Best Rate On Car Insurance

When it comes to finding the best rate on car insurance, there are numerous factors to consider. The insurance landscape is complex, with a wide range of providers offering different policies and rates. As an informed consumer, it's essential to navigate this market strategically to secure the most advantageous deal for your unique circumstances. This comprehensive guide will delve into the intricacies of obtaining the best car insurance rates, offering expert insights and practical tips based on real-world industry knowledge.

Understanding Car Insurance Rates

Car insurance rates are determined by a combination of factors, each influencing the overall cost of your policy. These factors include your personal information, the type of vehicle you drive, and the coverage options you choose. Personal details such as your age, gender, driving history, and credit score play a significant role in rate calculation. Additionally, the make, model, and year of your vehicle, as well as the geographic location where you primarily drive, impact the rates you’re offered.

The coverage options you select are another crucial factor. Comprehensive and collision coverage, which protect against damage to your vehicle, typically come with higher premiums. Conversely, liability-only coverage, which only covers damage you cause to others, may be more affordable. Understanding these factors and how they interact is key to identifying the best car insurance rates for your situation.

Shopping Around for the Best Deal

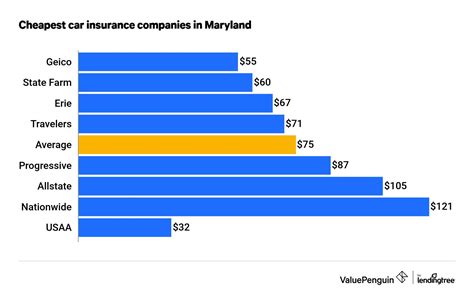

One of the most effective ways to secure the best car insurance rate is to compare quotes from multiple providers. The insurance market is competitive, and rates can vary significantly between companies. By obtaining quotes from a variety of sources, you can identify the most competitive offers and negotiate better terms with your current insurer.

Online comparison tools are a convenient way to gather quotes from multiple providers in one place. These tools allow you to input your details once and receive multiple quotes, making it easy to compare rates and coverage options. Additionally, speaking directly with insurance agents or brokers can provide valuable insights and personalized recommendations based on your specific needs.

When comparing quotes, pay attention to the coverage limits and deductibles. While a lower premium may be appealing, it could come with higher deductibles or lower coverage limits, which may not provide sufficient protection in the event of an accident. Ensure that you're comparing policies with similar coverage levels to make an accurate assessment of the best value.

Negotiating with Insurance Providers

Once you’ve gathered quotes and identified the most competitive rates, it’s time to negotiate with insurance providers. Many insurers are willing to work with you to secure your business, especially if you’re an existing customer. By highlighting the competitive quotes you’ve obtained elsewhere, you can leverage this information to negotiate a better rate with your current insurer.

When negotiating, be prepared to provide specific details about your coverage needs and why you believe you deserve a lower rate. For example, you might highlight your excellent driving record, safe driving behavior tracked through a usage-based insurance program, or any safety features installed in your vehicle. These factors can demonstrate your low-risk profile and potential for lower premiums.

Additionally, consider bundling your car insurance with other policies, such as home or renters insurance. Many insurers offer multi-policy discounts, which can significantly reduce your overall insurance costs. Bundling your policies can also streamline your insurance management, making it more convenient to handle your coverage needs.

Optimizing Your Car Insurance Profile

In addition to shopping around and negotiating, there are steps you can take to optimize your car insurance profile and potentially lower your rates. One of the most effective ways to do this is by improving your driving record. A clean driving history, free of accidents and violations, can significantly impact your insurance rates.

| Driving Record | Impact on Rates |

|---|---|

| Clean Record | Lower Rates |

| Accidents/Violations | Higher Rates |

Another way to optimize your profile is by improving your credit score. Many insurers use credit-based insurance scores to assess your risk level and set your rates. A higher credit score can indicate a lower risk profile, which may result in more favorable insurance rates. Focus on building and maintaining a strong credit history to potentially reduce your insurance costs.

Safety Features and Discounts

Installing safety features in your vehicle can also contribute to lower insurance rates. Many insurers offer discounts for vehicles equipped with advanced safety technologies such as lane departure warning systems, automatic emergency braking, and adaptive cruise control. These features can reduce the likelihood and severity of accidents, making you a lower-risk driver in the eyes of insurers.

Additionally, take advantage of any discounts offered by insurance providers. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and loyalty discounts for long-term customers. By understanding the discounts available and meeting the eligibility criteria, you can further reduce your insurance costs.

Understanding Coverage Options

When shopping for car insurance, it’s essential to understand the different coverage options available and how they impact your rates. As mentioned earlier, comprehensive and collision coverage typically come with higher premiums, while liability-only coverage is more affordable. However, it’s important to strike a balance between cost and adequate protection.

| Coverage Type | Description | Impact on Rates |

|---|---|---|

| Comprehensive | Covers damage from non-accident events like theft, fire, or natural disasters. | Higher Rates |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Higher Rates |

| Liability-Only | Covers damage you cause to others, but not your own vehicle. | Lower Rates |

When selecting coverage options, consider your unique needs and financial situation. If you have an older vehicle that's paid off, liability-only coverage may be sufficient. However, if you have a newer or more expensive vehicle, comprehensive and collision coverage may be more appropriate to protect your investment.

Additional Coverage Considerations

Beyond the basic coverage types, there are additional options to consider. Personal injury protection (PIP) and medical payments coverage can provide coverage for your injuries and those of your passengers in an accident. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance.

Rental car reimbursement and roadside assistance coverage can also be beneficial, providing peace of mind and financial protection in the event of a breakdown or other emergencies. While these additional coverages may come at a cost, they can be well worth the investment depending on your circumstances and peace of mind.

Future Implications and Market Trends

As the insurance industry continues to evolve, several trends and developments are shaping the future of car insurance rates. One notable trend is the increasing use of telematics and usage-based insurance programs. These programs track your driving behavior in real-time, offering personalized rates based on your actual driving habits rather than generalized risk assessments.

Another emerging trend is the integration of artificial intelligence (AI) and machine learning into insurance underwriting. AI-powered algorithms can analyze vast amounts of data to more accurately assess risk and set rates, potentially leading to more fair and personalized pricing. Additionally, the growing popularity of electric vehicles (EVs) and autonomous driving technologies is expected to impact insurance rates in the coming years, as these vehicles present unique risks and opportunities.

Staying informed about these industry trends and developments can help you anticipate changes in the market and make informed decisions about your car insurance coverage. By understanding the factors that influence rates and staying proactive in managing your insurance profile, you can position yourself to secure the best rates available.

What factors influence car insurance rates the most?

+The primary factors influencing car insurance rates include your driving history, credit score, the make and model of your vehicle, and the coverage options you select. Additionally, your age, gender, and geographic location can also have an impact.

How can I reduce my car insurance rates?

+To reduce your car insurance rates, you can focus on maintaining a clean driving record, improving your credit score, and taking advantage of discounts for safety features and multi-policy bundling. Shopping around and negotiating with insurance providers can also help you secure more favorable rates.

What is the difference between comprehensive and liability-only coverage?

+Comprehensive coverage provides protection for damage to your vehicle from non-accident events, such as theft, fire, or natural disasters. Liability-only coverage, on the other hand, only covers damage you cause to others, but not your own vehicle. Comprehensive coverage typically comes with higher premiums, while liability-only coverage is more affordable.