Best Insurance Company For Cars

Choosing the best insurance company for your car can be a daunting task, given the numerous options available in the market. With so many factors to consider, from coverage options to pricing, it's crucial to make an informed decision. This article aims to guide you through the process, providing insights and information to help you select the insurance provider that best fits your needs.

Understanding Your Insurance Needs

Before diving into the sea of insurance companies, it’s essential to have a clear understanding of your specific insurance needs. Consider the following factors to tailor your search accordingly:

- Vehicle Type and Usage: The type of car you own and how you use it can significantly impact your insurance rates. For instance, sports cars or luxury vehicles often come with higher premiums due to their increased risk of theft or damage. Similarly, if you primarily use your car for business purposes, you may require additional coverage.

- Coverage Requirements: Different states have varying minimum insurance requirements. Ensure you’re aware of your state’s legal mandates and consider whether you need additional coverage beyond the basics. Comprehensive and collision coverage, for example, can provide protection against a wide range of incidents, from natural disasters to vandalism.

- Budget: Your budget is a critical factor in determining the best insurance company for you. While it’s tempting to opt for the cheapest option, remember that price isn’t the only consideration. Balance affordability with the quality of coverage and the insurer’s reputation.

- Personal Preferences: Your personal preferences and priorities should also guide your decision. Do you prefer an insurer with a strong digital presence and self-service options? Or do you value the personal touch of an agent who can guide you through the complexities of insurance? Consider what matters most to you and choose accordingly.

Top Insurance Companies for Cars

Now, let’s explore some of the leading insurance companies in the market, highlighting their unique features and offerings.

State Farm

State Farm is one of the largest and most well-known insurance providers in the United States. With a strong focus on customer service, they offer a wide range of insurance products, including auto, home, life, and health insurance. Their Drive Safe & Save program rewards safe drivers with discounts, making them an attractive option for those with a clean driving record.

Key Features:

- Excellent customer service with a network of local agents.

- Competitive rates and a variety of discounts.

- Comprehensive coverage options, including gap coverage and rideshare insurance.

- User-friendly mobile app for policy management and claims.

Geico

Geico, or Government Employees Insurance Company, is another giant in the insurance industry. Known for their catchy advertisements, they cater to a broad range of customers, including military personnel and federal employees.

Key Features:

- Exceptional digital platform for online policy management.

- Competitive rates, especially for government employees.

- Flexible payment options and a simple claims process.

- Additional perks like roadside assistance and rental car coverage.

Progressive

Progressive has established itself as a forward-thinking insurer, offering innovative products and services. They were one of the first to introduce usage-based insurance, allowing drivers to pay based on their actual driving habits.

Key Features:

- Snapshot program for usage-based insurance.

- Wide range of coverage options, including custom equipment coverage.

- Discounts for safe driving, multi-policy, and continuous coverage.

- Excellent online tools for policy management and claims tracking.

Allstate

Allstate is a trusted name in the insurance industry, offering a comprehensive suite of insurance products. Their “Your Choice Auto” policy provides flexibility, allowing you to choose the level of coverage that suits your needs and budget.

Key Features:

- Flexible coverage options with “Your Choice Auto” policy.

- Innovative products like Key On Coverage, which covers accidental damage to keys.

- Discounts for safe driving, loyalty, and bundling policies.

- Excellent customer service with a network of local agents.

Esurance

Esurance is a subsidiary of Allstate, focusing on providing a seamless digital experience. They offer a range of insurance products and are known for their user-friendly online platform.

Key Features:

- Excellent digital platform for policy management and quotes.

- Competitive rates and a range of discounts.

- Usage-based insurance program, DriveSense.

- Comprehensive coverage options, including gap coverage.

Factors to Consider When Choosing an Insurance Company

Apart from the specific features and offerings of each insurance company, there are several other critical factors to consider when making your decision.

Financial Strength and Stability

It’s essential to choose an insurance company with a strong financial background. This ensures that they will be able to pay out claims even in the event of significant losses or natural disasters. Rating agencies like AM Best and Standard & Poor’s provide financial strength ratings for insurance companies, which can guide your decision.

