Buying Life Insurance

Securing your financial future and the well-being of your loved ones is a crucial step in life planning, and life insurance stands as a pivotal pillar in this journey. This comprehensive guide aims to unravel the complexities of buying life insurance, offering an insightful and practical approach to this important decision.

Understanding Life Insurance

At its core, life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, and in return, the insurance company provides a financial benefit to the designated beneficiaries upon the policyholder’s death. This benefit, often referred to as the death benefit, serves as a crucial safety net for the policyholder’s family, ensuring their financial stability and security.

The world of life insurance is diverse, offering various types of policies to cater to different needs and life stages. The two main categories are term life insurance and permanent life insurance, each with its unique features and advantages.

Term Life Insurance

Term life insurance is a straightforward and affordable option, providing coverage for a specified period, often ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and if death occurs within this timeframe, the beneficiaries receive the agreed-upon death benefit. This type of insurance is particularly beneficial for individuals with short-term financial responsibilities, such as covering mortgage payments or providing for children’s education.

| Pros | Cons |

|---|---|

| Affordable premiums | Coverage expires after the term |

| Flexibility to adjust coverage as needs change | May not cover long-term needs |

| Can convert to permanent insurance | Requires periodic reassessment |

For instance, consider a young couple with a new mortgage. Term life insurance can ensure that if either partner passes away, the surviving spouse will have the financial means to continue making mortgage payments and maintain their standard of living.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage. This type of insurance includes whole life, universal life, and variable life policies. While these policies typically have higher premiums, they offer the advantage of building cash value over time, which can be borrowed against or withdrawn if needed.

| Pros | Cons |

|---|---|

| Lifetime coverage | Higher initial premiums |

| Cash value accumulation | Complex policy features |

| Flexible death benefit and premium adjustments | May require medical exams |

Whole life insurance, for example, provides a fixed death benefit and guaranteed cash value growth. This makes it an attractive option for individuals seeking long-term financial protection and a stable investment vehicle.

Factors to Consider When Buying Life Insurance

Navigating the life insurance landscape requires careful consideration of several key factors. These include your current and future financial needs, the type of policy that best suits your goals, and your budget for premiums.

Assessing Your Financial Needs

Determining the right amount of life insurance coverage involves a thorough assessment of your financial situation. This includes evaluating your current expenses, future goals, and the financial impact your death would have on your dependents. Tools like life insurance needs calculators can provide a rough estimate, but a detailed analysis is often necessary to ensure adequate coverage.

For instance, a single parent with a dependent child might need coverage that can pay off their mortgage, cover their child's education expenses, and provide for their daily living costs until the child becomes independent.

