Auto Insurance Quote Comparison Online

Welcome to this comprehensive guide on comparing auto insurance quotes online. As an expert in the field, I'll provide you with an in-depth analysis of the process, highlighting the key factors that influence your insurance rates and offering valuable insights to help you make an informed decision.

The Importance of Auto Insurance Quote Comparison

In today's digital age, obtaining multiple auto insurance quotes online has become a convenient and efficient way to save money and find the best coverage options. By comparing quotes, you gain a deeper understanding of the market, allowing you to identify the most competitive rates and customize your insurance plan to suit your specific needs.

Let's delve into the key aspects of online auto insurance quote comparison and explore the factors that impact your premiums.

Understanding Your Insurance Needs

Before you begin comparing quotes, it's essential to assess your unique insurance requirements. Consider the following factors to tailor your search effectively:

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in determining your insurance rates. Additionally, factors such as the primary purpose of your vehicle (commuting, leisure, business) and the annual mileage can impact your premiums.

Coverage Requirements

Different states have varying minimum coverage requirements, but it's crucial to assess your individual needs beyond the legal minimum. Consider factors like your financial situation, the value of your vehicle, and any specific coverage options you may require, such as comprehensive or collision insurance.

Driver Profile

Your driving history and personal details, such as age, gender, and marital status, are key factors in insurance pricing. Younger drivers or those with a history of accidents or violations may face higher premiums, while experienced drivers with a clean record can often secure more favorable rates.

Discounts and Bundles

Insurance providers often offer discounts for various reasons, including safe driving records, multiple policy bundles (e.g., auto and home insurance), and safety features installed in your vehicle. Be sure to inquire about potential discounts when comparing quotes to maximize your savings.

Comparing Online Auto Insurance Quotes

Now that you have a clearer understanding of your insurance needs, let's explore the process of comparing online quotes.

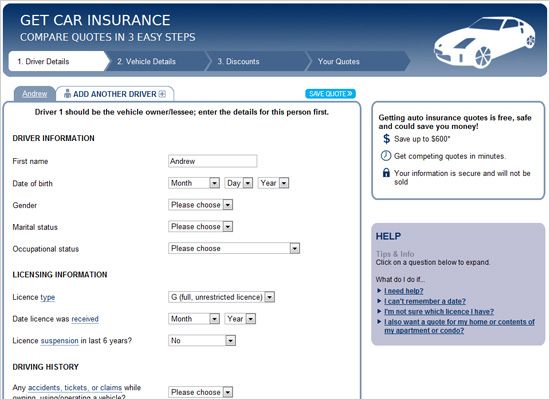

Online Quote Tools

Many insurance companies provide online quote tools on their websites, allowing you to input your details and receive personalized quotes instantly. These tools often offer a quick and convenient way to compare rates from multiple providers.

When using online quote tools, ensure you provide accurate and detailed information to receive the most precise estimates. Factors such as incorrect mileage or vehicle details can lead to inaccurate quotes, impacting your decision-making process.

Independent Insurance Brokers

Independent insurance brokers can be a valuable resource when comparing quotes. These professionals work with multiple insurance companies and can provide a broader range of options tailored to your needs. They can also offer expert advice and guide you through the comparison process.

Comparative Websites

There are several websites dedicated to comparing auto insurance quotes. These platforms allow you to input your details once and receive multiple quotes from various providers, saving you time and effort. However, it's important to verify the credibility and accuracy of these websites before relying on their estimates.

Direct Communication with Insurers

While online tools and comparative websites are convenient, it's essential to establish direct communication with insurance providers. Contacting insurers directly allows you to ask specific questions, clarify coverage details, and negotiate potential discounts. This personal interaction can provide valuable insights and help you make an informed decision.

Factors Influencing Your Auto Insurance Rates

Understanding the factors that impact your insurance rates is crucial for making an educated choice when comparing quotes. Here are some key factors to consider:

Driving Record

Your driving history is a significant determinant of your insurance rates. Insurers consider factors such as accidents, violations, and claims made against your policy. A clean driving record can lead to lower premiums, while multiple incidents can result in higher costs.

Credit Score

In many states, insurance providers are allowed to use your credit score as a factor in determining your insurance rates. A higher credit score is often associated with lower premiums, as it indicates financial responsibility and a lower risk profile.

