California Average Health Insurance Cost

Understanding the average health insurance costs in California is crucial for residents and businesses alike, as healthcare expenses can vary significantly across the state. This comprehensive guide will delve into the factors influencing these costs, provide a detailed analysis of average rates, and offer insights into the best practices for securing affordable health coverage.

Factors Influencing Health Insurance Costs in California

The cost of health insurance in California is influenced by a multitude of factors, including geographic location, age, health status, and the type of coverage chosen. Here’s a closer look at these key factors:

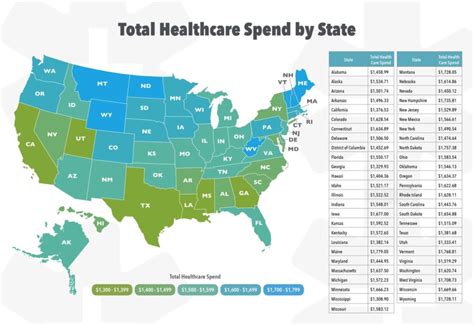

Geographic Location

California is a vast state with diverse demographics and varying healthcare needs. The cost of living, and consequently, the cost of healthcare, can differ significantly between regions. For instance, metropolitan areas like Los Angeles and San Francisco often have higher healthcare costs compared to more rural areas.

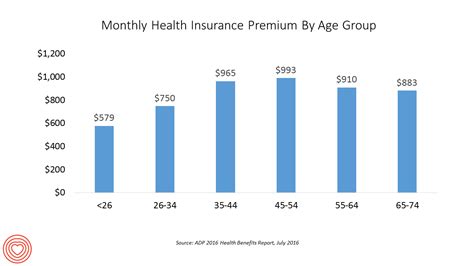

Age and Health Status

Age and health status are primary determinants of health insurance premiums. Generally, younger individuals pay lower premiums, as they are less likely to require extensive medical care. Conversely, older adults and those with pre-existing health conditions often face higher premiums.

Type of Coverage

The type of health insurance coverage chosen plays a pivotal role in determining costs. Options range from basic coverage with higher deductibles to comprehensive plans with lower out-of-pocket expenses. The level of coverage desired will directly impact the premium.

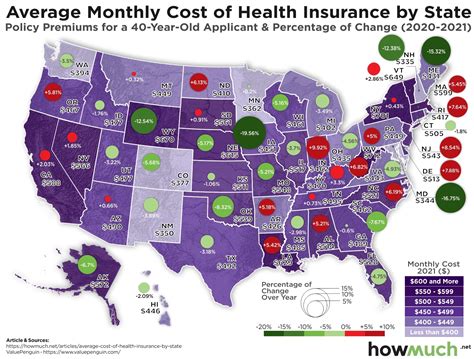

Average Health Insurance Costs in California

According to recent data, the average cost of health insurance in California varies depending on the type of plan and the demographic of the insured. Here’s a breakdown of the average costs:

| Plan Type | Average Monthly Premium |

|---|---|

| Individual Plans (Ages 18-34) | $450 - $600 |

| Individual Plans (Ages 35-64) | $550 - $750 |

| Family Plans | $1,200 - $1,800 |

| Employer-Provided Plans (Average) | $600 - $900 (Employee Contribution) |

These averages are based on a standard plan with a moderate deductible and out-of-pocket maximum. Premiums can vary significantly based on the specific plan features and the insured's health status.

Best Practices for Affordable Health Insurance in California

Securing affordable health insurance in California requires a strategic approach. Here are some best practices to consider:

Understand Your Healthcare Needs

Assess your healthcare needs and choose a plan that aligns with them. If you have few medical needs, a high-deductible plan with lower premiums might be suitable. However, if you anticipate significant medical expenses, a comprehensive plan with higher premiums and lower out-of-pocket costs could be more cost-effective.

Shop Around and Compare Plans

Don’t settle for the first plan you find. Compare different plans from multiple providers to find the best value. Online marketplaces like Covered California offer a wide range of options, allowing you to easily compare premiums, deductibles, and coverage details.

Utilize Tax Credits and Subsidies

California residents who purchase their health insurance through the state’s marketplace, Covered California, may be eligible for tax credits and subsidies to lower their monthly premiums. These credits are based on income and family size, and they can significantly reduce the cost of coverage.

Consider Employer-Provided Plans

If you’re employed, explore the health insurance options offered by your employer. Many employers contribute to the cost of employee health insurance, making it a cost-effective option. Additionally, group plans often have lower premiums than individual plans due to the pooling of risk.

Maintain Good Health

Staying healthy can directly impact your health insurance costs. Engage in regular exercise, eat a balanced diet, and maintain good health habits. This can reduce your risk of developing costly health conditions, leading to lower premiums and out-of-pocket expenses.

Future Trends and Considerations

The cost of health insurance in California is expected to continue evolving, influenced by factors such as healthcare legislation, market competition, and advancements in medical technology. Here are some key considerations for the future:

Healthcare Reform and Legislation

The Affordable Care Act (ACA) and other healthcare reforms have significantly impacted insurance costs and coverage options. Stay informed about any changes in legislation, as they can directly affect your coverage and premiums.

Market Competition

The health insurance market in California is competitive, with multiple providers offering a range of plans. This competition can drive down costs and improve coverage options. As a consumer, you have the power to choose the plan that best suits your needs and budget.

Advancements in Medical Technology

Advancements in medical technology can lead to more efficient and cost-effective healthcare, potentially reducing insurance costs over time. However, the initial adoption of new technologies can drive up costs in the short term.

FAQ

What is the difference between an individual and a family health insurance plan in California?

+Individual plans are designed for single individuals or couples, while family plans cover the primary policyholder, their spouse, and any dependent children. Family plans typically offer more comprehensive coverage and have higher premiums.

Are there any special considerations for young adults in California when choosing health insurance?

+Yes, young adults in California have the option to remain on their parents’ health insurance plan until they turn 26. This can be a cost-effective option for those who don’t have access to employer-provided insurance or prefer not to purchase an individual plan.

What are the benefits of purchasing health insurance through Covered California?

+Covered California offers a wide range of health insurance plans from various providers, allowing for easy comparison. Additionally, many California residents are eligible for tax credits and subsidies when purchasing insurance through Covered California, making it a cost-effective option.