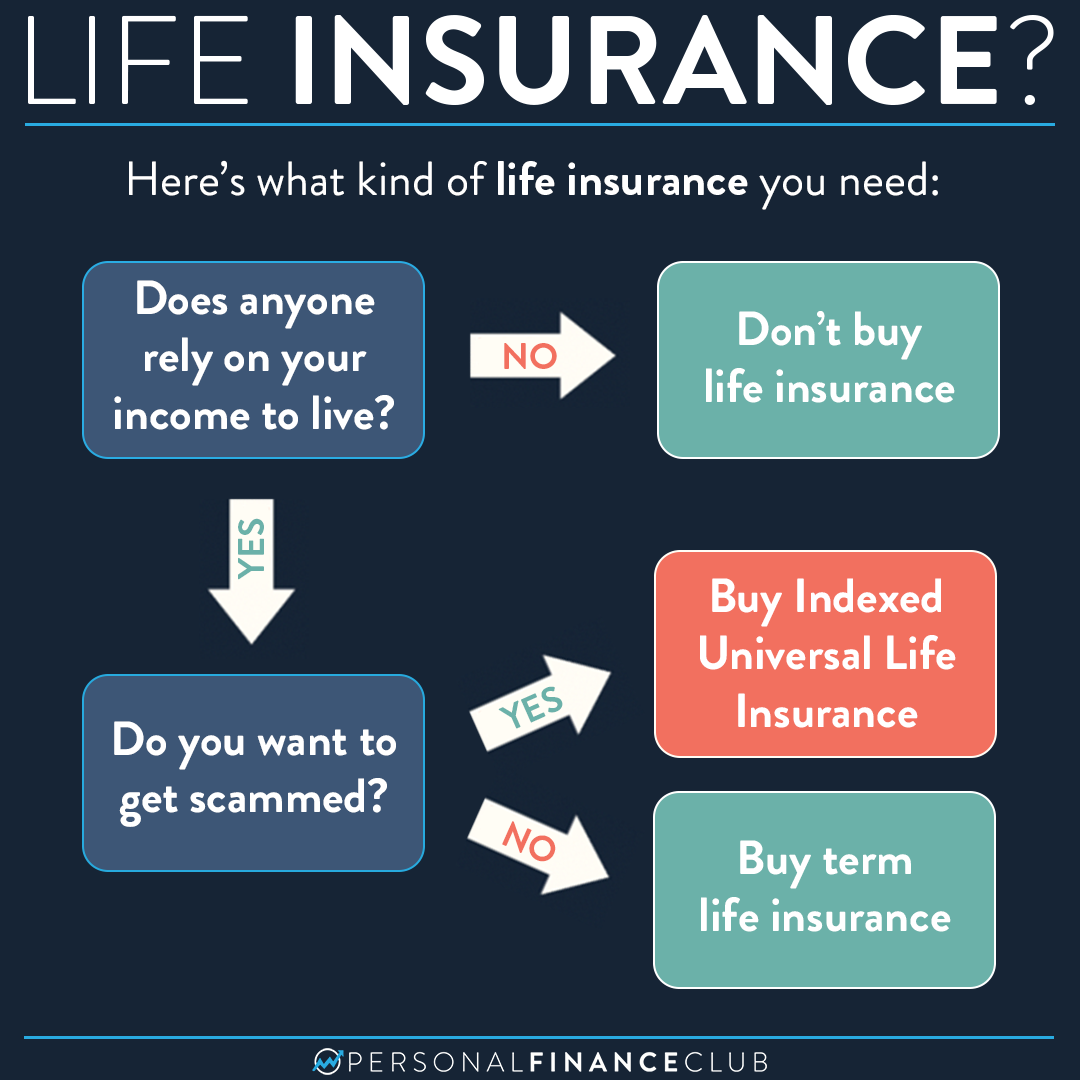

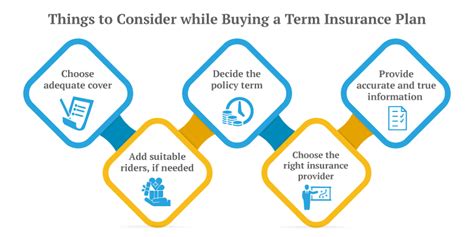

Choosing the Right Policy Type

The choice between term and permanent life insurance depends on your specific needs and circumstances. Term insurance is ideal for covering temporary financial obligations, while permanent insurance offers long-term protection and financial growth. It’s essential to review the features and benefits of each type to make an informed decision.

Budgeting for Premiums

Life insurance premiums can vary significantly based on the type of policy, the coverage amount, and your personal health and lifestyle factors. It’s crucial to find a policy that provides the necessary coverage while remaining within your budget. Some policies offer flexible premium payment options, such as annual, semi-annual, or monthly payments, to accommodate different financial situations.

Additionally, health considerations play a role in premium determination. Insurers often require medical exams or health questionnaires to assess your risk level. Maintaining a healthy lifestyle can lead to more affordable premiums and a smoother application process.

The Application and Approval Process

The journey to obtaining life insurance begins with an application, which typically involves providing personal and health information. Depending on the policy and insurer, the application process may include a medical exam and/or a review of your medical records.

Medical Underwriting

Medical underwriting is a crucial step in the life insurance application process. It involves an evaluation of your health and lifestyle factors to assess your risk level and determine the appropriate premium. This step may include a physical exam, blood and urine tests, and a review of your medical history and family medical history.

For instance, individuals with a history of serious illnesses or risky behaviors may face higher premiums or even be denied coverage. However, many insurers offer preferred rates for healthy individuals who meet certain criteria.

