American Healthcare Insurance

The American healthcare system is a complex and often confusing landscape, particularly when it comes to navigating the world of health insurance. With a wide range of plans, providers, and policies, understanding the ins and outs of healthcare insurance is crucial for individuals and families to ensure they receive the necessary coverage and access to quality medical care. In this comprehensive guide, we will delve into the intricacies of American healthcare insurance, providing an in-depth analysis and expert insights to empower readers with the knowledge they need to make informed decisions.

Unraveling the Complexity of Healthcare Insurance

Healthcare insurance in the United States is a multifaceted system, influenced by a myriad of factors including federal and state regulations, market dynamics, and the evolving needs of the population. Let’s explore the key aspects that define the American healthcare insurance landscape.

The Diversity of Insurance Plans

The first challenge in understanding healthcare insurance is the sheer variety of plans available. From employer-sponsored group plans to individual market policies, each type of insurance comes with its own set of rules, benefits, and costs. For instance, group plans often offer more comprehensive coverage and lower premiums due to the larger pool of participants, while individual plans may provide more flexibility but at a potentially higher cost.

| Insurance Type | Key Characteristics |

|---|---|

| Employer-Sponsored Group Plans | Comprehensive coverage, lower premiums, often with a choice of multiple plans |

| Individual Market Policies | Flexible options, may have higher premiums, can be tailored to individual needs |

Navigating the Insurance Market

The insurance market in the U.S. is a dynamic environment, with insurance companies constantly evolving their offerings to meet changing regulations and consumer demands. This can make it challenging for individuals to keep up with the latest trends and find the most suitable plan for their needs. For instance, the introduction of the Affordable Care Act (ACA) brought about significant changes, including the expansion of Medicaid, the creation of Health Insurance Marketplaces, and the mandate for essential health benefits.

Understanding Coverage and Benefits

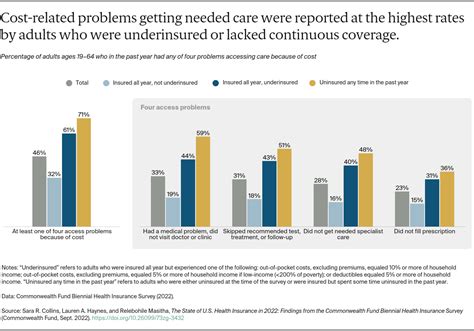

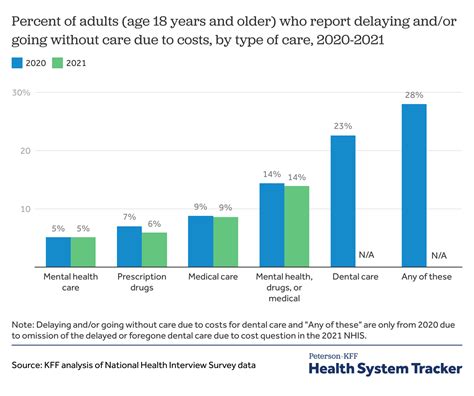

One of the most critical aspects of healthcare insurance is understanding what is covered and what isn’t. Insurance plans can vary widely in their coverage, from basic essentials like doctor visits and hospital stays to more specialized services such as mental health treatment, prescription drugs, and preventive care. It’s essential for individuals to carefully review the summary of benefits and coverage provided by their insurance company to ensure they are aware of any limitations or exclusions.

Cost and Affordability

The cost of healthcare insurance is a significant concern for many Americans. Factors such as age, location, and pre-existing conditions can greatly impact the premiums an individual pays. Additionally, insurance plans can have varying out-of-pocket costs, including deductibles, copayments, and coinsurance, which can add up quickly. Understanding these costs and how they work is crucial for effective financial planning.

Maximizing Your Healthcare Insurance Benefits

With a basic understanding of the American healthcare insurance landscape, it’s time to explore strategies for making the most of your insurance coverage.

Choosing the Right Plan

Selecting the right insurance plan is a crucial step in ensuring you receive the coverage you need. Consider your specific healthcare needs, including any ongoing medical conditions, prescription medications, and desired specialists or providers. Evaluate the plans offered by your employer or through the Health Insurance Marketplace, comparing premiums, deductibles, and the range of covered services. Don’t hesitate to seek advice from insurance brokers or financial advisors who can guide you through the process.