Claims Process and Customer Service

The claims process is a critical aspect of your insurance experience. Look for companies with a straightforward and efficient claims process, preferably with 24⁄7 claims support. Additionally, consider the availability and responsiveness of customer service representatives. A company with a strong customer service reputation can provide peace of mind in times of need.

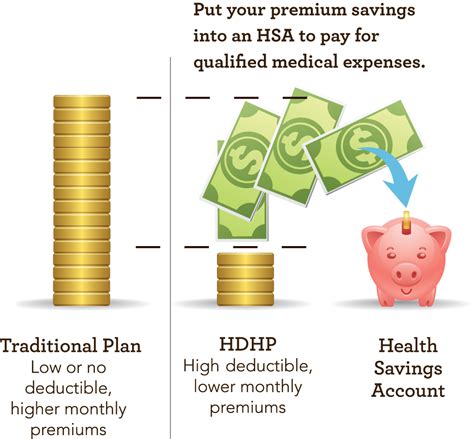

Discounts and Savings Opportunities

Insurance companies often offer a variety of discounts to attract customers and reward safe driving. Common discounts include multi-policy, safe driver, and loyalty discounts. Some companies also provide usage-based insurance programs, where your driving habits determine your premium. Compare the savings opportunities offered by different insurers to find the most cost-effective option.

Coverage Options and Customization

The range of coverage options and the ability to customize your policy are crucial considerations. Ensure the insurance company offers the specific coverage you need, whether it’s gap coverage, roadside assistance, or protection for custom equipment. The more flexible and customizable the policy, the better it can adapt to your unique needs.

Online Tools and Digital Experience

In today’s digital age, a seamless online experience is a significant advantage. Look for insurance companies with user-friendly websites and mobile apps for policy management, billing, and claims. Online tools can streamline the insurance process, making it more convenient and efficient.

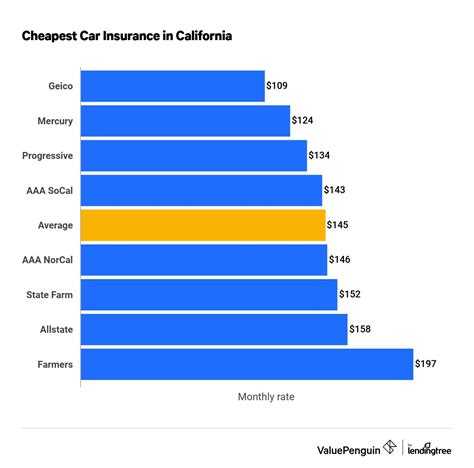

Comparing Insurance Quotes

Obtaining multiple insurance quotes is an essential step in the decision-making process. Compare quotes from at least three insurance companies to get a clear understanding of the market rates. Remember, the cheapest quote may not always be the best option. Consider the coverage, discounts, and customer service offered by each company when making your final decision.

Future of Auto Insurance

The auto insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. The rise of usage-based insurance and telematics is a significant trend, offering personalized premiums based on individual driving habits. Additionally, the development of autonomous vehicles is likely to have a profound impact on the industry, potentially reducing the frequency and severity of accidents.

As the industry adapts to these changes, insurance companies will need to stay agile and innovative to meet the evolving needs of their customers. This could include further enhancements to digital platforms, more personalized coverage options, and a deeper focus on customer experience.

Conclusion

Choosing the best insurance company for your car is a critical decision that requires careful consideration. By understanding your specific needs, comparing multiple quotes, and evaluating key factors like coverage, discounts, and customer service, you can make an informed choice. Remember, the best insurance company is one that provides the coverage you need at a competitive price, with excellent service and financial stability.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually or whenever you experience significant life changes, such as buying a new car, moving to a different state, or getting married. These changes may impact your insurance needs and premiums.

What factors can impact my auto insurance rates?

+Several factors can influence your auto insurance rates, including your driving history, the type of car you drive, your age and gender, your credit score, and the coverage limits you choose.

Can I bundle my auto insurance with other policies to save money?

+Yes, bundling your auto insurance with other policies, such as home or life insurance, can often result in significant savings. Many insurance companies offer multi-policy discounts to encourage customers to purchase multiple products.