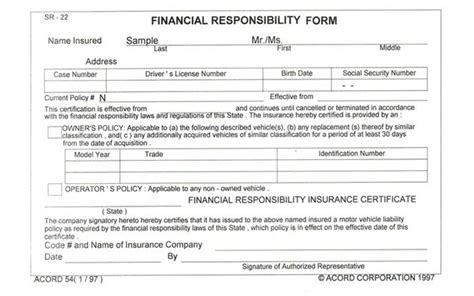

California Insurance Proof Certificate Sr 22

California, known for its diverse landscapes and bustling cities, also has a complex system of regulations when it comes to automobile insurance. One particular requirement that stands out is the need for an SR-22 certificate, a unique form of proof of insurance mandated for certain drivers. This article aims to delve into the intricacies of the California SR-22 certificate, exploring what it is, who needs it, how to obtain it, and its implications for drivers in the Golden State.

Understanding the SR-22 Certificate in California

An SR-22 certificate, often referred to as a Certificate of Financial Responsibility, is a legal document that proves an individual has met the state’s minimum liability insurance requirements. It is a specific type of insurance filing that certifies a driver’s coverage for liability insurance, typically after a major violation or incident. In California, this certificate is required for drivers who have had their license suspended or revoked due to certain offenses, such as driving under the influence (DUI), multiple traffic violations, or failing to maintain insurance coverage.

The primary purpose of the SR-22 is to ensure that drivers deemed a higher risk by the state maintain adequate insurance coverage. This requirement is often seen as a way to protect other drivers on the road and to ensure that any damages or injuries caused by these high-risk drivers are covered by insurance. The SR-22 acts as a guarantee to the state that the driver in question has met the necessary financial responsibility requirements.

Who Needs an SR-22 in California?

The California Department of Motor Vehicles (DMV) mandates the SR-22 requirement for drivers who have committed specific offenses. These offenses typically include, but are not limited to:

- Driving under the influence (DUI) or driving while intoxicated (DWI)

- Multiple moving violations, such as speeding, reckless driving, or failure to yield

- Driving without insurance coverage

- Failing to appear in court for a traffic violation

- Hit-and-run incidents

- Causing a serious accident

It's important to note that not all traffic violations result in an SR-22 requirement. The DMV assesses each case individually, and the decision to mandate an SR-22 is based on the severity of the offense and the driver's history.

The Process of Obtaining an SR-22

For drivers in California who have been ordered to file an SR-22, the process typically involves the following steps:

- Contact Your Insurance Provider: Reach out to your current or a new insurance provider to request an SR-22 form. It’s essential to choose an insurer that offers SR-22 insurance, as not all companies provide this service.

- Complete the Form: The insurance provider will guide you through the process of filling out the SR-22 form. This form requires personal information, details about your vehicle, and the type of coverage you need.

- Submit the Form: Once completed, the insurance provider will electronically submit the SR-22 to the California DMV. The submission process is usually done within a few business days.

- Wait for Confirmation: After the submission, you will receive confirmation from the DMV that your SR-22 has been accepted. This process can take a few weeks.

- Maintain Continuous Coverage: It’s crucial to maintain continuous insurance coverage throughout the SR-22 filing period. Any lapse in coverage could result in the cancellation of your SR-22 and further penalties.

| Key Points to Note | Details |

|---|---|

| Duration of SR-22 Requirement | In California, the duration of the SR-22 requirement varies based on the offense. It can range from 3 years for a first-time DUI to 5 years for repeat offenses or more severe violations. |

| Cost of SR-22 Insurance | The cost of SR-22 insurance can be significantly higher than standard auto insurance due to the high-risk nature of the policy. It's essential to shop around and compare quotes from multiple insurers. |

Implications and Challenges of SR-22 Insurance

Obtaining and maintaining an SR-22 certificate in California comes with several implications and challenges. Firstly, the cost of SR-22 insurance is often considerably higher than standard auto insurance policies. This is because insurers view drivers with SR-22 requirements as high-risk, which results in increased premiums. The duration of the SR-22 requirement can also be lengthy, sometimes extending over several years, which means drivers must maintain this costly insurance coverage for an extended period.

Additionally, drivers with SR-22 requirements may face challenges in finding insurance providers willing to offer them coverage. Some insurers may decline to provide SR-22 insurance, particularly if the driver has a severe offense on their record. This can make it difficult for certain drivers to obtain the necessary insurance and reinstate their driving privileges.

Furthermore, the SR-22 requirement in California can impact a driver's future insurance prospects. Even after the SR-22 period ends, the violation that led to the requirement will remain on the driver's record, potentially affecting their insurance rates for years to come. This can make it challenging for drivers to obtain more affordable insurance rates, even after they have demonstrated a record of safe driving.

Tips for Navigating SR-22 Requirements

For drivers facing SR-22 requirements in California, here are some tips to navigate the process more effectively:

- Compare Insurance Quotes: Shop around and compare quotes from multiple insurance providers. While SR-22 insurance is generally more expensive, rates can vary significantly between insurers.

- Maintain Continuous Coverage: Ensure that your insurance coverage remains uninterrupted throughout the SR-22 period. Even a brief lapse in coverage can result in serious consequences, including the cancellation of your SR-22 and additional fees.

- Consider a Specialist Broker: If you’re struggling to find an insurer willing to provide SR-22 insurance, consider working with a specialist broker who has experience in this field. They can often find coverage options that might not be readily apparent.

- Drive Safely: While the SR-22 requirement is in place, it’s crucial to maintain a clean driving record. Avoid any further violations or incidents that could extend the SR-22 period or result in additional penalties.

Navigating the world of SR-22 insurance in California can be complex and challenging. However, by understanding the requirements, seeking out expert advice, and taking proactive steps to maintain insurance coverage, drivers can effectively manage this process and work towards reinstating their driving privileges.

How long does an SR-22 remain in effect in California?

+The duration of an SR-22 requirement in California depends on the nature of the offense. For a first-time DUI, the SR-22 is typically required for 3 years. However, for more severe violations or repeat offenses, the duration can extend to 5 years or longer.

Can I drive without an SR-22 if I’ve had a DUI in the past but no longer need it?

+No, if you have had a DUI in the past and were required to file an SR-22, you must maintain the SR-22 insurance even after the requirement period has ended. This is because the SR-22 is a guarantee of insurance coverage, and without it, you may face penalties if involved in an accident or pulled over.

What happens if I let my SR-22 insurance lapse?

+If your SR-22 insurance lapses, the California DMV will be notified by your insurance provider. This can result in the cancellation of your SR-22, the suspension of your driver’s license, and additional fees to reinstate your driving privileges. It’s crucial to maintain continuous coverage throughout the SR-22 period.