Utilizing Your Coverage Effectively

Once you have chosen your insurance plan, it’s important to use it wisely. This includes understanding how to access care within your network of providers and how to navigate the often complex world of insurance claims and billing. Many insurance companies offer member portals or mobile apps that can provide real-time updates on your coverage and claims status. Stay informed about your policy’s annual benefits reset, ensuring you maximize your coverage before the year ends.

Managing Your Out-of-Pocket Costs

Controlling your out-of-pocket expenses is a key aspect of managing your healthcare insurance effectively. Keep track of your deductibles and how much you’ve paid towards them, as this can impact your financial liability for the remainder of the year. Consider setting aside funds in a Health Savings Account (HSA) or Flexible Spending Account (FSA) to help cover these costs. Additionally, explore ways to reduce your overall healthcare expenses, such as utilizing generic medications or negotiating medical bills.

Staying Informed and Engaged

The healthcare insurance landscape is constantly evolving, with new regulations, insurance offerings, and medical advancements. Stay informed by regularly reviewing your insurance plan’s benefits and any changes that may impact your coverage. Engage with your insurance company and healthcare providers to clarify any uncertainties and ensure you are taking full advantage of your benefits. Remember, knowledge is power when it comes to navigating the complex world of American healthcare insurance.

The Future of American Healthcare Insurance

Looking ahead, the future of American healthcare insurance is poised for significant changes and innovations. Here’s a glimpse into some of the trends and developments that are shaping the industry.

Telehealth and Digital Health Solutions

The rapid adoption of telehealth services during the COVID-19 pandemic has accelerated the integration of digital health solutions into the healthcare system. From virtual doctor visits to remote monitoring of chronic conditions, telehealth is expected to play a more prominent role in the future of healthcare delivery. This shift not only improves access to care but also offers cost-saving benefits for both patients and insurance providers.

Value-Based Care Models

Value-based care models are gaining traction as a way to improve healthcare outcomes and reduce costs. These models focus on providing high-quality care while reducing unnecessary procedures and hospital admissions. By incentivizing healthcare providers to deliver efficient, effective care, insurance companies can better manage costs and improve patient outcomes.

Consumer-Driven Health Plans

Consumer-driven health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), are becoming increasingly popular. These plans give individuals more control over their healthcare spending, encouraging them to be more engaged in their healthcare decisions. As these plans continue to evolve, they are expected to play a larger role in the future of healthcare insurance, offering flexibility and cost savings to consumers.

Addressing Social Determinants of Health

Recognizing the impact of social and economic factors on health outcomes, insurance companies and healthcare providers are increasingly focusing on addressing social determinants of health. This includes initiatives to improve access to healthy food, housing, and other social services. By addressing these underlying factors, insurance providers can help reduce healthcare disparities and improve overall population health.

Data-Driven Innovations

The healthcare industry is embracing data-driven innovations to improve efficiency and patient outcomes. From predictive analytics to artificial intelligence, these technologies are being used to identify high-risk patients, optimize treatment plans, and reduce unnecessary costs. As these innovations continue to evolve, they are expected to play a pivotal role in shaping the future of healthcare insurance.

What is the Affordable Care Act (ACA)?

+The Affordable Care Act, often referred to as Obamacare, is a federal law enacted in 2010 that aims to make healthcare more affordable and accessible. It introduced several key provisions, including the expansion of Medicaid, the creation of Health Insurance Marketplaces, and the mandate for essential health benefits.

How do I choose the right insurance plan for my needs?

+Consider your healthcare needs, including any ongoing medical conditions, prescription medications, and desired specialists or providers. Evaluate the premiums, deductibles, and covered services of the plans offered by your employer or through the Health Insurance Marketplace. Seek advice from insurance brokers or financial advisors for personalized guidance.

What are some ways to reduce my out-of-pocket healthcare expenses?

+Utilize generic medications, negotiate medical bills, and consider setting aside funds in a Health Savings Account (HSA) or Flexible Spending Account (FSA) to help cover out-of-pocket costs. Stay informed about your insurance plan’s annual benefits reset to maximize your coverage.