Policy Approval and Implementation

Once your application is approved, you’ll receive a policy document outlining the terms and conditions of your coverage. It’s essential to review this document carefully to ensure it aligns with your expectations and needs. At this stage, you’ll also set up your premium payment schedule and choose any additional riders or features you wish to include in your policy.

For example, you might opt for a waiver of premium rider, which waives your premium payments if you become disabled and unable to work.

Maximizing the Benefits of Life Insurance

Life insurance offers more than just financial protection. With the right strategy, it can be a powerful tool for estate planning, wealth accumulation, and tax efficiency.

Estate Planning and Legacy Protection

Life insurance can be a vital component of your estate plan, ensuring that your assets are distributed according to your wishes and providing a financial cushion for your loved ones. By naming specific beneficiaries and creating a clear plan for the distribution of the death benefit, you can minimize potential conflicts and ensure a smooth transition of your assets.

Wealth Accumulation and Cash Value

Permanent life insurance policies, particularly whole and universal life, offer the added benefit of cash value accumulation. This cash value grows over time and can be accessed through policy loans or withdrawals. It serves as a tax-advantaged way to build wealth and can be used for various financial goals, such as funding retirement or covering unexpected expenses.

Tax Efficiency and Estate Taxes

Life insurance proceeds are generally income tax-free, making them an efficient way to transfer wealth to your beneficiaries. Additionally, for high-net-worth individuals, life insurance can be used as an effective tool to mitigate estate taxes. By purchasing a life insurance policy with the estate as the beneficiary, the death benefit can offset the estate tax liability, preserving more of the estate’s assets for the beneficiaries.

Future Implications and Considerations

As your life and financial situation evolve, it’s essential to periodically review your life insurance policy to ensure it continues to meet your needs. Major life events like marriage, the birth of a child, a career change, or the purchase of a new home may signal the need for increased coverage or different policy features.

Furthermore, staying informed about industry developments and regulatory changes is crucial. The life insurance landscape is dynamic, with new products and features emerging regularly. By staying abreast of these changes, you can make informed decisions and take advantage of any new opportunities that may enhance your coverage or reduce your costs.

Conclusion

Buying life insurance is a significant financial decision that requires careful consideration and planning. By understanding the different types of policies, assessing your financial needs, and navigating the application process, you can secure a policy that provides the peace of mind and financial protection you and your loved ones deserve. Remember, life insurance is not just about covering the costs of death; it’s about ensuring a secure and prosperous future for those you care about.

How much life insurance coverage do I need?

+

The amount of coverage you need depends on your individual circumstances and financial goals. As a general rule, it’s recommended to have coverage that is 10-15 times your annual income. However, this can vary based on your debt, assets, and the financial needs of your dependents. It’s best to consult with a financial advisor or use a life insurance needs calculator to determine an accurate figure.

Can I buy life insurance without a medical exam?

+

Yes, some insurers offer simplified issue or guaranteed issue policies that do not require a medical exam. These policies often have lower coverage limits and higher premiums, and may not be suitable for everyone. However, they can be a good option for individuals with health concerns or those who prefer a more streamlined application process.

What happens if I miss a premium payment?

+

Missing a premium payment can have serious consequences. Depending on the policy, you may have a grace period of 30-60 days to make the payment before the policy lapses. If the policy lapses, you may lose your coverage and any cash value built up, and you’ll need to apply for a new policy, which may be more expensive or difficult to obtain.

Can I change my life insurance policy after it’s been issued?

+

Yes, you can often make changes to your policy, such as increasing or decreasing coverage, adding or removing riders, or changing beneficiaries. However, any changes may require additional underwriting and may impact your premiums. It’s important to review your policy regularly and make adjustments as your life and financial situation evolves.

How long does the life insurance application process typically take?

+

The application process can vary depending on the insurer and the type of policy. For term life insurance with a simplified application process, it can take just a few days to receive approval. For permanent life insurance policies, especially those that require a medical exam, the process can take several weeks or even months. It’s important to allow sufficient time and to be thorough in your application to avoid delays.