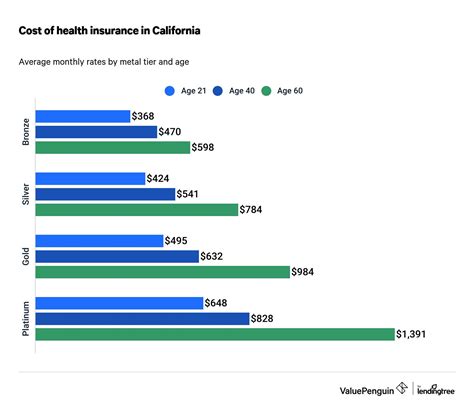

Location and Demographics

Your geographic location and demographic factors, such as age and gender, can impact your insurance rates. Areas with higher crime rates or a history of frequent accidents may have higher premiums, while certain demographics may be considered higher risk by insurers.

Vehicle Type and Value

The make, model, and value of your vehicle are key considerations for insurers. More expensive or high-performance vehicles may result in higher premiums due to the increased risk of theft or accidents. Additionally, older vehicles with lower market values may be insured at a lower cost.

Usage and Mileage

The purpose and frequency of your vehicle's usage can influence your insurance rates. Higher annual mileage or using your vehicle for business purposes may result in increased premiums, as it indicates a higher risk of accidents or claims.

Discounts and Bundles

Insurance providers often offer discounts to attract customers. These discounts can be for a variety of reasons, including safe driving records, multiple policy bundles, or safety features installed in your vehicle. Taking advantage of these discounts can significantly reduce your insurance costs.

Performance Analysis and Customer Satisfaction

When comparing auto insurance quotes, it's essential to consider not only the cost but also the performance and reputation of the insurance providers. Here's how you can evaluate these aspects:

Claim Handling and Customer Service

Research the claim handling process and customer service reputation of each insurance provider. Look for online reviews and ratings to gauge their efficiency and responsiveness when it comes to handling claims and customer inquiries. A provider with a strong track record in these areas can offer peace of mind.

Financial Stability

Assess the financial stability of the insurance companies you're considering. Look for ratings from reputable agencies such as AM Best or Standard & Poor's. A solid financial rating indicates the insurer's ability to pay claims and provides reassurance regarding their long-term viability.

Policy Features and Coverage

Compare the policy features and coverage options offered by different providers. Ensure that the policies you're considering align with your specific needs and provide adequate protection. Look for additional benefits such as rental car coverage, roadside assistance, or accident forgiveness, which can enhance your overall coverage.

Future Implications and Considerations

As you navigate the world of auto insurance, it's important to consider the evolving landscape and potential future changes. Here are some factors to keep in mind:

Technological Advancements

The insurance industry is increasingly adopting technology, including telematics and usage-based insurance. These advancements allow insurers to gather more data on driving behavior, which can impact your premiums. Stay informed about these developments and consider how they may affect your insurance rates in the future.

Regulatory Changes

Keep an eye on any regulatory changes that may impact auto insurance rates. Changes in state laws or industry regulations can influence the pricing structure and coverage options available. Stay updated on these changes to ensure you're aware of any potential shifts in the market.

Market Competition

The competitive nature of the insurance market can drive prices down and provide more options for consumers. As new insurers enter the market and existing providers strive to retain customers, you may find more favorable rates and innovative coverage options. Stay informed about market trends to take advantage of these opportunities.

Personal Circumstances

Your personal circumstances and lifestyle choices can impact your insurance rates over time. As your life changes, whether through career transitions, moving to a new location, or acquiring additional vehicles, your insurance needs may evolve. Regularly reassess your coverage and compare quotes to ensure you're still getting the best value and coverage.

Frequently Asked Questions

How often should I compare auto insurance quotes?

+It’s recommended to compare quotes at least once a year, as insurance rates can fluctuate based on various factors. Additionally, significant life changes, such as moving to a new state or purchasing a new vehicle, may prompt you to seek more favorable rates.

What information do I need to provide for an accurate quote?

+To obtain an accurate quote, you’ll need to provide details such as your vehicle’s make, model, and year, your driving record, and your personal information, including age, gender, and marital status. Being precise with these details ensures you receive an accurate estimate.

Can I bundle my auto insurance with other policies to save money?

+Yes, bundling your auto insurance with other policies, such as home or renters insurance, can often lead to significant discounts. Many insurers offer multi-policy discounts, so it’s worth exploring this option to maximize your savings.

What are some common discounts available for auto insurance?

+Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles equipped with safety features. Some insurers also offer loyalty discounts for long-term customers.

How can I improve my chances of getting lower auto insurance rates?

+To improve your chances of obtaining lower rates, maintain a clean driving record, improve your credit score, and consider installing safety features in your vehicle. Additionally, shopping around and comparing quotes regularly can help you find the most competitive rates.