Auto Insurance Quotes New York

Obtaining auto insurance quotes in New York can be a complex process, as the state has unique regulations and factors that influence insurance rates. New York is known for its diverse population, dense urban areas, and varying driving conditions, all of which impact the cost and availability of auto insurance. This guide aims to provide an in-depth analysis of the auto insurance landscape in New York, offering valuable insights to help drivers navigate the process of securing the best coverage at the most competitive rates.

Understanding the New York Auto Insurance Market

The auto insurance market in New York is characterized by a high level of competition among insurers, resulting in a wide range of coverage options and pricing structures. New York is a no-fault state, which means that, in the event of an accident, drivers must file a claim with their own insurance company to cover medical expenses and other damages, regardless of who was at fault. This unique feature of New York’s insurance system has a significant impact on the types of coverage available and the factors that influence insurance rates.

The state's Department of Financial Services (DFS) closely regulates the auto insurance industry, ensuring that insurers provide fair and reasonable rates. The DFS also enforces strict guidelines to protect consumers, such as requiring insurers to offer mandatory minimum coverage limits and ensuring that rates are not based on discriminatory factors like gender or marital status.

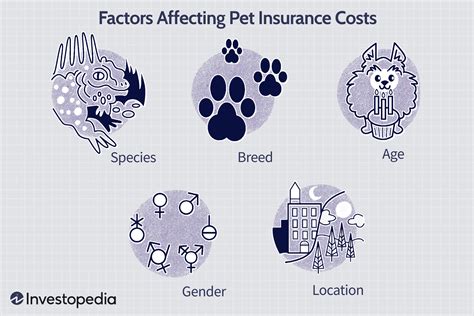

Key Factors Affecting Auto Insurance Quotes in New York

Several factors influence the cost of auto insurance in New York. Understanding these factors can help drivers make informed decisions when comparing quotes and selecting a policy.

- Driver Profile: Personal characteristics, such as age, driving record, and credit score, play a significant role in determining insurance rates. Younger drivers, for example, are often considered higher risk and may face higher premiums. A clean driving record and a good credit score can lead to more favorable rates.

- Vehicle Type: The make, model, and year of a vehicle can impact insurance costs. High-performance cars and luxury vehicles may have higher insurance premiums due to their potential for higher repair costs and theft risks.

- Coverage and Deductibles: The level of coverage chosen, including liability, collision, and comprehensive coverage, will affect the overall cost of insurance. Additionally, selecting higher deductibles can result in lower premiums.

- Location: The specific city or town in New York where a driver resides can influence rates. Urban areas with higher population density and traffic congestion often have higher insurance costs due to increased accident risks.

- Insurance Company: Different insurance providers offer varying rates and coverage options. Shopping around and comparing quotes from multiple insurers is crucial to finding the best deal.

Comparing Quotes: A Step-by-Step Guide

Securing the most suitable auto insurance policy at a competitive rate requires careful comparison of quotes from multiple insurers. Here’s a step-by-step guide to help New York drivers navigate the quote comparison process:

- Assess Your Coverage Needs: Determine the level of coverage you require. Consider your personal financial situation, the value of your vehicle, and your risk tolerance. New York requires all drivers to carry minimum liability coverage, but you may wish to opt for higher limits or additional coverage types to protect yourself further.

- Gather Information: Compile the necessary information, including your driver's license number, vehicle registration, and personal details like date of birth and employment status. Having this information ready will streamline the quote process.

- Compare Quotes Online: Start by comparing quotes online from several reputable insurance providers. Many insurers offer online quote tools that allow you to input your information and receive instant quotes. Be sure to compare not only the premiums but also the coverage limits and deductibles offered.

- Contact Insurance Agents: While online quotes are convenient, speaking directly with an insurance agent can provide valuable insights and personalized recommendations. Reach out to local insurance agents or brokers who can offer quotes from multiple insurers, ensuring a comprehensive comparison.

- Evaluate the Fine Print: When comparing quotes, pay close attention to the policy details, including any exclusions or limitations. Ensure that the coverage limits and deductibles align with your needs and that there are no hidden fees or unexpected gaps in coverage.

- Consider Bundling Options: Many insurance providers offer discounts when you bundle multiple policies, such as auto and home insurance. If you own a home or rent an apartment in New York, explore the potential savings from bundling your policies.

- Negotiate and Seek Discounts: Don't hesitate to negotiate with insurance providers. Discuss your driving history, safety features in your vehicle, and any other factors that might qualify you for discounts. Many insurers offer discounts for safe driving records, completing defensive driving courses, or installing anti-theft devices.

Maximizing Savings: Tips for Affordable Auto Insurance in New York

New York’s competitive insurance market offers drivers numerous opportunities to save on auto insurance. Here are some additional tips to help you secure the most affordable coverage:

- Maintain a Clean Driving Record: A spotless driving record is one of the most effective ways to keep insurance costs low. Avoid traffic violations and accidents, as they can significantly impact your insurance rates.

- Choose a Higher Deductible: Selecting a higher deductible can lead to lower premiums. However, ensure that you can afford the higher out-of-pocket expense in the event of an accident or claim.

- Explore Discounts: Many insurers offer a variety of discounts, including safe driver discounts, good student discounts, and loyalty discounts for long-term customers. Ask your insurance provider about the discounts they offer and take advantage of those that apply to your situation.

- Consider Usage-Based Insurance: Some insurance providers offer usage-based insurance programs, where your driving behavior and habits are monitored to determine your insurance rates. These programs can be beneficial for safe, low-mileage drivers, as they may result in lower premiums.

- Shop Around Regularly: Insurance rates can change over time, and shopping around periodically can help you identify more competitive offers. Consider reviewing your insurance options at least once a year to ensure you're getting the best rate.

The Future of Auto Insurance in New York

The auto insurance landscape in New York is continually evolving, influenced by technological advancements, changing regulations, and shifts in consumer behavior. Here’s a glimpse into the potential future of auto insurance in the state:

| Trend | Impact |

|---|---|

| Telematics and Usage-Based Insurance | With the increasing adoption of telematics and connected car technologies, usage-based insurance is expected to become more prevalent. This shift could offer greater customization and cost savings for safe drivers. |

| Autonomous Vehicles | As autonomous vehicles become more common, insurance policies will need to adapt to cover new risks and liabilities. This may lead to a shift in focus from individual driver behavior to vehicle performance and manufacturer liability. |

| Regulation and Consumer Protection | The DFS is likely to continue its role in regulating the insurance industry, ensuring fair practices and protecting consumers. Future regulations may address emerging issues like data privacy and the use of artificial intelligence in insurance underwriting. |

| Digital Transformation | The digital transformation of the insurance industry is set to continue, with more insurers embracing online platforms and digital tools for quote comparisons and policy management. This trend will enhance convenience and accessibility for consumers. |

How often should I review my auto insurance policy in New York?

+It’s a good practice to review your auto insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for unnecessary premiums.

Can I get auto insurance quotes without providing my Social Security number in New York?

+Yes, many insurance providers allow you to obtain quotes without providing your Social Security number. However, having this information ready can speed up the quote process, as it’s often requested to conduct a more comprehensive credit check.

Are there any discounts available for electric vehicles (EVs) in New York auto insurance policies?

+Some insurance providers offer discounts for electric vehicles, recognizing their lower environmental impact and potentially reduced accident risks. Check with your insurer to see if they offer such incentives.